BOOKING HOLDINGS

Who Booking Holdings is and what it does doesn’t need much explanation—we all know it. It’s one of the largest companies in the world in the travel industry. Booking Holdings platforms focus mainly on online bookings for accommodations, flights, rental cars, and other travel-related services.

But how many platforms does it have? Plenty! There’s Booking.com for global accommodation bookings, Priceline offering discounts for travelers in the U.S., Agoda focusing on hotels and flights in Asia, Kayak for travel price comparisons, Rentalcars.com for car rentals, and OpenTable for restaurant reservations.

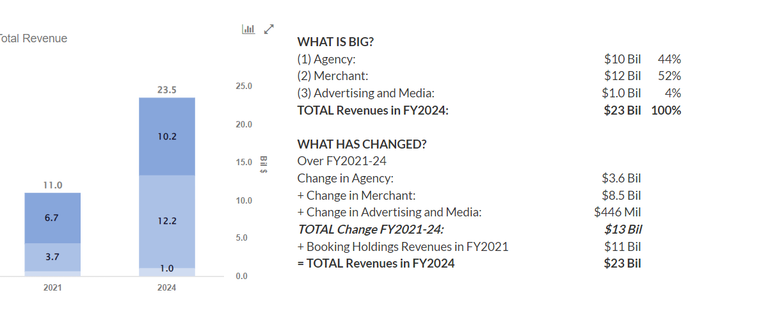

And the same goes for its revenue. That is, it doesn’t rely on just one revenue stream but three! Specifically:

The Merchant Model, where it buys accommodations at wholesale prices and rents them out at higher rates.

The Agency Model, acting as an intermediary and earning a commission from transactions between property owners and customers.

Advertising, by displaying ads across its platforms.

Of these, the Merchant Model is the most significant segment, contributing 52% of total revenue, and it’s been growing rapidly over the past 12 years, at a rate of 17% annually.

FUNDAMENTALS

Okay, all that’s great, but we want numbers! I get it, and that’s exactly what we’re going to dive into now.

By studying Booking Holdings , it becomes clear that the company is performing exceptionally well and continues to gain market share. This is evident when you look at the two most critical metrics for assessing its performance:

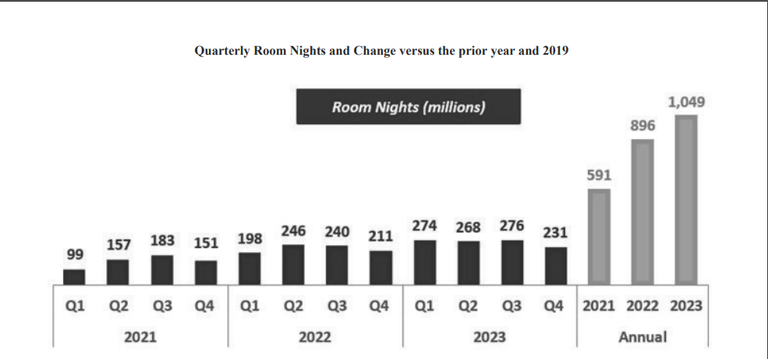

(a) The total number of room nights booked, and

(b) The gross booking volume across its platforms.

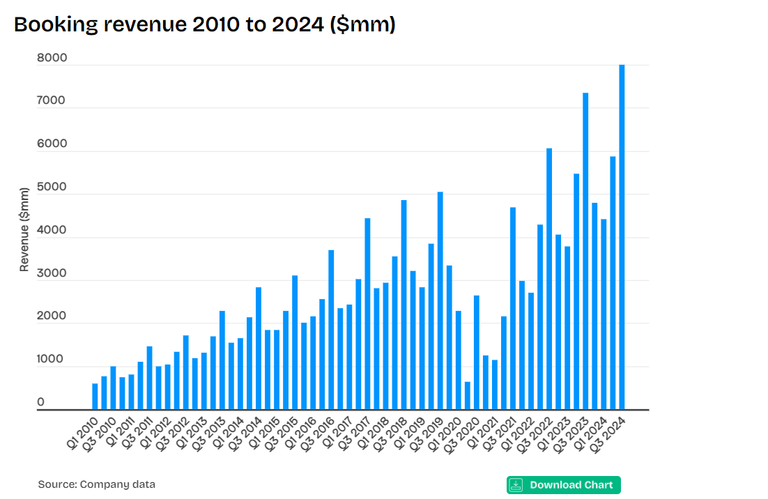

We can see that in the post-COVID period, both of these key metrics are growing at an incredible pace. Specifically, for the 12 months ending in September, Booking ($BKNG) reported 1.11 billion room nights, while gross booking volume exceeded $160 billion.

Moreover, excluding the pandemic year, the company’s financials are exceptional:

A. Total Revenues

2014: $8.44 billion

LTM (Last Twelve Months): $23.05 billion

Average growth rate: 10.85% annually, despite the pandemic.

B. Net Income

2014: $2.42 billion

LTM: $5.04 billion

Strong growth in net earnings.

C. Free Cash Flow

2014: $2.78 billion

LTM: $8.5 billion

Free cash flow per share shows the fastest growth of all metrics at 12.13% annually, highlighting that the company is doing something right.

D. Balance Sheet

Cash & Cash Equivalents: $15.78 billion

Long-Term Debt: $13.79 billion

A crystal-clear balance sheet, indicating the company is well-positioned to weather a potential recession.

E. Margins

Gross Profit Margin: 84.67%

Operating Margin: 28.7%

Net Profit Margin: 21.85%

Outstanding profitability margins, which are continuously improving.

F. ROIC: 38.4%

An incredibly high Return on Invested Capital, showcasing the management’s exceptional ability to allocate the company’s resources effectively.

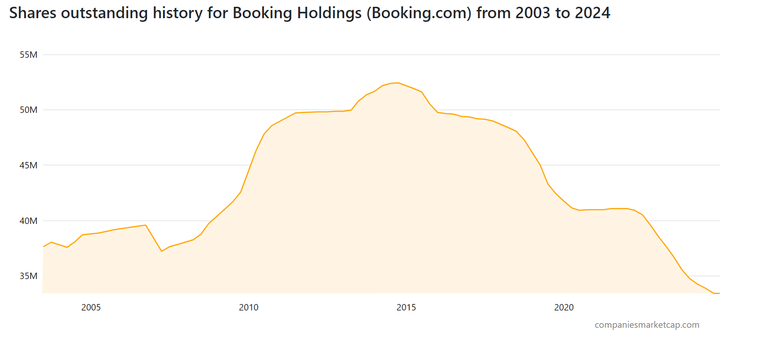

G. Total Shares Outstanding

2014: 52 million shares

2024: 33.2 million shares

A significant reduction in shares, benefiting shareholders through buybacks.

So, the company’s shares decreased? Exactly! By reducing the total number of shares by 36%, the company has increased its Earnings Per Share (EPS) by 50%, even if we assume zero growth in net income.

That is a proper burning.

Additionally, beyond share buybacks, the company has started paying a dividend, with a current dividend yield of 0.7%.

VALUATION

And what about valuation? Well, the company currently has a Forward P/E ratio of 25.69 (3-year average: 19.39) and a Forward FCF yield of 4.73% (3-year average: 5.55%).

From these two metrics, we can deduce that the stock is slightly overvalued.

Overvalued, so it’s not worth investing?

NVESTMENT OUTLOOK

So, is it worth investing or not? Well, as we can see, Booking offers an attractive return (>10% annually), assuming a P/E of 26. This is much lower than the 10-year average and entirely justified for a high-quality company growing its EPS at a double-digit rate.

Currently, the stock is trading at $5,278 and appears to be fairly valued. However, for a greater margin of safety, one might consider waiting for the price to drop below $4,800—about an 8% decline from the current level. From there, one could expect a 15% annualized return.

Sources

Posted Using InLeo Alpha