Today I am kicking off with sectors that everyone should watch the next 5 years.

I will showcase

(a) a hot sector,

(b) its estimated growth by 2030,

(c) some examples of companies in the field

Andddd I am starting, of course, with electronic payments

The electronic payments sector is transforming how money moves globally. With the rise of e-commerce, mobile payments, and digital wallets, this industry has become an essential component of modern commerce.

Growth: 8% annually until 2030

Examples of companies:

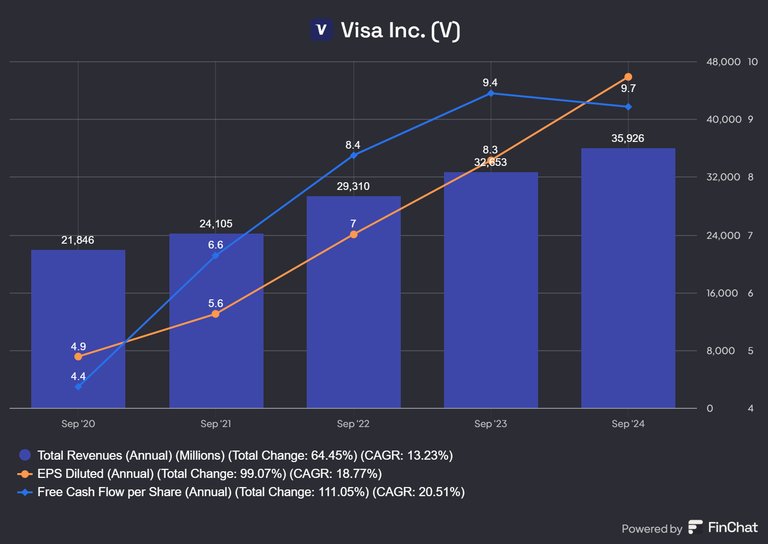

A. Visa ($V)

B. Mastercard ($MA)

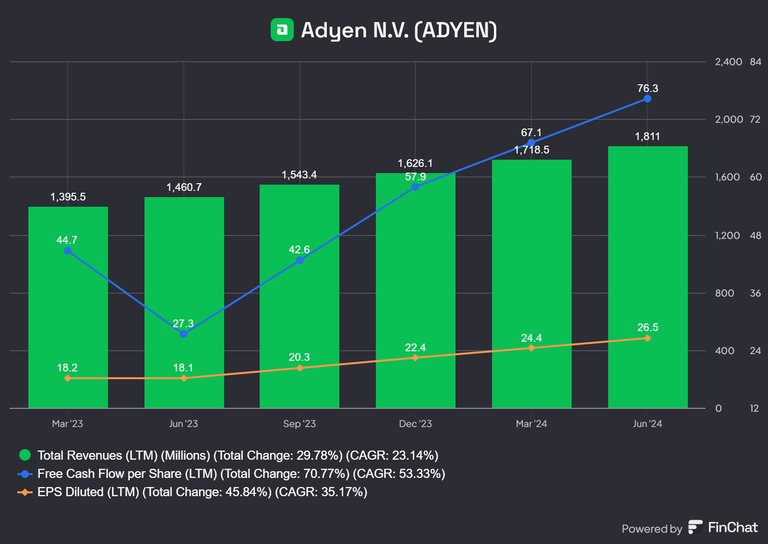

C. Adyen ($ADYEN)

D. Paypal ($PYPL)

This sector benefits from increasing consumer trust in online payment systems and continuous innovations in fintech.

Next up is e-commerce

The revolution in online retail continues, as more and more consumers prefer the convenience of shopping online. This trend is evident across all demographics worldwide 🧐

Estimated average growth: 11% annually until 2030

Examples of companies

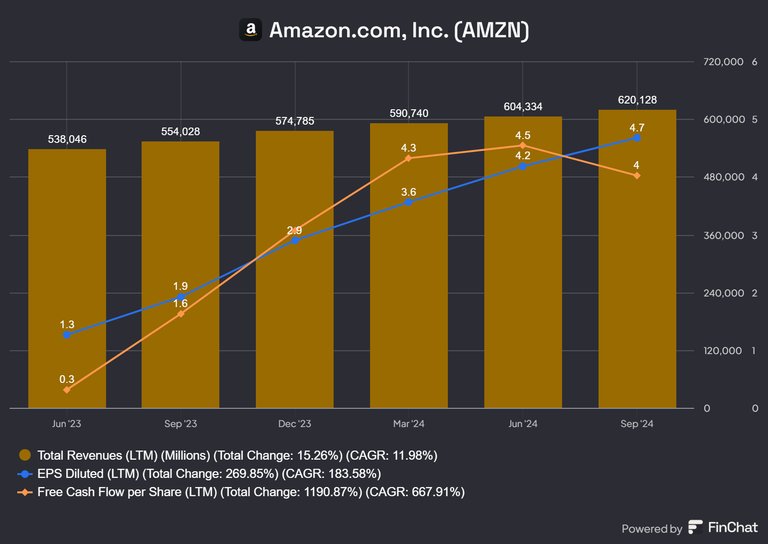

Amazon ($AMZN)

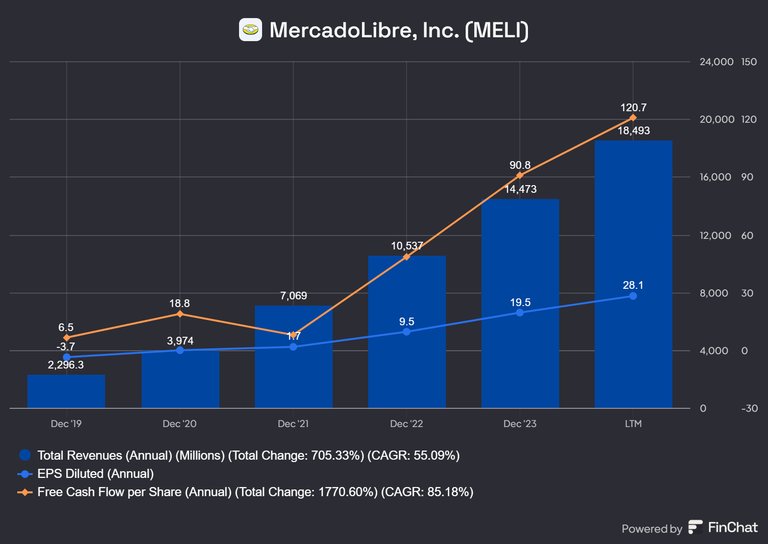

Mercadolibre ($MELI)

Alibaba ($BABA)

PDD Holdings ($PDD)

Sea Ltd ($SE)

This sector is fueled by rising internet penetration, smartphone adoption, and a growing middle class in emerging economies. E-commerce also continues to evolve with trends like social commerce and direct-to-consumer (DTC) brands.

HCM (Human Capital Management)

Human Capital Management is at the heart of the future workplace. As businesses face a rapidly changing labor market, efficient workforce management is critical to staying competitive. This includes talent acquisition, employee engagement, and skills development.

Estimated average growth: 9% annually until 2030

Examples of companies

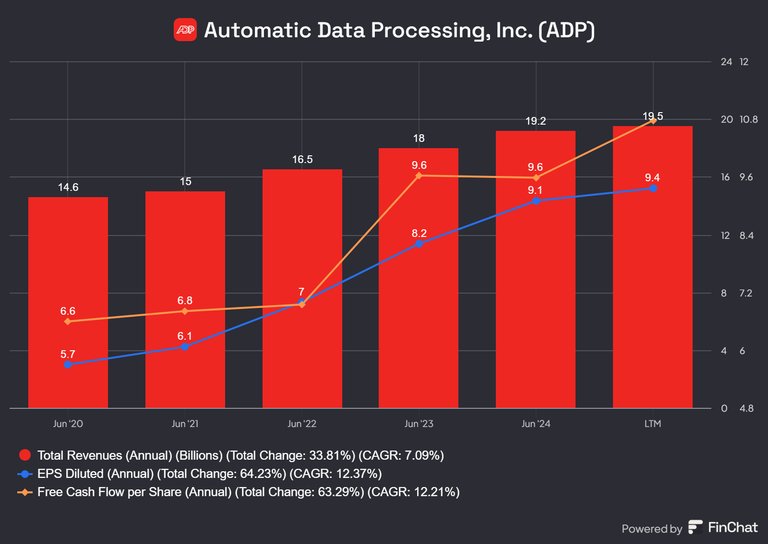

Automatic Data Processing ($ADP)

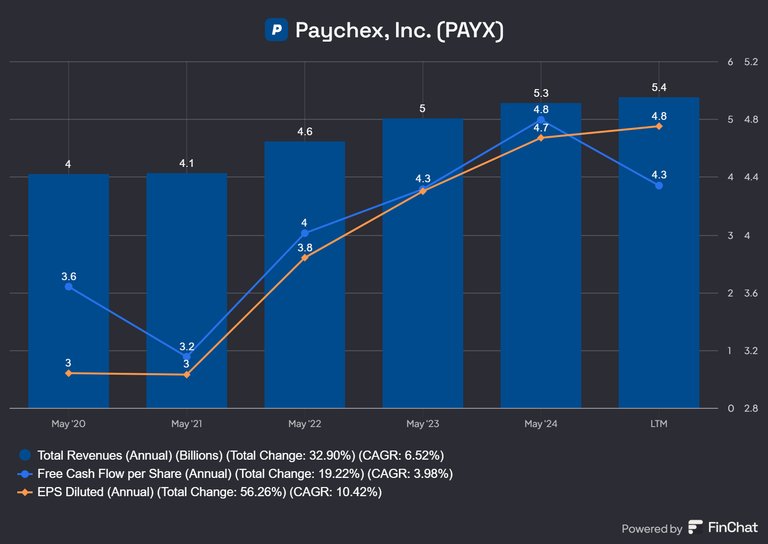

Paychex ($PAYX)

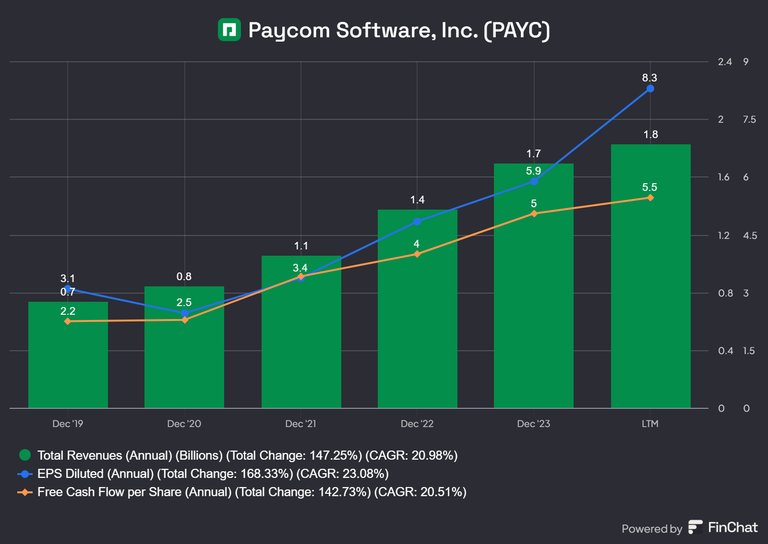

Paycom ($PAYC)

This growth reflects the vital role of human resources in business strategy.

3 COMPANIES WITH IMPRESSIVE PROFIT GROWTH

These companies have skyrocketed their operating profits in recent years, rapidly boosting their operating margins

A. Uber ($UBER)

Operating Margin 2017: -49%

Operating Margin 2024: 6%

B. Netflix ($NFLX)

Operating Margin 2015: 5%

Operating Margin 2024: 26%

C. Salesforce ($CRM)

Operating Margin 2015: 1%

Operating Margin 2024: 20%

I personally love companies that manage to improve their profitability metrics over time.

Do you Guys have any sector or stock that you believe will overperform in the next years and I have to put in my watchlist?

Posted Using InLeo Alpha