There is a lot of discussion about regulation, governments stopping cryptocurrency, and a host of ideas that are not aligned with the reality of what is taking place. In fact, it goes in direct contrast to 70 years worth of evidence.

Ledger technology is nothing new. This was employed for decades, proving the merit for constructing a financial system. It grew over the years until those involved literally ran the world. This was not based upon conspiracy theory. Rather, it was simple financial acumen.

It is a system that operated outside the control of any single government or central bank. The Federal Reserve had no say whatsoever and it evolved into hundreds of trillions of dollars.

We are seeing the same thing developing now. The major difference is that we have transparency and that, instead of limited to bankers, it allows anyone to participate.

This is the power of ledger technology. It is proven and it will usurp any single economic or financial system.

Source

Eurodollar

The system that we are modeling is the Eurodollar system. For anyone who studied that, the similarities are obviously. Before getting into it, let us give a brief overview.

A Eurodollar is any USD that is held in a bank outside the United States. Originally it was just European banks yet the term was extended to include Asia too. Keep in mind this has nothing to do with the EURO currency.

As USD was spread throughout the world after World War II, especially in Europe and Japan, we saw a large accumulation of holdings as a result. This fostered in a new era of banking, one established by the international banking entities.

What they did was create an entire system of borrowing and lending based upon the Eurodollar. While there was USD at the base, new instruments were built on top. Thus, we saw a wave of assets that were developed, collateralized, traded, and used for value transfer. This is exactly what we are seeing formed now.

None of these assets that were created existed in any physical form. They were all based upon ledgers. In other words, the money was "created out of thin air".

Very quickly the bankers realized what they had. They literally could make money to make money. Since this was completely unregulated, and global in nature, we saw a system of trust established without law. Essentially, either the counterparty or the asset had to be trusted.

Through these bank instruments, trillions of dollars worth of transactions were done. Banks were able to leverage these assets for further gain by collateralizing loans with them. This allowed for the entry into global markets to seek greater profitability.

Obviously, this was a closed system. In fact, for the first couple decade, the bankers didn't even want it known what they were doing. Certainly this was a Golden Goose they did not want to get out.

As long as the system had liquidity, there were no problems. This is what actually fueled the global economy. It solved Triffin's Paradox for the Federal Reserve while providing the liquidity necessary to keep the economy expanding.

The Problem Cryptocurrency Solves

We see a lot of attacks on cryptocurrency telling us how it is not real or backed by anything. The reality is we are seeing a very similar system to the Eurodollar being erected. As stated, the difference is that it is operating outside the international banking system.

Because all of this operated outside the traditional banking system, it was known as the shadow banking system. It is ironic that cryptocurrency is now going to be the new banking system outside the shadow banking system.

Many ask what problem does cryptocurrency solve? This is an easy one when we understand what happened to the Eurodollar system since the Dotcom bubble.

At the core of the Eurodollar system is the USD that is offshore. This is the foundation upon which everything was built. The challenge arose when the US government starting increasing its deficit spending. When Congress does that, to pay the bills, it sells Treasury Securities. Many are these are sold to US based entities, changing nothing. A portion, however, are sold internationally, pulling USD out of the Eurodollar system. Over the last 20 years, there were tens of trillions in deficit spending, resulting in trillions being sucked out of the Eurodollar system.

Here is the solution cryptocurrency provides. We have a global liquidity crisis in USD, the foundation for a 70 year financial system. Entities are having to sell their Treasuries simply to put their hands on cash. This impacts the quality of collateral that is used, causing a major tightening of global economic conditions.

Cryptocurrency, as a whole, is going to provide the solution to that liquidity crisis. This is a system that is being constructed based upon the same ledger technology. The major difference is the transparency that comes from utilizing blockchain.

Printing Money To Make Money

Many feel the massive of expansion of cryptocurrencies is a problem. Here again, we get the answer from the Eurodollar system. Throughout the years, as long as their was enough liquidity, the system operating effectively. It was only after liquidity started to dry up that problems arose.

People who are involved in cryptocurrency might be led to believe this is unsustainable. How can we just keep creating money out of thin air and it not collapse? The answer lies in growth. Keep in mind that the Eurodollar system fueled an ever expanding global economy. Since the end of WWII, and especially since the early 1980s, we saw a massive transformation of our economy. Technological developed took place at an unprecedented rate, providing economic growth.

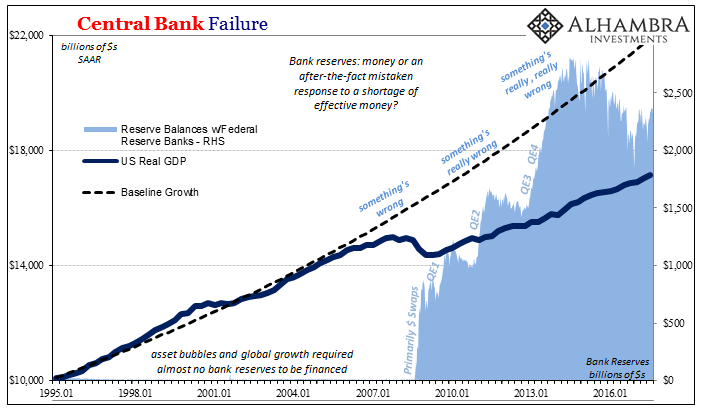

Unfortunately, since the Great Financial Crisis, this tapered off. By every metric, we are below the long-term growth trendline, costing the US economy trillions, let alone globally.

Source

As more money is made, productivity can increase. We are dealing in a digital world. It is easy to see how more cryptocurrency value can result in more being coded. Developers want to be paid. As the resources available increase, the output can follow a similar pathway.

This is the basic foundation of an economy. Of course, to be effective, there needs to be the ability to expand. This was something limited in the traditional economy, especially in the less wealth countries. With the digital world, this is much less of a concern. Today, we have tens of millions of people globally who are able to create projects through coding. This all enhances the economy we are creating.

It will also filter through to the general economy. At present, we see a lot of Venture Capital money funding crypto development. There is going to be a point where the opposite happens: cryptocurrency is used to fund physical world projects.

Those who are involved can see the payoffs already. This is what the international bankers realized long ago. They could put their ledger instruments to work, generating higher returns. Here we would also see lending taking place, helping to fuel even greater expansion.

The international bankers made a ton of money. They were also able to parlay that into basically running the world. It is safe to presume that cryptocurrency is going to follow the same path.

Ledger technology is proven. Cryptocurrency provides a technological upgrade to what the shadow banking utilized, giving greater confidence in the assets that are generated. If someone is holding a token, we can likely see what the market value is on it. This eliminates a great deal of the uncertainty.

The idea of printing money to make money is nothing new. Hence, we should not act like this is some novel idea. For that reason, we can also revel in the fact that there is a long history of ledger technology creating not only wealth but economic expansion.

Therefore, in closing, the naysayers either do not understand this system or they are operating from some agenda.

The Eurodollar system is being reconstructed, this time by the global population instead of just the banking system.

For 50 years the system operated rather efficiently. It only started to go awry after the US Congress started to mess things up. Of course, we should note who is trying to meddle with cryptocurrency.

Cryptocurrency will excel in the end because, like the Eurodollar, it is global in nature and outside the control of any government or central bank.

We have more than 70 years worth of history showing us how this works. Ledger technology is nothing new. We are only giving it an upgrade.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta