Crytocurrency is bringing up a lot of facts about money and what truly occurs regarding the financial system. As we design new systems, it is important to understand what the challenges reside.

Most look for utility when it comes to a coin or token. This often leads to the question "what can I use it for". People are looking for cryptocurrency to be a medium of exchange. It makes sense since we use the term currency in the name. Sadly, that is misleading.

It would be better if we used the term digital asset when referring to cryptocurrency. The reason for this is we are dealing with different assets that have specific characteristics.

For example:

value capture tokens: this is where most fungible crypto falls. The token or coin is related to the value of the platform or ecosystem.

stablecoins: this is the medium of exchange tokens

non-fungible tokens: digital ownership assets

As we can see, these do not mirror each other. The purpose varies greatly.

When discussing this topic, there is another factor to consider. When it comes to currency, commercial adoption is easy. The challenge comes from the financial. This is something that most overlook when discussing the US dollar.

To show how these differ, we will highlight the language applied to each.

Source

Capital Flow

When hearing a discussion about currencies, especially the USD, how often did you hear mention of the term "capital flow"? Most likely this was never brought up.

The same is true with cryptocurrency. Have you ever heard anyone discussion the capital flow of a coin or token and how important that is? Most focus upon the use case and what can be bought.

Here is where some clarification is required:

Commercial utility is vital to a currency. It is also the easy part. Getting adoption as a medium of exchange is simply a matter of providing people with an alternative. The situation with Hive Backed Dollar (HBD) in Sucre, Venezuela is an example. Adoption there is going rather well as more shops agree to accept the coin for payment. Since the Bolivar is a total dumpster fire, it is simply a matter of offering another option.

This can ebb and flow. It a better solution comes along, the merchants and individuals in that region will make a different choice. The resiliency, as a threshold, is much lower.

We know we are dealing in this area when we see the term payment. It is often coupled with the idea of transactions although that can cross over into the financial.

Capital flow is more resilient. It is also a much higher barrier. Here we see the financial world taking over.

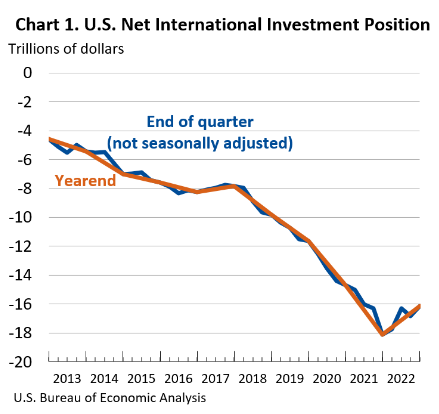

The above chart shows the Net International Investment Position (NIIP) of the United States. It shows the U.S. position is over $16 trillion. This is one of the metric used to isolate what the capital flow is for a nation.

Under this, assets are foreign assets owned by Americans. Liabilities are US assets that are owned by foreigners. Obviously, when US assets are being purchased, money is flowing into the country. The net position reveals the capital flow.

This is naturally not an exact science. There are variables such as increase/decline in asset values along with currency exchange rates. Nevertheless, this does give us an idea about trends.

Since the beginning of 2018, the net has been $8 trillion flowing into the United States.

Capital Flow Over Transactions

We discussed Hive Bonds over the last 18 months or so. This is an idea in keeping with capital flow.

Going back to the NIIP, there is now $8 trillion more (net) in US assets held by foreigners. What does that mean for the currency?

To start, US dollars are required to purchase these assets. Whether one is purchasing bonds, stocks, or even single family homes, USD is the only currency accepted.

Then we have the transactions related to these assets. For example, a dividend that is paid out by a company like Apple will be made in USD. The same is true for bonds, whether they are US Treasury or corporate. Rents are paid on properties in that currency. Property taxes and expenses related to the property also require USD.

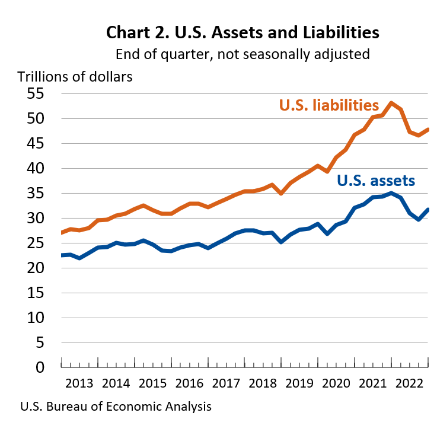

This chart shows us the gross positions. Notice how the net chart is a bit misleading. After a drop off in both categories, we see a jump over the last 6 months. Even the liabilities are showing more assets being acquired by foreigners.

We are talking about just shy of $48 trillion in US based assets being held by foreigners. If these net even a 3% return, that is almost $1.5 trillion is USD being distributed. We also have to keep in mind this is US based assets as opposed to USD denominated assets. The latter is a much bigger number since debt around the world is often written in USD. Since there are no capital controls on that currency, anyone can issue bonds out in that denomination.

Ultimately, it is capital flow that tells the story. To start, they end up leading to transactions. However, and even more importantly, it is a much slower transition. Tens of trillions in assets is not going to be moved very quickly. In fact, there is little incentive to do it when safety is found. The capital flow is continually to the US since that is the safe haven as compared to most of options.

The Meaning For Cryptocurrency

When it comes to adoption, the low hanging fruit is commerce. Getting merchants to accept the currency as a medium of exchange is a central focus. That said, it is only the starting point. Stablecoins are the solution here and this is what needs to be pushed.

The much bigger challenge is to develop the infrastructure which enables the construction of the assets which will attract capital. Value capture tokens end up being the asset instead of being the medium that allows for the purchase of the assets. Here is where a great deal of confusion enters, on both the general public and those constructing these systems.

For cryptocurrency to truly make a dent it is going to have to operate that this level. The financial arena is where the big numbers enter. It is also where the conversion is a much greater challenge.

There are a number of areas where currency creation needs to focus:

- payment

- funding and investing

- derivatives

- collateralization

Notice only one of these deals directly with commerce. By the way, the NIIP does NOT include derivatives, meaning the numbers are higher if those are taken into account.

If cryptocurrency is going to replace the existing monetary system, it is going to have to encourage a massive shift in capital flow. This means constructing a great deal more than payment systems.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta