A 2021 survey conducted by the Philippine Central Bank (BSP) estimates that there are still 34.3 million unbanked adults in the country. Many of them are unable to meet the standards set by traditional financial institutions or are unaware of the advantages of owning a bank account. And even though most of these 34 million individuals are under the low-income bracket, there is still a significant amount of transactions happening in those ecosystems.

Because of this, microfinance companies stepped forward and catered to the unbanked Filipinos. With the goal of financial inclusion and poverty alleviation, they provide a wide variety of services on a smaller scale. Some of them may include life insurance, savings accounts, and retirement funds, among others.

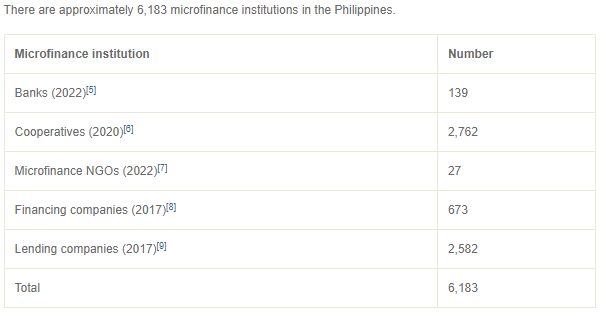

source: Sedpi.com

What makes microfinance companies effective in recruiting new members is their approach. A representative of the institution would regularly visit clients and collect their weekly contributions in cash. Many find this personal approach better than going to a bank and talking to a representative.

Joining a Microfinance Company

I've known for a while now that there is a microfinance company that has established a group in our community. But it's just this Tuesday that I finally decided to sign up. I'm one of many who missed the opportunity of securing a life insurance plan in their twenties. But that is also probably due to the fact that those were not very popular at the time and the monthly premiums were not cheap.

The requirements needed to sign up were similar to that of a bank. I attended the orientation in one of our neighbors' houses and was dumbfounded by what they presented for their life insurance offer.

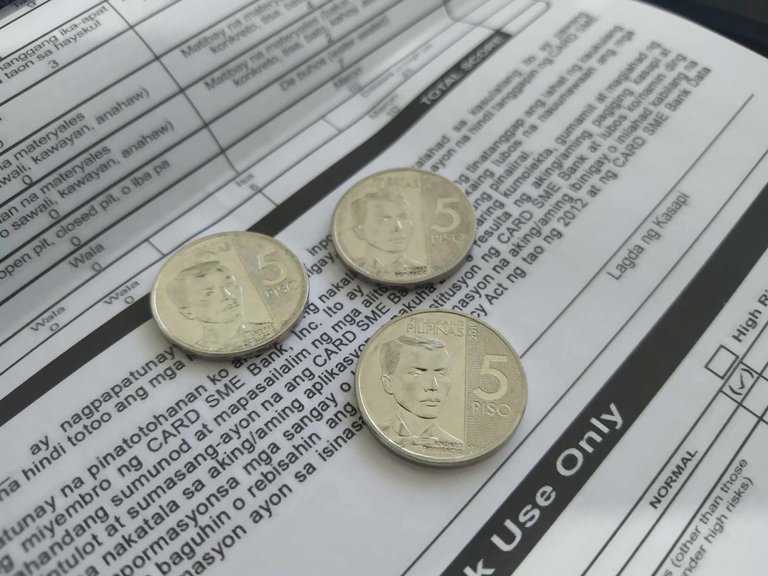

A weekly payment of fifteen pesos, roughly 0.26 USD, is all it takes to be insured. This package covers accidental or natural death, total and permanent disability, vehicular accident hospitalization, etc. For a weekly fifteen pesos premium, you are covered for up to 100,000 pesos. (1700 USD) I thought it was too good to be true at first. There's no way that it's feasible to offer that amount of insurance for that low of a premium.

But the catch there is that you also have to pay weekly a 50-pesos minimum savings deposit and five pesos retirement fund. They also highly encourage members to take loans out continuously. I am guessing this is where the company gets the majority of its revenue from. Their interest rates are slightly lower than bigger banks and can especially help small business owners.

Conclusion

The Philippines is still in the midst of modernization and fast economic growth. During this process, some are left behind and cannot adapt to these changes. These microfinance companies play an important role in bridging the gap by catering to the unbanked population and offering them new opportunities.

Come join the TEAMPH community and let's help each other in this great Splinterlands journey. Together we thrive, kapamilya!

Join TEAMPH Discord Here.