Understanding that cryptocurrency is as much about technology as it is monetary is going to key for navigating its path forward. After all, we talk about it being central to Web 3.0, a technological evolution of the Internet.

Because of this, we can expect some general patterns to emerge that are commonplace throughout all technological adoption. As the technology progresses through the different phases, we see similarities to others that went before. The pace, of course, can alter while, at the same time, many do not advance must passed hype.

Nevertheless, if a technology is successful, it will follow a basic trend.

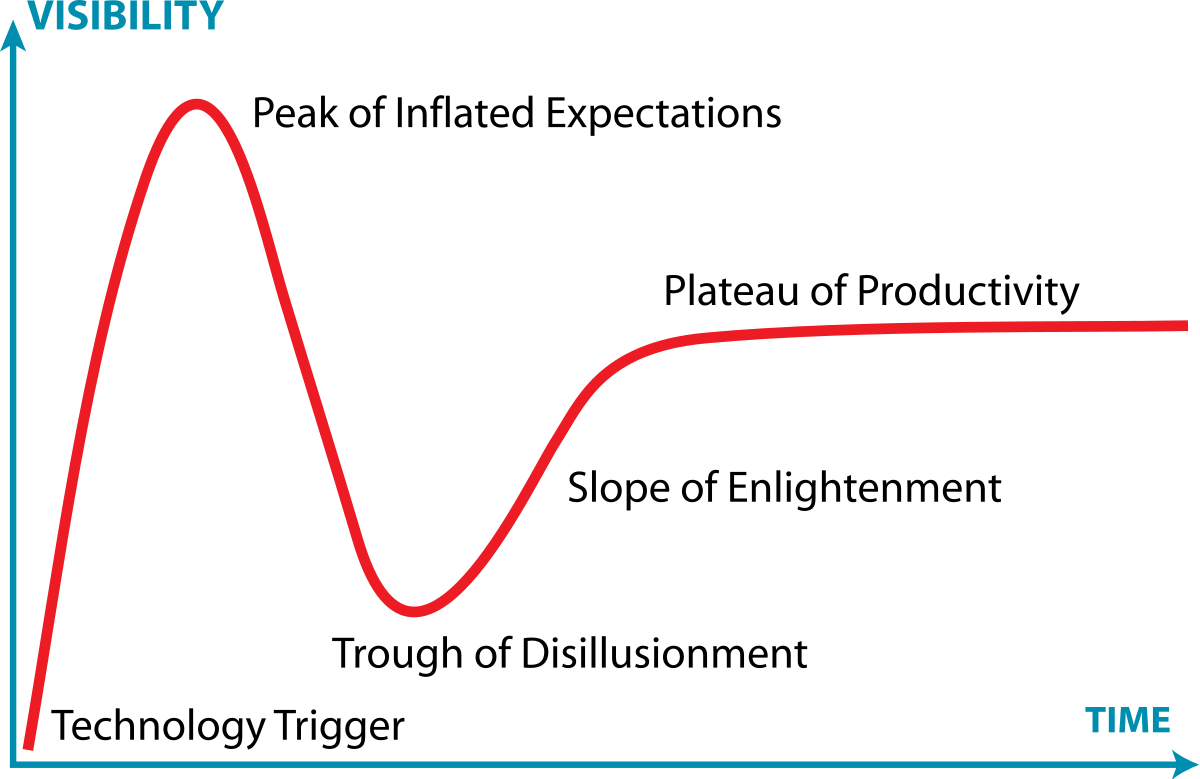

Gartner Hype Cycle

For those who are unaware of this, here is what it looks like:

This is successful technologies follow in general terms.

Notice what is not part of this chart. Take a close look and see what is absent. We are dealing with the path of successful technologies here and yet there is something glaring missing. Do you know what it is?

Where is the rehype?

Aren't we told this in a recent post?

The ability to leverage and go long ensures that speculation and hype will always grossly overvalue assets like this, no matter where the baseline is.

Here is the challenge when one looks at things only as a market and overlooks the technology component completely. Also, it is a gross misunderstanding of markets which we will get to in a moment.

