There was a bit of news that came out regarding HIVE. It might have flown under the radar due to the fact that it is the holiday season.

Binance decided to add a futures contract for HIVE to its platform. This will provide eligible traders with certain benefits.

Unfortunately, for some, like those in the United States, trading on that Binance is forbidden.

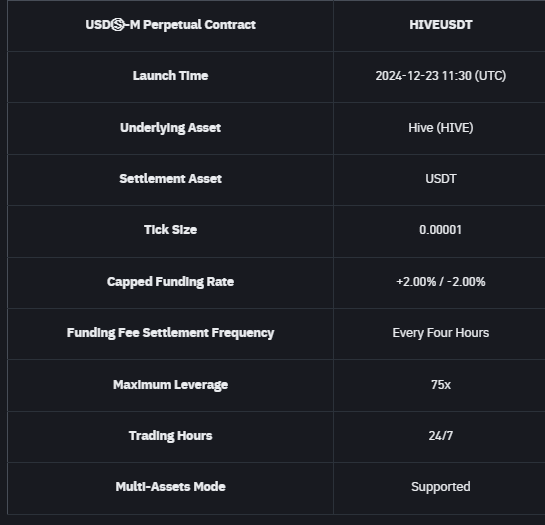

Binance Adds HIVE Futures Contract

Binance fell under the radar after an eventful year with CZ. Since he went to jail, things appear to be quiet with the exchange.

That said, they are still operating and expanding their offerings. As of the 23rd of December, this includes HIVE.

Source

Futures contracts are a derivative of the underlying asset. This is another vehicle for traders to utilize when approaching HIVE. In fact, there are a number of benefits.

Advantages To Futures contracts

Traders of HIVE have a couple different options that was not previously available.

As we can see, leverage can be applied. For those who like to speculate to larger degrees, this can result in a 75x max. Obviously, for those who are right in the price moves, it can be highly profitable.

Of course, the flipside is also true which is why many should avoid this.

The second benefit comes for the reverse. Traders can hedge their holdings in HIVE by derisking via a contract. This means going short to offset a long position in the underlying asset.

When most people think of derivatives, they only consider the leveraged aspect of things since that is what the media portrays. However, these assets are also used to reduce risk.

A final benefit is that institutions can enter the arena. They are often prohibited from dealing in the underlying asset. With cryptocurrency, there are often custody issues. WIth a future contract, this is traded like any other financial product. There also tends to be more volume with the futures market.

Will This Help HIVE

The answer to this is mixed.

There is no direct correlation between the price of HIVE and the futures contracts. Having this available does not mean more buy demand for the underlying asset.

Some futures contracts do settle with delivery. Most commodities operate in this manner. At the end of the futures contract, the seller delivers the grain (or whatever) to the buyer.

With these contracts, we are likely dealing with cash settlements. That means no HIVE is purchased to establish the contract. It is simply another layer operating on top of the coin. It is a stark difference from the Bitcoin and Ethereum ETF which actually have the underlying assets custodied.

Indirectly, this is a helpful move. As stated, there are a number of benefits for traders that could make HIVE more appealing. While traders will simply use the futures contracts as the vehicles, if could stimulate some buying for those who want long position.

Also, the potential entry of institutions is always a benefit. Even though they are not likely to buy HIVE, over time, this could help with the exposure it receives.

To check out the trading pair (HIVE/USDT), click HERE.

Posted Using InLeo Alpha

)

)