There is a reason to be very optimistic about Hive. Many feel that it is a nothing chain with very little taking place. They feel the value is low in relation to other things out there.

Unfortunately, a great deal of this missing a major point about money. When we truly look at the monetary system, we see why Hive is aligned very well for the future evolution.

We are also operating in a completely different era as compared to before. Much of what is taking place is radically transforming most of society. Money is at the center of this.

This is a high-information age. While a single currency is beneficial in a low information time, the opposite is true now. Over the last 80+ years, the banking system advanced along with technology. This completely altered the state of money.

Pre-Depression, we operated on a hybrid of commodity money along with private bank money. In 1937, because of the bank's distrust of the Fed's ability to act properly when needed, they decided to ignore the idea of reserve based money. Instead, they opted for one ledger-based. A decade later we saw the emergence of the Eurodollar system.

This is the state we find ourselves in today.

Source

Governments Excluded From Money

For most of the last century, the major governments were excluded from the money game. The same is true for the Central Banks. This comes as a surprise to people but reserves are not given any consideration by the banking industry. The major currencies are generated by the commercial banking system and that is a small piece of the total. The reality is banks were creating hundreds of trillions of dollars that is totally outside governments or the Central Banks.

This is also the reason why the idea that governments are going to stop cryptocurrency is a complete joke.

Ledger banking was in place for decades. There is no way for any authority to step in and regulate it. As technology advances, this is only going to get increasing more difficult to monitor.

The Bankers Are Going To Be Excluded From Money

This might seem like a bold claim but it is also true. In a world of low information, the needs for an agreed upon standard is crucial. This also opens up the door for all kinds of middlemen. Ultimately, these entities end up becoming gatekeepers for the system.

The bankers gave us the model, technology is providing the capability. With Ledger Banking, money creation happens instantly. All that is required is an agreement between two parties. Since the industry served as the on and off ramp to most financial activities, it was in position to assume full control.

It makes sense if we equate it to a bridge. When confronted with a river, to enable the most people to cross in an efficient manner requires the building of a bridge. Of course, the one who controls the bridge has power over most activity.

Here is where bankers were positioned.

Money In A High Information Age

What happens when a bridge is no longer needed? In other words, how does the situation change if there are hundreds of bridges? The bridge is the bank. When we advance, the need for a single currency diminishes. This means we end up with thousands of bridges.

Suddenly, we have banking without the banks. Money, which was Ledger-based for decades, now can exclude the bankers.

For example, who needs a single unified currency when an application enables near instant swaps among thousands of tokens. There no longer is a need for everyone to operate using a single currency. Everyone can have their own yet the application manages all the information required.

Here we see where power is instantly sucked out of the banking system. Not only are unlimited number of bridges showing up but people can instantly jump from one to the other.

Nobody is in control.

Blockchain - New Version Of Check Clearing System

Many overlook the history of checking as a form of money. According to research by the Federal Reserve Bank of Atlanta, even as far back as 1910, most of the transactions took place using this medium.

This established a system of correspondence, payment processing, and settlement. Checks were treated the same as gold backed money as well as being transferred at rapid speeds. Over time, a massive network of computers was employed by the banking system to facilitate global transactions.

Money on deposit in Account A (ledger) was deducted while it was added to Account B (ledger) in a different bank in another geographic region. It was all done without any physical transference.

Due to the advancements in communication systems, this was able to be accomplished in less time than sending physical money. Yet, the legacy system became obsolete.

Blockchain not only replaced the bank, it provides near instant settlement. The transfer of money from Account A (wallet) to Account B (wallet) can be almost instant. On Hive, this occurs in roughly 3 seconds.

This also eliminates the need for:

- Payment Processing

- Interbank Settlement

- Bank Wires

Money Is Information

As we can see, the system employed over the last century is nothing more than an information system. The entire Eurodollar system (aka shadow banking) is just accounting. That is what ledgers are. However, we also notice this is a large portion of traditional banking.

Elon Musk likes to call money a database. He is not far off.

The advancement of money over the last century was not do some much to financial evolution as much as improvement in our communication systems. Information can now be sent around the globe in under a second.

Money transference is as simple as sending an email or text message. It is really no different.

A blockchain like Hive is really an information system. It is a database (Ledger) of transactions that travel around the world, without any banking system or third party involved. The decentralized nature of the system means that, once again, nobody is in control.

Understanding The Banking System

The key to replacing the banking system is to truly understand it. This provides the foundation upon which to build the application to fulfill the services presently handled by those entities.

Why is Hive ideally suited for this? To really get that answer, we need to go back to the basics. If banking is really a glorified communications system. then having a robust one is crucial. With Hive, we are dealing with 3 second transaction times. This is very powerful when it comes to global finance (communications).

It also has a fee-less structure to it. This is something that is vital. Eliminating the middlemen and replacing them with new entities is not much of an improvement. Essentially, there is still friction within the system, i.e. additional cost.

Hive is one of the few that removes this from the equation.

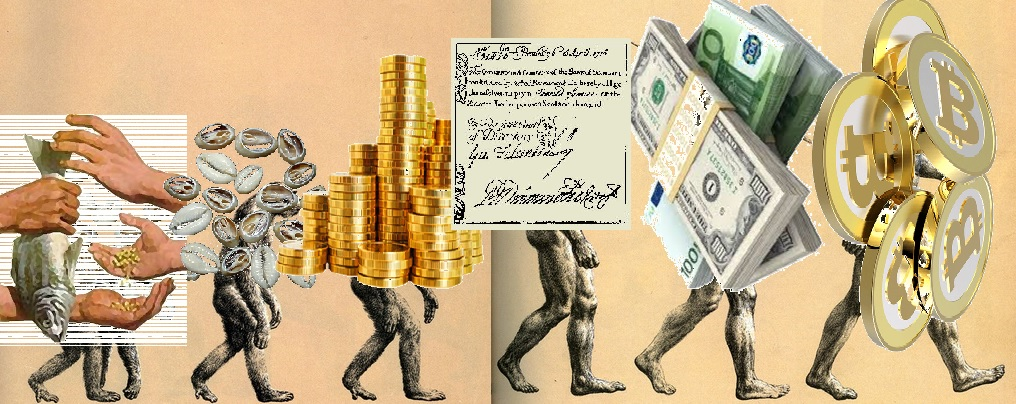

Cryptocurrency - The Evolution Of Money

With more than a century of Ledger-based banking behind us, it only makes sense that the next generation builds on top of this. Cryptocurrency is able to do that.

Here we see where blockchain expands the private money system. It is a realm that governments and Central Banks are not involved with. As we just showed, this is no surprise since they truly were not part of the money game for a long time.

Cryptocurrency is data and that is getting very difficult to control. We see systems being built out that are truly decentralized in nature. This means that network, with nodes all over the world, is unstoppable. The transfer of data simply keeps occurring. This is an issue for the establishment when that data represent money.

This is the next stage in Ledger-based money.

Of course, this time, instead of governments being cut out, the commercial banking system will be pushed aside.

Eventually, banks will become like newspapers, a relic of the past.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta