The past week we had some interesting news and the Central Banks also gave us hints and showed us their strategy for 2025.

Bank of Canada Cuts Key Interest Rate to 3%, Ends Quantitative Tightening

The Bank of Canada has reduced its key interest rate to 3%, while also announcing the end of its quantitative tightening policy and the start of asset purchases beginning in March. These changes aim to stabilize and moderately increase the Bank’s balance sheet.

According to the January Monetary Policy Report (MPR), forecasts remain highly uncertain, mainly due to potential U.S. trade tariffs. While global growth is expected to average 3% annually over the next two years, Canada’s economy faces trade uncertainty and a stronger U.S. dollar, leading to a significant depreciation of the Canadian dollar.

The Canadian economy is showing signs of recovery, mainly driven by increased consumer spending and housing market activity. However, business investment remains weak. Despite slow labor force growth and a relatively high unemployment rate (6.7%), the job market is stabilizing. GDP growth is expected to pick up in 2025 (1.8%), though at a more moderate pace due to slowing immigration.

Inflation remains close to the 2% target, with housing price inflation gradually declining. Factors like the temporary suspension of GST/HST on certain products are affecting CPI fluctuations. In the event of a prolonged trade conflict with the U.S., Canada could face lower growth and higher living costs.

Conclusion

The Canadian dollar continues to depreciate against the U.S. dollar due to trade uncertainty and interest rate differentials. While the rate cut and steady monetary policy support the economy, the future trajectory of the currency largely depends on U.S. trade relations and Canada’s resilience to external shocks. (Neutral to Negative 🔴)

Federal Reserve Holds Rates at 4.5%, Powell Stresses Price Stability

Federal Reserve Chairman Jerome Powell announced yesterday that the Fed is keeping interest rates at 4.5%, emphasizing that the U.S. economy remains strong, but inflation is still above the 2% target. He made it clear that there is no rush to cut rates, prioritizing price stability instead.

The labor market remains resilient, though high interest rates are affecting liquidity. Powell reiterated that the Fed will adjust its policy if necessary, but for now, no immediate changes are planned.

One key highlight of his speech was his comments on cryptocurrencies. 👀 Powell stated that banks can now serve crypto-related clients, provided they implement strict risk management measures. This more open stance allows more banks to offer crypto services, reducing the risk of debanking. Meanwhile, regulators will continue monitoring the space.

Powell did not announce new crypto regulations, but his comments suggest that the Fed acknowledges their importance and is trying to balance innovation with stability.

Conclusion

Keeping rates at 4.5% strengthens the U.S. dollar, as higher rates make it more attractive to investors. The rate gap with the Bank of Canada, which cut to 3%, could further weaken the Canadian dollar.

The Fed’s new stance on crypto is positive, as it enables more banks to provide services without fear of regulatory pushback. However, the emphasis on risk management could lead to stricter oversight in the future.

Overall, the Fed’s monetary policy keeps the dollar strong, while markets closely watch its next moves. 🇺🇸 🚀 (USD 🟢) 👀👆

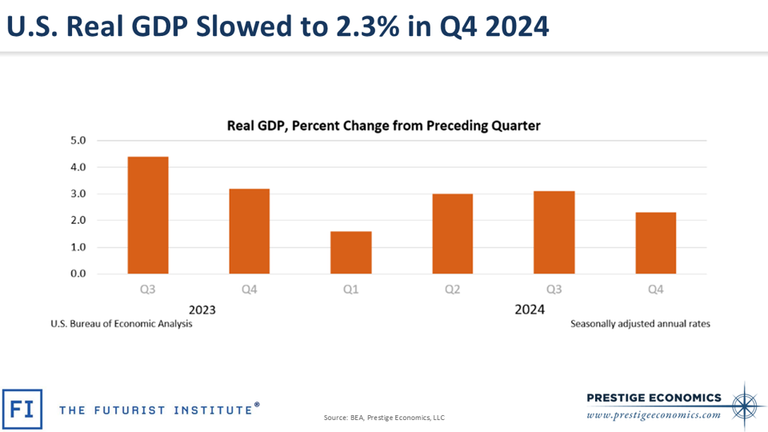

Summary of U.S. GDP Report – Q4 2024

- The U.S. economy grew at an annualized rate of 2.3% in Q4, below expectations of 2.7%.

- This marks a slowdown from the 3.1% growth recorded in Q3.

- Real consumer spending increased 4.2% annually, following a 3.7% rise in the previous quarter.

- The GDP Price Index rose 2.2%, lower than the forecasted 2.5%.

- Core PCE prices increased 2.5%, in line with expectations.

Key Takeaway

Despite recession concerns, the U.S. economy continues to grow above average, driven by strong consumer spending. The Fed has no immediate reason to cut rates.

ECB Rate Cut & Lagarde’s Statements – January 30, 2025

The European Central Bank (ECB) cut interest rates by 25 basis points, setting:

- The deposit rate at 2.75%

- The main refinancing rate at 2.90%

- The marginal lending rate at 3.15%

(Effective February 5, 2025)

The decision was based on easing inflation, which is expected to return to the 2% target within the year.

Despite rising real wages, consumer spending remains weak. The Eurozone economy remains sluggish in the short term, but the ECB expects a gradual recovery in 2025. Credit conditions remain tight, though lower rates will gradually make borrowing cheaper for businesses and households. Asset purchase programs (APP & PEPP) continue to decline, and the repayment of targeted refinancing operations (TLTROs) has been completed.

Lagarde’s Key Statements

ECB President Christine Lagarde emphasized that the Eurozone economy has not yet fully recovered, and consumer confidence remains low despite rising real incomes. However, expectations for recovery remain unchanged.

Market Impact & Euro Outlook

- For the euro: The rate cut and Lagarde’s cautious tone could put downward pressure on the euro, especially if the Fed keeps rates high.

- For the economy: This signals the start of gradual monetary easing aimed at supporting growth. Markets will closely watch future ECB decisions for hints on further rate cuts.

Posted Using INLEO