Continual overhyping is impossible. As was stated in the last article it is impossible to overhype the Internet now.

Here are some other things that cannot be overhyped:

- toilet paper

- flat screen televisions

- smartphones

- Internal Combustion Engine vehicles

Sure a single company could make bold claims about a t.v that cooks and cleans. However, if the technology fails, the result will be obvious.

Look at the hype cycle chart again. If a technology is adopted, it becomes mainstream. Thus, it cannot be hyped like it was when people were not aware of it. Obviously, word would spread the television does not cook or clean.

To kick off another cycle requires a new technological development such as ICEs being challenged by EVs.

This is one of the reasons why the Internet only had one bubble. There was no repeat of the Dot-Com bubble. By the time mass adoption happened, it was impossible to overhype the technology.

Be Careful Of The Misdirection

The web is full of misdirection. People make arguments all the time which come from agendas, ideologies, as well as an assortment of other reasons. We see this a lot when it comes to money.

How many times have we covered that the Fed does not create USD? This is a basic part of the fractions reserve banking systems most of the major currencies operate under.

Here is a bulletin put out by the Bank of England stating clearly how it is done. This goes back to 2014.

This article explains how the majority of money in the modern economy is created by commercial banks making loans

Then we have this from 2019, right on their website:

Most of the money in the economy is created, not by printing presses at the central bank, but by banks when they provide loans.

So why do I bring this up? Simply because there are people who will argue with you that the central banks are printing the currencies. It is understandable since the Fed Chair himself lied on national television claiming there is a money printer. Anyone who does a wee bit of research will understand this.

Getting back to the topic at hand, we see the same behavior in trying to counter the discussion we are having.

This idea that 300M people use crypto is absurd. Go talk to 100 people, ask them about crypto and how involved they are. Most still think it is a scam (especially during scam season aka bull markets that just turned bearish). Most people are not involved. The ones that are? These 300M "users"? They have a Coinbase account and they hold $500 worth of Bitcoin through a centralized custodian. They don't know shit and that doesn't count.

Just wait what happens when they're getting paid to learn within the attention economy on a real decentralized network. This "300M people are crypto users" bullshit is at least x10 overblown, probably more. At least 90% of these people still only know how to use email/password logins and connect their bank account to a centralized exchange. That's WEB2 bullshit. It's meaningless.

This is what we get from the above linked article.

At the core is the contesting of the 300 million crypto users. This is valid since questioning research is always worthwhile. However, notice something.

The claim is 300M is impossible. What is the reason? Basically that 90% of the people are too stupid to be involved. The goal is by using strong terms like meaningless, bullshit, and absurd, one will favor the argument that is based in nothing more than technical arrogance.

Anecdotes having a tough time carrying the entire argument. Is the 300M grossly overstated? It is possible. But without any research to back it up, it is nothing more than an opinion.

How Markets Play Out

Now that we see the process of the technological hype cycle, we can easily how this plays into markets. Since cryptocurrency and blockchain are both technologies, they will follow this path to some degree presuming the adoption rate is there.

If you feel confident these two technologies are not going away and the growth rate, to some degree will continue, then we can expect market activity to also fall into a category.

Since we are going to ignore the technology side of the equation, we have to realize some particulars about markets.

For example, we have this:

If 100x more value is being created, people will just gamble on it 100x more aggressively. It is known. There is no limit on speculation as is being implied here, especially when the assets and networks themselves ARE MONEY. Not just regular money either. SMART MONEY. Money that can be programed to do anything. Think about it. As if crypto can't be programmed to speculate x1000 times worse than before? We already saw that with DEFI. DEFI isn't going anywhere.

This is the core of the issue. Most of the markets are not speculators. It is easy to fall prey to this but the numbers reveal otherwise.

Real estate is one of the largest markets in the world with an estimate $300 trillion. Are most people speculating on it? No. They buy a property to live in or for cash flow if an investor. Certainly there are those who speculate on real estate but they are the minority.

Derivatives are the largest, with an estimated $750T-$1.5Q. Is this used for speculation? Actually, most derivatives are used to hedge balance sheets using VaR models.

The bond market is at least 50% larger than the equities market. Again, while there are some speculators, most bonds are purchased as a fixed income investment by pension funds and insurance companies.

Even within the stock markets, blue chips and dividend plays are very popular. These far outweigh the growth stocks that get all the media attention. As you can guess, the leading toilet paper companies aren't growth plays.

The Apple Transition

Obviously Apple is one of the largest companies in the world. This is a prime example of a growth stock that transitioned. It also epitomized the why we only had one Dot-Com crash.

The value of Apple is off the charts. Due to the introduction of the IPhone, it essentially became an Internet infrastructure provider. Since more than half of the users in the world access the web via mobile, the fact there were more than 1 billion of these phones sold tells you their place in the industry.

Apple is not a growth stock anymore. This is evident by the fact Warren Buffett got involved a few years ago. While he does shop for bargains, he doesn't speculate. His purchasing is based upon other criteria than just price go up based upon FOMO.

Over the next 5-7 years, cryptocurrency is going to see the same thing. There will be projects that move out of the speculation arena and become powerhouses. They will do so due to the utility they provide. Here we will see adoption increase to the point whereby the value generated offset the need to simply speculate. The risk associated with many of these companies will decline.

How do we know? We saw the same thing happen with the likes of Amazon, Priceline, and Google. These early Internet innovators were very risky during the Dot-Com era. However, by the Great Financial Crisis, they were solid companies following strong business models.

So what will the projects be in cryptocurrency that fulfill this?

It might be a token that is tied to a wallet that starts to get crazy usage. Perhaps it is a DEX that becomes extremely popular. We could see a blockchain or two filling this role. Who knows, maybe the Ethereum people will be proven right all along.

This is one of the market dynamics we can expect.

Scarcity = Volatility

Here we have another fundamental of markets we cannot overlook. When an asset is scarce, there will be volatility in the price. This is something that we can back test in dozens of markets and millions of assets.

For years, we discussed the Age of Abundance. Here we are basing the premise of the future not on an economic system that is built around scarcity. It seems like many still are tied to the old world view.

How does this apply to cryptocurrency?

At present, Coingecko tracks over 12K different coins and tokens. This is a number that, over the next 5 years, will jump to 50K. Or 100K. Or 500K. We have no idea how many will emerge but we do know more will.

We also know that Bitcoin is capped. This means that there will always be volatility with that coin. Could it settle down as the market capitalization gets bigger? Sure. But in the end, it will always have a larger degree of volatility compared to the overall market.

There is also the utility aspect of things to consider. Bitcoin allows for the transfer of money from one wallet to another without any third party. This is something it does very well. Outside of that, the use case is rather limited.

As the industry evolves, we are going to see projects become the equivalent of multi-national corporations. They will have business models that are highly success and attract millions (or more) users. Thus, the BTC dominance percentage will decline over time.

What does this mean? Ultimately, the market will be less dependent upon the ebb and flow of BTC. It also provides us insight into the reduced volatility that will take place.

When value is being built and technology is expanding its reach, winners start to emerge. These entities, in this case crypto related projects, are worth a lot. As stated, over time, they go from high growth assets to value plays. The safety provided by them provides some insulation.

For example, if the equity market were to crash 70% like crypto, it is doubtful Apple goes that far. Sure, it would get crushed like everything else, but it would still outperform due to their existing customer base, cash flow, holdings, and an assortment of other factors. Tesla, on the other hand, might see a 90% drop.

In Conclusion

We see how market dynamics shift over time. Even a Tesla, if it keeps expanding its production along with market share in different industries will find itself attracting another type of investor.

Figuring out where technologies are on the hype curve will reveal what we can expect from markets. As adoption increases (slope of enlightenment), we see how mainstream penetration affects all aspects, including the markets.

Cryptocurrency is going to follow suit. The buildout of infrastructure continues which means utility is expanding. This truly affects market dynamics as risk is reassessed.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta