Lately i have seen a lot of videos , and read a lot of tweets on how to use Chatgpt to creat a script that can be used in tradingview. The script will provide you with a strategy on how to time buy and sell signals , some are using the Simple moving averages others the Exponential moving averages etc. So i thought why not try using Chatgpt to do the same of course with different parameters and with what i have in mind of using. So i tried two different scripts one for a strategy that can also be used to trade if i connect trading view with an exchange and an indicator.

Strategy

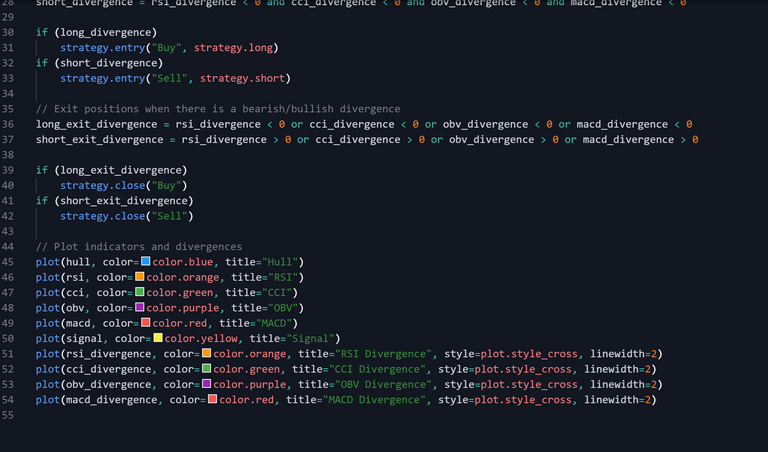

I asked for this This code implements a Hull, RSI, CCI, OBV, MACD Divergence strategy in TradingView using the Pine Script language. The strategy uses input parameters such as hull length, RSI length, CCI length, OBV length, fast length, slow length, and signal smoothing length to calculate technical indicators such as hull moving average, RSI, CCI, OBV, and MACD. The strategy then enters long or short positions when there is a bullish or bearish divergence in the indicators, respectively. It also exits the position when there is a bearish or bullish divergence, respectively.

It initially worked and on the strategy testing it gave a really good profit but when trying to use it again it's like it has errors that is almost unsolvable.

//@version=5

strategy("Hull, RSI, CCI, OBV, MACD Divergence Strategy", overlay=true)

// Input parameters

hull_length = input.int(title="Hull Length", defval=14, minval=1)

rsi_length = input.int(title="RSI Length", defval=14, minval=1)

cci_length = input.int(title="CCI Length", defval=14, minval=1)

obv_length = input.int(title="OBV Length", defval=14, minval=1)

fast_length = input.int(title="Fast Length", defval=12, minval=1)

slow_length = input.int(title="Slow Length", defval=26, minval=1)

signal_length = input.int(title="Signal Smoothing Length", defval=9, minval=1)

// Calculate indicators

hull = ta.hma(ta.ema(close, hull_length*2) - ta.ema(close, hull_length), math.sqrt(hull_length))

rsi = ta.rsi(close, rsi_length)

cci = ta.cci(high, low, close, cci_length)

obv = ta.obv(close, volume)

[macd, signal, _] = ta.macd(close, fast_length, slow_length, signal_length)

// Calculate divergences

rsi_divergence = ta.divergence(rsi, 2)

cci_divergence = ta.divergence(cci, 2)

obv_divergence = ta.divergence(obv, 2)

macd_divergence = ta.divergence(macd, 2)

// Enter long/short positions when there is a bullish/bearish divergence

long_divergence = rsi_divergence > 0 and cci_divergence > 0 and obv_divergence > 0 and macd_divergence > 0

short_divergence = rsi_divergence < 0 and cci_divergence < 0 and obv_divergence < 0 and macd_divergence < 0

if (long_divergence)

strategy.entry("Buy", strategy.long)

if (short_divergence)

strategy.entry("Sell", strategy.short)

// Exit positions when there is a bearish/bullish divergence

long_exit_divergence = rsi_divergence < 0 or cci_divergence < 0 or obv_divergence < 0 or macd_divergence < 0

short_exit_divergence = rsi_divergence > 0 or cci_divergence > 0 or obv_divergence > 0 or macd_divergence > 0

if (long_exit_divergence)

strategy.close("Buy")

if (short_exit_divergence)

strategy.close("Sell")

// Plot indicators and divergences

plot(hull, color=color.blue, title="Hull")

plot(rsi, color=color.orange, title="RSI")

plot(cci, color=color.green, title="CCI")

plot(obv, color=color.purple, title="OBV")

plot(macd, color=color.red, title="MACD")

plot(signal, color=color.yellow, title="Signal")

plot(rsi_divergence, color=color.orange, title="RSI Divergence", style=plot.style_cross, linewidth=2)

plot(cci_divergence, color=color.green, title="CCI Divergence", style=plot.style_cross, linewidth=2)

plot(obv_divergence, color=color.purple, title="OBV Divergence", style=plot.style_cross, linewidth=2)

plot(macd_divergence, color=color.red, title="MACD Divergence", style=plot.style_cross, linewidth=2)

The second thing i asked was a Divergence Indicator with Hull 50, Support, and Resistance

//@version=5

indicator("Divergence Indicator with Hull 50, Support, and Resistance Optimized", overlay=true)

// Define input variables

rsi_len = input.int(14, title="RSI Length")

rsi_oversold = input.int(30, title="RSI Oversold")

rsi_overbought = input.int(70, title="RSI Overbought")

macd_fast = input.int(12, title="MACD Fast Length")

macd_slow = input.int(26, title="MACD Slow Length")

macd_signal = input.int(9, title="MACD Signal Length")

obv_ma = input.source(title="OBV MA Source", defval=close)

cci_len = input.int(14, title="CCI Length")

stoch_len = input.int(14, title="Stochastic Length")

stoch_smooth = input.int(3, title="Stochastic Smoothing")

hull_len = input.int(50, title="Hull Moving Average Length")

atr_len = input.int(14, title="ATR Length")

// Calculate indicators

src = hl2

rsi = ta.rsi(src, rsi_len)

[macd_line, macd_signal_line, _] = ta.macd(src, macd_fast, macd_slow, macd_signal)

obv = obv(close, volume)

obv_ma_val = ta.sma(obv, obv_ma)

cci = ta.cci(high, low, close, cci_len)

[stoch_k, stoch_d] = ta.stoch(high, low, close, length=stoch_len, smoothK=stoch_smooth, smoothD=stoch_smooth)

hull = ta.hma(src, hull_len)

// Calculate support and resistance levels

atr = ta.atr(src, atr_len)

support = ta.lowest(low - atr * 2, atr_len * 4)

resistance = ta.highest(high + atr * 2, atr_len * 4)

// Plot the indicators on the chart

show_rsi = input.bool(true, "Show RSI")

if show_rsi

plot(rsi, color=color.orange, title="RSI")

hline(rsi_oversold, color=color.black)

hline(rsi_overbought, color=color.black)

show_macd = input.bool(true, "Show MACD")

if show_macd

plot(macd_line, color=color.blue, title="MACD Line")

plot(macd_signal_line, color=color.yellow, title="Signal Line")

plot(macd_line - macd_signal_line, color=macd_line[1] < macd_signal_line[1] ? color.green : color.red, title="Histogram")

show_obv = input.bool(true, "Show OBV")

if show_obv

plot(obv_ma_val, color=color.orange, title="OBV MA")

plot(obv, color=color.blue, title="OBV")

show_cci = input.bool(true, "Show CCI")

if show_cci

plot(cci, color=color.orange, title="CCI")

show_stoch = input.bool(true, "Show Stochastic")

if show_stoch

plot(stoch_d, color=color.blue, title="Stochastic")

show_hull = input.bool(true, "Show Hull MA")

if show_hull

plot(hull, color=color.purple, title="Hull MA")

// Plot support and resistance levels

show_srl = input.bool(true, "Show Support/Resistance")

if show_srl

plot(support, color=color.green, title="Support")

plot(resistance, color=color.red, title="Resistance")

That one doesn't work i tried a lot copying the errors and then chatgpt correcting them but a new error was always poping.

The reason i used chatgpt is because it makes things easier and if you set you parameters right you will get an excellent result, I will keep on trying until i am able to put what i have in my head in a pine script.

Posted Using LeoFinance Alpha