It is amazing to watch the transformation.

Back at the end of 2018, I wrote an article how cryptocurrency was going to target $1 quadrillion in market capitalization. If you think that target is absurd now, it was really asinine at the time.

So far, there aren't too many who are offering a similar projection. In this regard, there is still plenty of room on the island.

That said, some people are getting closer.

Chainlink Creator Discussing Real World Assets

Many are increasing their forecasts do to the idea of real world assets settling on blockchain. This is something that has thoroughly been discussed.

Sergey Nazarov believes we are at a tipping point where we will start to see the transformation.

Chainlink (LINK) co-creator Sergey Nazarov says this could be the year that sees a great merger between blockchain and the traditional global financial system.

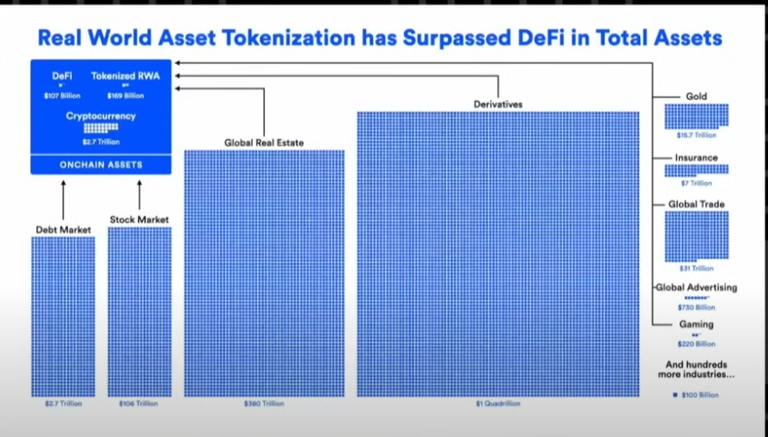

In a speech at the consensus 2024 conference, Nazarov says the market for on-chain assets is more than $100 trillion.

The above chart details the breakdown of assets based upon their market caps. If he is correct, this is going to be an online gold rush.

While I do not disagree with the idea of real world assets appearing on blockchains, the true value is in the creation of others. Nevertheless, let's dive into this for a few moments.

One of the most sensible transitions is for the global stock markets, valued at $100 trillion, to be placed on blockchain. This is likely the easiest of transition since it similar in nature. The difference between a stock and token, in utility, is small. Certainly, there are different rights associated with stock that might not be a part of a token such as sharing in the profits of the company.

Real estate is another market that gets discussed. The problem there is it will require a lot of intervention since governments are heavily involved. All real estate goes through some government entity (at least one). This means getting them to completely alter how they do things. Sadly, governments tend to be slow to change, even when there is financial incentive.

Finally, the debt market is also easily aligned. With near instant settlement, these transactions could be cleared in moments.

The advantage are certainly there.

Digital Revolution

To me, the gold rush is not so much in the tokenization of real world assets. This will play a part and we cannot ignore the numbers.

However, to go from $100T-$200T to $1 quadrillion is a major leap.

How does that occur?

This is where we move away from real world assets and get into digital assets. For example, we can see the size of the derivative market. These might be "real" but are not tied to anything physical. They are essentially products that Wall Street created out of thin air.

Yet, their value dwarfs the others.

What happens when cryptocurrency starts to create their own derivatives? Taking this a step further, how are the numbers altered when millions of projects are tokenized, with many different use cases interwoven.

Let us look at gaming from the chart above. It is valued at $220 billion.

Tokenization means this is over a $1 trillion business. I will presume the market cap is totally the value of the companies in the gaming industry. Certainly, this gives us a basis to operate from.

However, what are the assets in the game worth? At this point, very little since they are completely tied to the game itself. That said, what happens if we tokenize the value of the in-game assets? How does this change things?

Also, consider the idea that gamers can keep pumping more money into their gaming "business" yet never lose the value. It can be transferred as they move to different games. The value is there, only the asset is altered.

Here is an example of where an industry could see a 4x over what the present market capitalization.

Capturing Value That Is Missed

The key to all this is we have value that is being generated yet it not captured.

For example, the television series Breaking Bad was very popular. Even though it is off the air for a number of years, many still follow it. The same is true for programs such as Seinfeld, Game of Thrones, and others.

What is this "fandom" worth? How is it captured?

The reality is we do not have many ways to quantify it. Sure, people can buy merchandise which generates revenue. We have the ability for the owners of the content to distribute it.

In other words, the social layer for these shows is not captured.

Tokenization can do that. What if there was a Breaking Bad token. Essentially, we are looking at a community that has a huge following. In an upcoming article, we will discuss social tokens.

When we discuss the numbers here, we will see how they can quickly get absurd. Ultimately, the $1 quadrillion might be rather low.

Real world assets are not the biggest ship in this sea. The next layer is actually where the large numbers are. Some are starting to come around to hundreds of trillions in value being on blockchain.

They are moving closer but not quite there yet.

That will change in time.

Posted Using InLeo Alpha