Bear markets are tough. They are a test of resolve, something that many fail to meet. We see how many people left due to the fact that prices have crashed.

For those still on Hive and being active, congratulations. My estimation is you made a decision that will work out very well in the future.

We often discuss the concept of long-term thinking on Hive. This article is going to illustrate how things can change for everyone who is filling their bags.

This stems from a Tweet where someone was asking about $HIVE and what can it be used for. It is a topic that really strikes at the core of what Hive is about. For this reason, we will cover the essential component of what will make the base coin skyrocket in the future.

As always, none of this is financial advice.

Math Says $HIVE To Skyrocket

We talk about building. This is something that, after a while, can get old. However, it is the foundation for all that is taking place.

At each level, we see activity. This is important because we have both a scaling base layer along with a second layer that will be the feeder system. Ultimately, the appeal of Hive is going to be the games and applications that are built on it.

The main premise we must already remember is that staked $HIVE acts as an access coin. This is the main use case that will propel things to insane heights.

Just think about that for a second. We are not talking about hype or bull markets. Neither is required for $HIVE to excel. Instead, we are dealing with a utility that is built in which, over time, should stimulate demand. Market conditions aside, when demand is strong and supply rather fixed, there is no choice but for price to go up.

Resource Credits are the backend token (non-tradeable) system of each Hive based activity. Each of these requires a certain amount of RC:

- posting an article or comment

- voting for a post, witnesses, or proposals

- creating an account

- sending HBD or $HIVE to another wallet

- claiming Hive rewards

- posting a Custom JSON (most games use this feature)

- swapping HBD and $HIVE on the Internal Exchange

There might be a couple of other base layer features that were omitted. Nevertheless, we can see how all activity that is tied to the blockchain uses resource credits. The only way to get these is for someone to stake $HIVE.

What we are left with is a situation whereby the price of $HIVE is dependent upon the activity on the blockchain. The two are linked completely. If we see a massive increase in the latter, the former must follow at some point.

How Much Per User?

An easy way to frame this is by picturing how much Hive Power is going to be utilized by the average user on Hive. This is an impossible figure to forecast but we can play around with some numbers to get an idea.

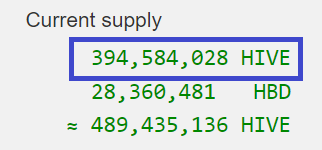

According to Hiveblocks, this is the present supply of $HIVE:

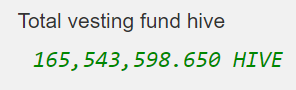

At the same time, here is the amount that is staked:

This means we have roughly 230 million $HIVE that is not staked.

Using the total of roughly 400 million, how much HP can each person have if there are 1 million users? Obviously the answer if 400.

Certainly this is enough to fulfill the needs of each person.

However, we already see 165 million locked up. With resource credit delegation, this can be used for newer people. Nevertheless, for our purposes here let us just focus upon the total.

We will presume that the average users required 50 Hive Power. This is taking into account the expected appreciation in resource credit prices as the chain gets more active.

Utilizing some advanced math skills, 400 million divided by 50 is 8 million.

That means we will suck up all the $HIVE in existence with 8 million people. While that might sound like a lot, it is really a drop in the bucket.

Internet Users

Let us look at a few applications to get an idea of what we are talking about. Keep in mind that the future of Web 3.0 is likely the combination of social media and finance. This is something we have on Hive.

Here is a partial list compiled from a quick web search:

- Medium 100M

- Paypal 300M

- Twitter 230M

- YouTube 2.6B

- JPMorgan 62M

- Bank of America 68M

- TD Ameritrade 11M

- World of Warcraft 125M

This list is of platforms that are (or could be) applicable to Hive. While we cannot say that these numbers will be matched, the point being is that 8 million users is a drop in the bucket.

To look at it another way, there are more than 1.5 billion estimated to be unbanked. Hive solves this basic problem.

As we can see, mix in finance and social media results in the understanding of how small a user base of 8 million really is.

If each person requires roughly 50 HP to operate they way they desire, we can see how quickly the 400 million gets scooped up.

Simple math. No hype or bull market nonsense.

In the end, applications and games that build on Hive are going to provide RCs to their users. This means those entities are going to have to stock up on HP. Where are they going to get it?

The basic answer lies in the fact that, eventually, someone will have to start cleaning it off the open market. There really is no other way around it.

It is why building is so important. Over the long term, as more users are attracted, the pressure to give them access increases. This really accelerates when the network effect is factored in.

The "if" is not whether the price increases. Instead, it is whether we get the users. IF that happens, the price of $HIVE has to increase.

Watch the builders, they are the ones who are adding the value to the ecosystem.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta