The past week was packed with news from the corporate world, as we’re right in the middle of earnings season. But what about the macroeconomic news from the U.S?

So, why is this interesting? Because the U.S. economy remains strong and is moving in the right direction. Of course, some are still waiting for a crash and hoping they’ll find a chance to buy at much lower levels. But honestly, with the latest updates, I don’t see that happening.

So let’s dive into the latest U.S. news, which includes (a) GDP growth rate, (b) the FED’s favorite index, Core PCE, (c) the consumer confidence report, and (d) the jobs report, which actually got a lot of people thinking.

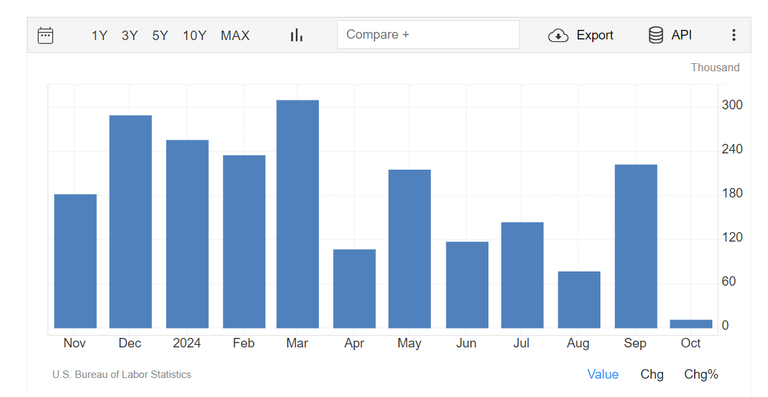

Jobs Report

We’ll start with the jobs report, which raised a lot of questions and worried even more people. Why’s that? you might ask. Well, the report showed something NO ONE expected. And when I say no one, I mean it! New jobs plunged, with only 12,000 added.

12,000? Isn’t that a bit low? you might say. Exactly! Just imagine, analysts were expecting 125,000 jobs. We’re talking about a nearly 95% drop from the September report, which had shown 223,000 new jobs. So, as you’d expect, this spooked a lot of people and gave the doomsayers an excuse to start talking about a coming recession, a collapsing labor market, and other “lovely” predictions.

Okay, but if that’s not the case, then what happened? you might wonder. Well, in October, the U.S. faced some situations that dramatically affected job openings. On one hand, there were a series of strikes, and on the other, deadly hurricanes hit a large part of the country.

That’s why these numbers don’t really reflect the true state of the labor market, and it’s best to ignore them. And that’s not just my opinion; many analysts support this view too.

GDP

As for U.S. GDP, it grew by 2.8% in the third quarter. And although the growth rate slipped from 3.0% in the previous quarter, it still shows that the U.S. economy is quite strong. This growth is due to solid consumer spending on both goods and services, increased exports, and government spending.

As long as we see GDP growth, the U.S. will stay far from a recession. Let the doomsayers say what they want.

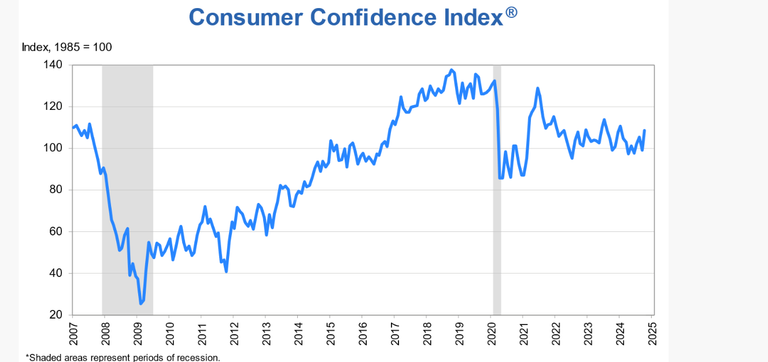

Consumer Confidence

Consumer confidence also plays its role here, as it saw a significant increase in October, reaching 108.7 points from 99.2 in September. In fact, this increase is the largest monthly rise since March 2021! And, of course, that’s a very good thing! Because when consumers are optimistic, money flows into the markets, and GDP growth stays positive.

But you know what the best part is? The percentage of consumers expecting a recession in the next 12 months fell to its lowest level since July 2022, and the percentage of those who think the economy is already in recession also decreased.

Core PCE

And finally, we have Core PCE, the FED’s favorite inflation gauge.

The Core PCE rose 0.3% on a monthly basis in September, exactly as analysts expected, slightly higher than the previous month’s 0.2%. On an annual basis, however, the Core PCE reached 2.7%, just slightly above the forecast of 2.6%, but remaining steady compared to the previous month. So, we can see that while there was a tiny increase on a monthly basis, inflation didn’t worsen on an annual basis, likely giving FED policymakers confidence that inflation is slowly moving toward their 2% target.

Posted Using InLeo Alpha