We will start off by stating I have no idea about the technical capabilities and how this could be done at the blockchain level. However, if some with development skills could chime in about the feasibility, that would be great.

It seems that CZ is at it again. The CEO of Binance admitted the company mistakenly staked customer's cryptocurrency. This is something that those of us on Hive know all to well. One time could be a mistake, multiple ends up being a trend.

We have to be leery of centralized exchanges. With all that is taking place within the cryptocurrency industry, it is hard to know who is friend or foe. For this reason, it is best to get as much on-chain as possible.

This is something we will explore in this article and offer up a solution to the problem. It ties into the Hive Backed Dollar (HBD) and how to leverage both coins for exponential impact within the ecosystem.

BUSD Crosses 20 Billion

The "stablecoin wars" are heating up. We have 3 major players, at the moment, who are vying for the prize.

At the top of the list is still Tether, with USDC in second place. Coming up the rear but gaining is Binance with the BUSD token. This just crossed 20 billion in market capitalization.

Binance has an advantage over the others in that it is the largest cryptocurrency exchange. Recent moves basically made BUSD the default stablecoin on that platform. This actually is an intelligent move on their part since it provides an expansive use case. Now, when traders want to "park" their money, BUSD will be the choice.

Even with all the focus from politicians and regulators, we see how the path forward for this sector is very optimistic. Stablecoins offer a powerful use case that the industry is just starting to uncover.

We discussed some of this regarding HBD. Please skim through this article as a precursor to some of the ideas we are going to present there.

Hive Creating A Similar Situation

When it comes to the Hive Backed Dollar, Hive has an interesting situation. There is the Internal Exchange which allows users to swap HBD for $HIVE (and vice versa). At the same time, we also have the ability to generate profits off the activity of users through the HBD Stabilizer. However, instead of feeding the pocket of someone like CZ, we see the proceeds being fed into the Decentralized hive Fund (DHF).

Here is what I wrote in the other article:

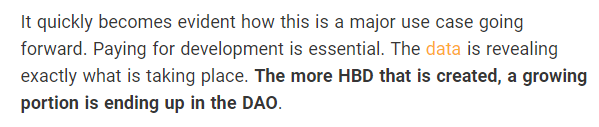

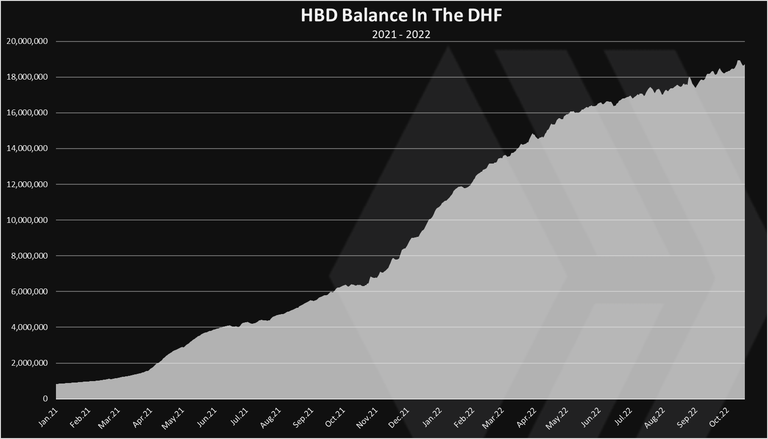

Basically, the more HBD that gets creates, the more that finds it way into the DHF. This makes sense when we think about it. By following how the flow works, we can see clearly what takes place.

- HBD is created and placed in users wallets

- Users trade some of the HBD for $HIVE, often trading with the HBD Stabilizer

- More HBD is fed into the DHF, which allows for larger HBD allocation to the HBD Stabilizer

- This allows for more trading, which increases as more HBD is in users wallets

Rinse and repeat.

One of the keys is to achieve depth and liquidity with HBD. This is vital for markets to operate efficiently. We know the present level of HBD is not sufficient. BUSD recently went over 20 billion; HBD bare has 10 million available.

As was opined, HBD has a major use case that is setting it apart from much of the stablecoin world. Because of the actions of the HBD Stabilizer, HBD is actually serving the role of funding and investing. The HBD that enters the DHF ends up, in part, funding further development tied to the Hive blockchain.

This is a very powerful use case.

Therefore, the decision to offer a base layer, fixed income market on Hive has been a giant step forward. Over the next few years, the HBD Stabilizer will just keep feeding the DAO with more coins, expanding the ability fund development.

So this brings up the question of how can we add to this?

$HIVE In Savings

At present, anyone who puts HBD into savings receives 20% APR paid out in HBD. This is serving as a low-risk, strong return option for users of Hive. Now that we have data showing the threat to the ecosystem due to more HBD being created is minimal, we can take a look at adding another layer.

Keep in mind, the more HBD that is created, a significant portion ends up on the DAO. We have data over the last year showing this.

Going back to the idea of CZ staking users coins, here is where we offer some incentive to bring some back on-chain. Fortunately, due to the establishment of the DAO, the governance of Hive is more secure than it was a few years ago. Nevertheless, helping to reduce the attack vector is never a bad thing.

A possible path to take is for Hive to offer a 10% APR on $HIVE placed into savings. The key is the payouts do not come from inflation but, rather, are done using HBD.

Thus, if one puts $100 worth of $HIVE into savings, he or she will earn $10 worth of HBD.

We already have the Internal Exchange which has some of the best liquidity for both coins. This means we have ongoing price feeds that can allow for us to use a 3 day moving average.

