Bristol-Myers Squibb : Despite Beating Estimates, the Stock Dropped

A classic case of market overreaction.

DOUBLE BEAT

First things first—Bristol-Myers Squibb achieved a double beat! This means it exceeded expectations for both revenue and earnings per share (EPS).

Specifically, for the last quarter, the company’s revenue reached $12.3 billion, up 7.5% year-over-year and $740 million above estimates!

Likewise, EPS came in at $1.67, beating analyst expectations by $0.20.

Regarding the company’s existing drugs:

- Eliquis sales jumped 11% YoY, reaching $3.2 billion—about $170 million above forecasts.

- Revlimid, which has faced generic competition since 2022, generated around $1.3 billion in sales—down 8% YoY, but still beat projections.

- Opdivo, an oncology drug, saw a 4% increase in revenue, reaching $2.5 billion.

- Abecma, a CAR-T cell therapy co-developed with 2seventybio, generated $105 million, marking a 5% YoY growth.

Wait a minute, these are great numbers! So why did the stock drop?

Because the 2025 guidance didn’t excite investors. Bristol-Myers Squibb projected $45.5 billion in revenue and EPS between $6.55 and $6.85—below analyst expectations.

Should We Be Worried?

Not necessarily! The company has huge growth potential. Let’s look at the future.

THE FUTURE OF BMY

This is where things get interesting. Bristol-Myers Squibb isn’t sitting idle—it’s investing heavily in its future:

- 16 new products expected by 2030

- $10 billion in additional sales by 2026

- Cobenfy, a new schizophrenia treatment, just received FDA approval

- Acquisition of Mirati Therapeutics to boost its oncology segment

So while short-term sentiment may be shaky, the long-term outlook remains strong. Could this dip be a buying opportunity? That’s the big question.

The company beat earnings per share (EPS) estimates but missed revenue expectations.

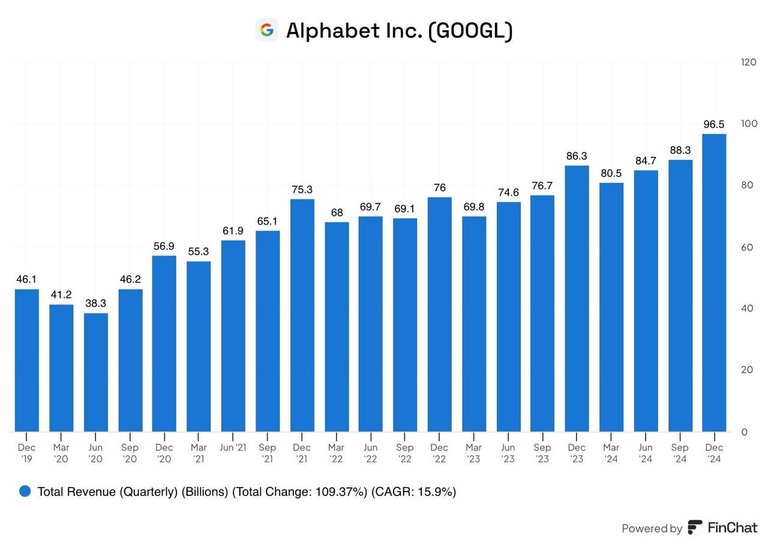

Now, when we say it missed revenue estimates, we’re talking about just 0.09%. And not only that—on a year-over-year basis, revenue grew by +12%

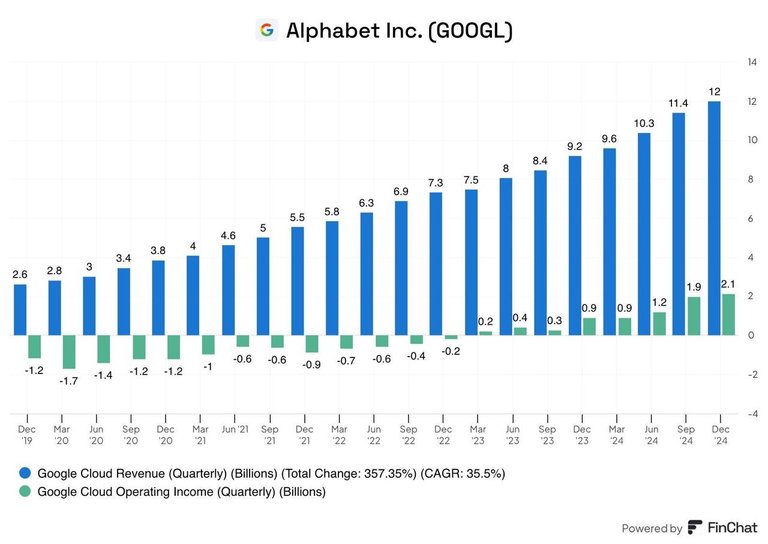

Also, Google Cloud (GCP) surged +31% and keeps becoming more and more profitable.

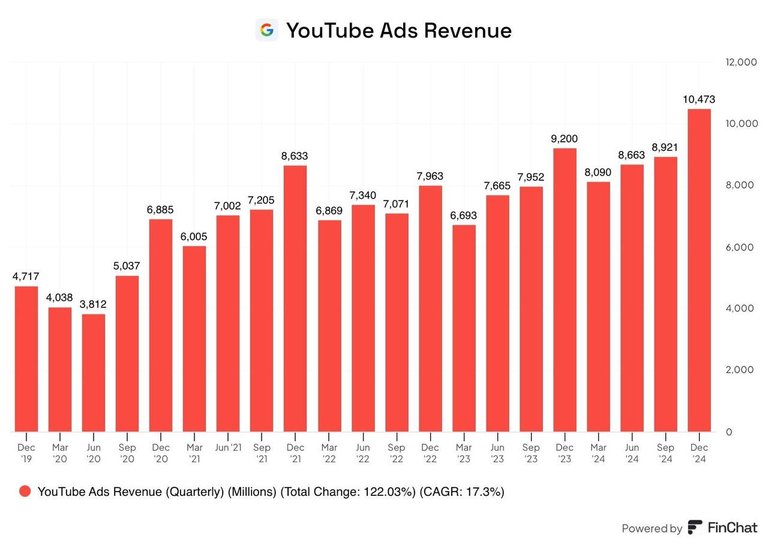

Let’s not forget YouTube, which crossed $10 billion in quarterly revenue for the first time ever. Reminder: Google bought YouTube for just $1.5 billion .

Despite all this, the stock is down -10% this week.

The main reason? Management decided to increase 2025 investments to $75 billion, way above analysts’ expectations of $50 billion.

Honestly, I don’t get this investor reaction. Okay, sure—the company could return the money to the investors. But then what? Where would the growth come from? 🧐

When a company can invest its capital at an ROIC above 30%, it would be foolish not to.

They have tons of projects that could drive massive growth in the coming years.

And you know what that means? More future profits for investors.

In my opinion, this mindset is way more productive in the long run.

Sure, this might hurt free cash flow in the short term, but long term? It’s setting us up for even bigger profits.

Posted Using INLEO