In recent days, and specifically after the last FED meeting, the prevailing opinion in the markets is that the FED is making a mistake. What mistake? That it will likely proceed with fewer rate cuts than we had expected in 2025.

The FED isn’t making a mistake, and this was confirmed by the latest Core PCE report.

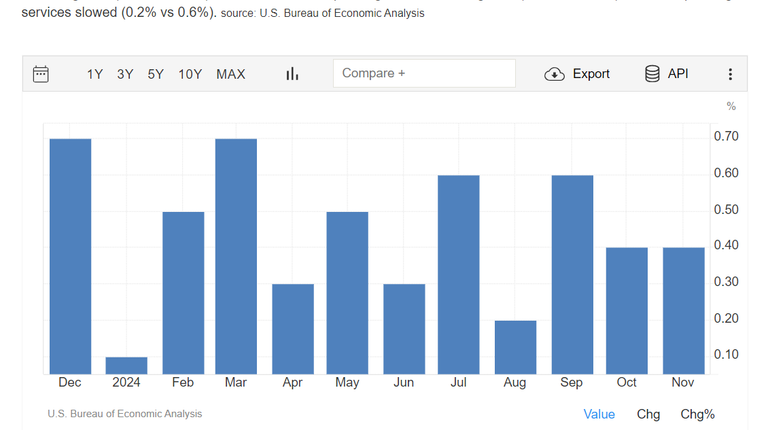

CORE PCE

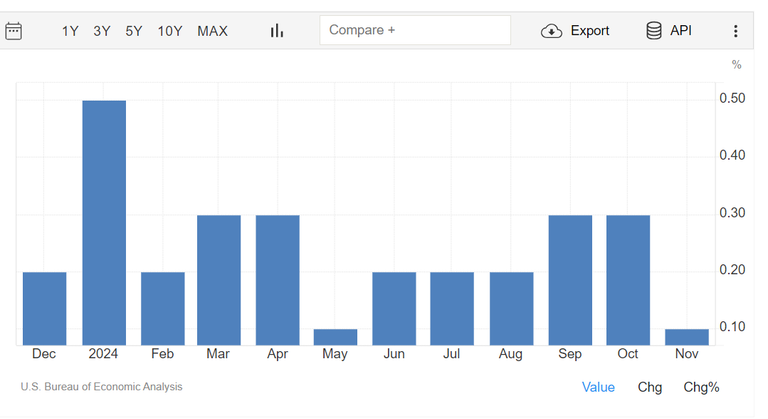

As we’ve mentioned, the FED takes the Core PCE very seriously, which is why we’ll take a closer look at the latest numbers. So, as it turns out, on a monthly basis, Core PCE rose by just 0.1% in November. This is lower than the expected 0.2% and also below the previous month’s 0.3%.

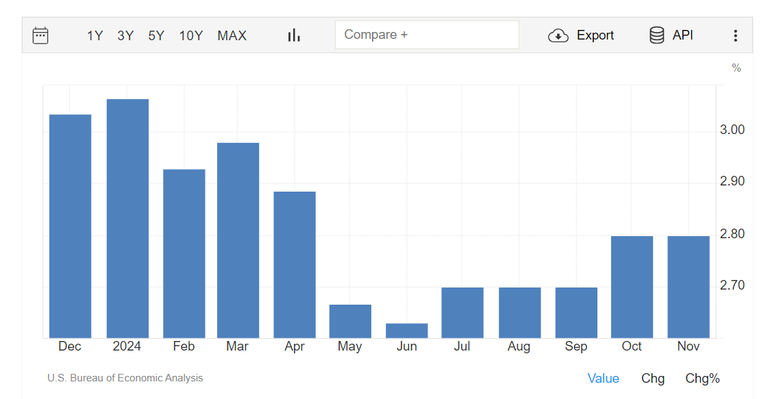

The results were also positive on an annual basis, with Core PCE coming in at 2.8%, lower than the 2.9% forecast and remaining steady compared to the previous month.

And what does this mean? It means inflation has calmed down. Especially considering that just a few months ago, it was significantly higher. And what does that tell us? That the FED’s measures are working.

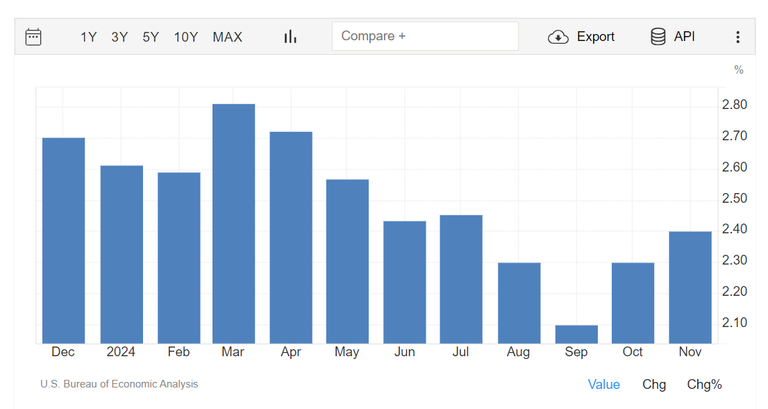

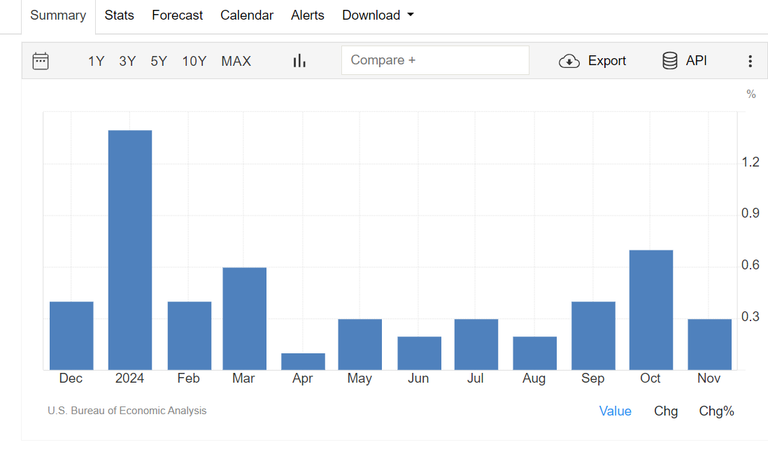

Even the overall PCE, which includes food and energy, came in at 0.1% on a monthly basis—lower than both the forecast and the previous month’s 0.2%. On an annual basis, it stood at 2.4%, slightly higher than October’s 2.3% but below the 2.5% forecast.

In short, everything is under control.

INCOME

And it’s not just inflation; we’ve also seen other data showing that the U.S. economy is… on fire! Let me tell you why:

- Personal income rose by 0.3% in November. Okay, a bit lower than the expected 0.4%, but it’s still climbing, and

- Consumer spending increased by 0.4%. People are spending. And when people spend, the economy “runs.”

But the savings rate fell to 4.4%. Isn’t that bad? Not necessarily. The fact that people are spending more while saving less shows they have confidence in their ability to meet their needs. And that’s a sign of a healthy economy.

Bank of Japan (BOJ)

The Bank of Japan (BOJ) decided to maintain its loose monetary policy, keeping the key interest rate at 0.25% to support economic growth. In the short term, the yen is likely to face pressure due to the accommodative policy and gradual inflation rise. However, concerns raised by Mimura and the emphasis on exchange rates highlighted by Ueda suggest that in cases of significant volatility, the government and the BOJ might intervene, limiting the yen's depreciation or even leading to temporary strengthening.

Monetary Policy Committee (MPC)

The Monetary Policy Committee (MPC) kept the key interest rate at 4.75% during its December 2024 meeting.

The MPC demonstrates determination to maintain restrictive monetary policy until inflation stabilizes, despite the economic slowdown. However, uncertainty regarding demand trends and labor market developments makes monitoring upcoming data critical in future meetings. The trajectory of interest rates will depend on balancing inflationary pressures with economic growth.

Posted Using InLeo Alpha