The goal is to provide people with a reason to hold $HIVE. It is often pointed out that most investors do not want to curate content nor do they like the 13 week lock up period. For this reason, we can offer another alternative.

A 10% return might not be the best thing in cryptocurrency, but it is a strong return on a coin that could see massive appreciation. It also is lower than what many can get by powering up. Of course, using savings has no impact upon governance since that is only tied to staked $HIVE.

Time Locked Vault

Here is where we get into the long discussed idea of a time locked vault at the base layer of Hive.

For those who are not aware of this idea, basically it is expanding savings so there is an option for a higher return in exchange for locking up the HBD for a longer period of time. We will use a 1 year 25% return for the example.

The time locked vault adds another layer to the ecosystem that provides even greater security. One of the reasons HBD in the DAO is a positive is that it is not a threat to the blockchain. Since it is locked up, it cannot be converted to HP and used for governance. It also cannot alter the coin distribution through the conversion mechanism.

We can see the same thing with the time vault.

Let us look at the proposed idea and how it could play out:

An individual puts $HIVE into savings, earning 10%. That is paid out in HBD. What are the options?

- swap HBD for $HIVE

- put HBD in savings

- bridge HBD across to a derivative

- keep it liquid

- put it in the time vault

Here is where we see the flow of HBD. While we cannot know the percentages, we can conclude is that a certain amount of the HBD generated will be put in the 1 year vault for a higher return. Therefore, just like the DAO due to HBD Stabilizer, a portion of new HBD created ends up locked away.

Ragnarok Savings

There is another powerful idea emerging that is actually similar to what companies like Circle are doing.

Ragnarok is going to sell all assets tied to the game for HBD. This not only provides a use case but also effectively serves as a "lock up" option. The goal is to take whatever HBD is acquired and put it into savings. Here the interest will be earned, HBD that is used to fund the reward pool for the game.

The idea is that, over time, the amount of HBD in savings (or a time vault) grows as in-game assets are sold, thus increasing the reward pool. There is no reason to touch the principal since that is the proverbial "golden goose".

Circle

Circle is the company behind USDC. This is a stablecoin that is backed 1:1, with each USDC having a USD or a cash equivalent tied to it. The last part is very important.

Without looking up the percentages, we can presume that the overwhelming majority (probably 80%) is backed by cash equivalents, i.e. US TBills. This is important to note since cash generates no return yet the TBills (or bonds if they use them) do have a payout.

Thus, each time someone creates a new USDC by submitting dollars, more Treasuries are purchased. It is a move that ends up generating a larger payout in interest.

And guess who benefits from that? Obviously, this is kept by Circle.

The point of the Ragnarok example is that here we see a similar concept applied. A key difference is the interest is being used to benefit the players and investors in the game.

Under this scenario, it is likely that Ragnarok would want to get the best return and would lock up all of its HBD in a time vault. We also see how HBD is now funding the reward pool and aspects of the game itself.

How many other projects will do the same thing?

Rinse and repeat.

Feeding Value To $HIVE

Over the last year, we covered the idea of HBD in detail. The relationship between HBD and $HIVE is very powerful. It is something that can be leveraged for greater gain to the ecosystem.

A main premise is that we have to drive value (not price) to each coin separately. Then, due to the correlation, we are able to see that compound upon itself in terms of the impact.

The idea of paying HBD as interest earned on $HIVE placed into savings is a way to add more value to the latter coin. It adds another reason for people to hold $HIVE.

Of course, as more is placed into savings, it is not on the open market to be readily traded. While 3 days is not a long lock up period, someone who is playing the markets will not utilize this option. Under that scenario, liquidity is key.

Feeding value to $HIVE is crucial since it is the backing mechanism for HBD. By removing some liquidity from the exchanges, we could tighten supply, potentially pushing prices higher. The coins are not destroyed so they are in the market cap yet are not actively on the market.

Here is where the leveraging of both coins against each other can have an impact.

The Hive Financial Network

The foundation of the Hive Financial Network was to drive value to the both the base layer coins.

One aspect is Hive Bonds. This utilizes the time vault to provide liquidity to whatever money is tied up. However, this is only a piece of the puzzle. By having an asset that can be collateralized, we now open up the possibility for lending. This pushes the case further out since HBD in the time vault that is bonded and used for lending is likely to be redeposited once reaches maturity.

We also proposed the idea of having layer 2 markets and operations that utilize a derivative of HBD. This is done via a 1:1 bridge. That means the HBD is in a wallet on Hive, backing a derivative stablecoin at the second layer. If this is being used for transactions, just like Ragnarok, a certain percentage of the HBD is not going to be accessed.

Hopefully it is becoming clear how this can all tie together.

Remember, the key areas of focus for a currency need to be:

- payments

- derivatives

- funding and investing

- collateralization

This means we have to provide:

- depth (the creation of more HBD)

- liquidity (HBD Stabilizer, liquidity pools)

- sophistication (Hive Financial Network)

- infrastructure (Layer 2 solutions)

Base layer, fixed income on Hive provides a solid financial foundation for the ecosystem. When we add in the social media aspect, we see how the integration of DeFi is forming Web 3.0.

What are your thoughts on adding another piece to Hive's Fixed Income menu?

Let us know in the comment section below.

Other Articles Related To This Subject:

- What Gives HBD Value: Payment System

- What Gives HBD Value: Derivatives

- What Gives HBD Value: Investing And Funding

- What Gives HBD Value: Collateralization

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta