Cryptocurrency is going to make some people very wealthy. It already has. Of course, as they say, we ain't seen nothing yet.

This morning it is reported that FTX is buying the assets of Voyager. Sam Bankman-Fried is going to come out ahead on this one.

Some do not like the sentiment expressed here. For a variety of reasons, many feel that what is taking place is somehow bad. As we go through this article, we will see how these people prefer something that is unnatural.

Have you seen the hatred for the 1%? These people are nothing but greedy, inconsiderate, plagues on society. We see something similar with cryptocurrency. People hating on the whales because "they have more".

Of course, we can make the case this is nothing more than conditioning. We see a vast number of people who simply want without doing anything. They feel it should be handed to them.

Engaging in the insanity is what keeps people occupied with mediocrity.

Distribution Curves

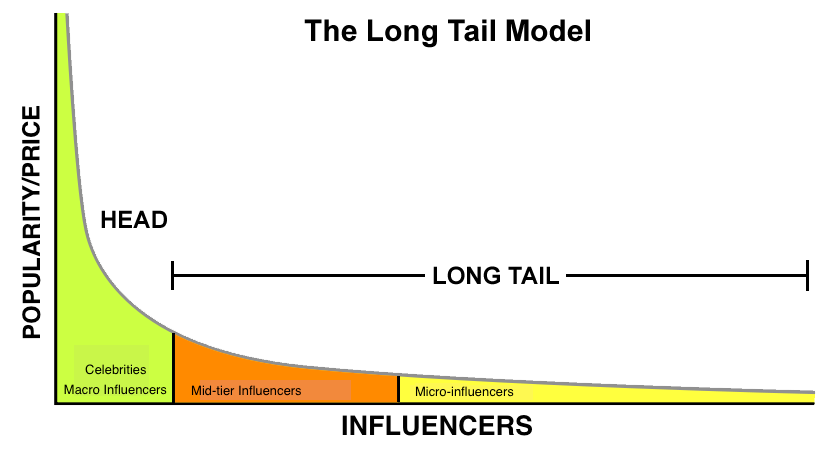

Have you ever noticed there are things called distribution curves? They come under many different names depending upon what the focus was of the researcher. Nevertheless, we see graphs such as the long-tail curve.

Under this model, we see things clearly. Here the focus is on influencers. This is just one area of application. It does, however, exemplify a situation we know to be true. Look at YouTube and cryptocurrency. How many people make videos about this topic as compared to the ones who actually have the influence?

We know there are a few how garner most of the clicks, have the most hours viewed, and, in turn, make most of the money from Google on this ad payouts (for this genre).

The same is true for books. Have you ever noticed the greatest works of all time were written by a few people? Even in contemporary times, people like Stephen King, James Patterson, and J.K. Rawling garner most of the sales.

It is the same in business:

- Amazon has the most significant amount of online sales

- Toyota and VW sell the most cars

- Apple takes most of the smartphone revenue

- In the past, Kodak dominated the camera market and Blockbuster video rentals

This is true for complex, organic systems.

- The largest oil fields yield most of the oil.

- Most of the population resides in a handful of cities

- A few economies generate most of the production

- Most products are manufactured in a handful of countries

The key here is that, while things shift, the overall remains in place. Blockbuster was knocked off by Netflix, who now has the majority of streaming. MySpace was once the dominant online social media platform. Facebook obliterated that to take over the top spot, by a wide margin.

Cryptocurrency is no different. Thus, we are left with a choice: where do we want to be?

Make The Proper Decision

Once we face this reality for what it is, then we can handle it. Again, this appears to be very few people since they want to engage in fantasy.

Cryptocurrency is going to offer the opportunity for some people to get very wealthy. This industry will create more millionaires and billionaires than any other in the world. The benefit is that it has a very low barrier to entry.

While much of the focus is upon the monetary aspect, we see how many are able to enter simply by putting forth time. This coupled with innovation, creativity, and dedication can change the fortunes for an individual along with his or her family.

Again, isn't it ironic that we are conditioned to hate the 1%. We have politicians who stand up and attack them. Of course, most overlook the fact that, when it comes to finances, those same people are the 1%. They want you to detest wealth while they amass it.

The Internet was a powerful tool for wealth creation. That created some of the most powerful companies in the world. For all the reasons to dislike Mark Zuckerberg, we cannot argue with his innovation, tenacity, and, ultimately, success. He built a conglomerate of platforms that have more customers (users) than any other in the history of the world.

It is something nobody else accomplished.

We see people like Larry Ellison, Mark Cuban, Brin and Sergei, and Jeff Bezos, individuals who staked some claim to the vast wealth being generated by this new medium. They took risks that most others cower from on their way to making their fortunes. Most call them "lucky", a sign of conditioning to achieve very little.

There is a reason why we know these names:

- Bill Gates

- Steve Jobs

- Reed Hastings

- Sam Walton

- Elon Musk

It is likely we used some, if not most, of their products/services. Each has customers in the millions (or billions).

Are you going to be one of the innovators within cryptocurrency that is going to put you up on the list?

Cryptocurrency Will Follow The Same Curves

We are going to see domination within the cryptocurrency world. In fact, things are already starting to line up.

- A handful of blockchains will handle the majority of transactions

- Wallet usage will focus upon a small number

- In each segment, one or two applications or platforms will dominate

- There will be mega-games which have the overwhelming number of players

- Most of the value of NFTs will be tied to just a few

Again, this is no different than actors, sports stars, art, and box office revenues.

The difference is that anyone can get into this game. Many talk about the large number of worthless tokens. That is certainly true. But is that any surprise? Look at the graph above. It is in keeping with how things go. We simply are not going to see the majority of projects succeed.

What will occur is a number of unexpected tokens will excel. There is no monopoly that says what is dominant today will be that way in 5 years. Actually, we can almost guarantee things are going to be different. Innovation is going to cause disruption, even within the early "leaders" of today. Will they adapt and change? Only time will tell.

The same is true with the crypto influencers. They have their wagon hitched to YouTube. Will that always be the dominant player? If history is any guide, we can predict something else will step up.

So where do you want to be? Are you satisfied being at the long end of the curve? That is where most of humanity resides. It is why we see so many living the "life of quiet desperation". What are they really accomplishing?

When ones wants everything handed to him or her, while spending time complaining, that person ends up with little to nothing in the end.

How many talk about losing weight? Sure, everyone wants 6-pack abs but are we willing to do what is necessary to get it? Obviously not judging by our waistlines.

Are you willing to go out and run a couple miles everyday? Do you hit the gym 5 times a week? If the answer is no, they why do engage in fantasy? The path to a 6-pack is clear yet few of us take the action to get there.

Those who excel in body building, marathon running, or a sport push forth and do what is necessary. In short, they do what others are unwilling to do.

It is not easy to get to the left side of the curve, in any realm. Many claim those there are lucky. This is another foolish idea to believe. Is there a degree of luck in the equation? Sure. However, you will see years of training, effort, education, risk taking, and long hours to get so "lucky". Yet somehow, people believe that things just came easy.

History shows us that when that happens, whatever is gained is lost. It is why lottery winners tend to end broke after 5 years.

Cryptocurrency and blockchain are offering tremendous opportunities. Unfortunately, there are no shortcuts. Those who are dedicated, innovative, creative, and bold will succeed. Of course, many who have those traits will also fail. The reality is most endeavors end up failing. The main difference is those who reside on the left side of the curve keep going. They do not quit and set their goals accordingly. A failure is not the end, only a set back.

So where do you want to be with cryptocurrency? What kind of impact do you want to have? How do you want to express your talents? Are you ready to stake your claim in this expansive new field where billions are going to be served?

The opportunity is there for those who are willing to step up and put forth the effort. Make no mistake, this is not easy.

There will be some to step forth and take up the task. Sadly, most will not.

If we understand the distribution curves and stop fighting them, we can then begin to lay out our path to stake our claim.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta