One of the most important factors when it comes to money is to see things from a global perspective. This is something that is not often done, especially who those in the developed countries. The tendency of those in the United States and Western Europe is to view monetary issues through our own eyes, ignoring the realities that the rest of the world finds itself in.

This article is going to discuss one of the easiest use cases for the Hive Backed Dollar (HBD). We cannot even begin to uncover how much misinformation is posted about this subject, coming mostly from people in developed countries.

The flipside to this is explanation is not required to those in Cuba, Nigeria, or Venezuela. These people understand intimately what is taking place. Therefore, let us explore HBD through their eyes.

When doing so, we see this is a $1.725 trillion opportunity. How much of that do you think can be captured by this coin?

US Dollar Supply

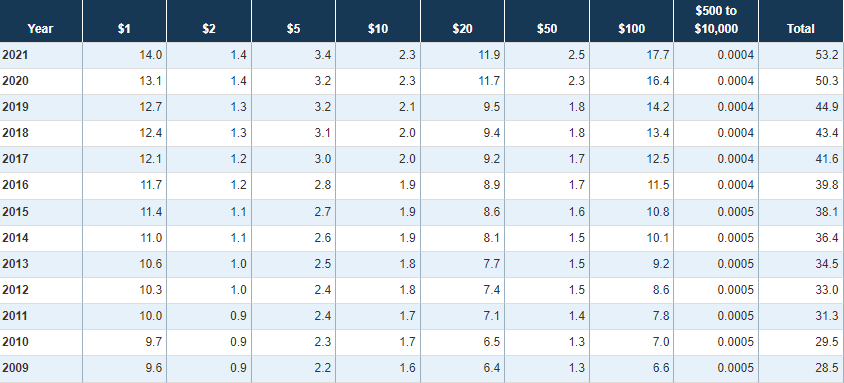

The table listed is from the Federal Reserve. It is the most recent data on the banknotes in circulation. This means we are looking at the physical cash that is available, broken down by note.

An interesting thing happened in 2017. The number of $100 bills in circulation surpassed that of $1. When it comes to physical currency, this doesn't make sense. It is rather difficult to use $100 bills consistently as a medium of exchange. Getting the correct amount of change is often difficult along with the security threat.

So why did this happen? We will get to that in a second.

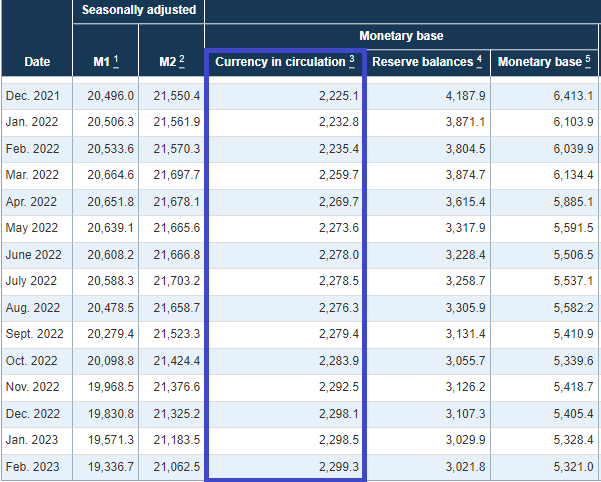

Next we will look at the most recent H.6 from the Fed. This details the total amounts of the same table, expressed in USD terms.

At the end of Feb, there was $2.3 trillion in physical currency for the US dollar outstanding. This does not include demand deposits or commercial bank money. This is only the total of the banknote total in the first table.

Here is the kicker:

There are estimates that place the amount of banknotes held overseas (outside the United States) as high as 75%.

This equates to $1.725 trillion.

Defense Against Government

One of the reason the estimates are moving to that level is because of the $100 bills. As we noted, utilizing $100 as a medium of exchange is not really practical. Paying for a $10 lunch with $100 is troublesome in many instances.

So, again, why the increase in the number of those bills?

The answer to this lies in the fact that people, outside the United States, often use the US dollar as defense against their own government. This is a situation that does not need to be explained to the Nigerians, Venezuelans, or Cubans.

With all due respect to Ray Dalio, when it comes to this, cash is not trash. Instead, with the USD, cash is king.

Those of us in the West, even if not using the dollar, can see our native currency fluctuate 10%-20%. This can be a hindrance when traveling. At the same time, some imports can get more expensive although there are often ways around that with locally produced goods.

That is not the case in the countries mentioned. They can see their currencies, against the USD, drop 80% or even 90%. This is devastating to an economy. Unfortunately, there is a worse situation: currency cancellation.

We recently saw this effects of this in Nigeria as the country cancelled its physical currency. Did you notice what a mess that was (and still is)?

Therefore, for many, the solution is to get a hold of physical dollars. One major advantage to this is that, since 1861 when physical cash became the norm, there is one currency that was never cancelled.

Do you want to venture a guess at what that is?

The HBD Opportunity

When it comes to low hanging fruit, this is it.

The Hive Backed Dollar (HBD) slides into this situation nicely. One disadvantage most people have outside the United States when dealing with the dollar is they have no access to the digital version. This means that physical cash is the only route to take since dealing with the banks is out.

When people question the demand for the USD, they fail to realize that many countries have a black market for US dollars. They are bought and sold just like drugs or weapons. Of course, there are safety concerns in addition to the illegality of it.

HBD is the ideal solution.

To start, it is a dollar denominated asset that is in digital format. This means anyone with a smartphone can utilize it. At the same time, there are no restrictions upon who can gain access. If one has a Hive account, he or she is free to utilize the internal exchange to swap [$HIVE](https://leofinance.io/@leoglossary/leoglossary-usdhive0 for HBD.

We are also dealing with a currency that is not dependent upon the monetary policy or guesswork of the central bank. HBD is market driven meaning we can generate as much as required in response to market demands. The conversion mechanism allows Hive to move the value from one coin to the other.

The lack of transaction fees is also something that cannot be overlooked. When dealing in HBD, as long as resource credits are tied to the wallet, one can engage with the blockchain. This means transactions can occur with 100% of the money reaching its destination.

Also, unlike services from the likes of Visa, merchants have no fees tied to their accounts. We also have settlement that averages under 2 seconds. Try that with a merchant account.

Finally, HBD is the unit of account that these people understand and are looking for.

Target Rich Environment

There are an estimated 2 billion people in the situation described here. This is a target rich environment for a solution. It also should not be surprising this is the focus for central bank digital currencies (CBDC). Of course, that puts one back in the central bank system and all the screwups that accompany that.

Once again, Hive solves this.

With roughly 2 billion people who could be served by the HBD and an estimated $1.7 trillion in banknotes hidden under mattresses around the world, we see how big the numbers can become.

Using this as a guide, it is obviously unreasonable to expect a couple trillion HBD to be needed. However, the idea of 50 billion HBD being used in lieu of physical dollars is not. This is still a drop in the bucket compared this the $1.725 trillion opportunity.

Considering there are 31 million HBD in existence and more than 20 million of that is in the Decentralized Hive Fund (DHF), we can see how a massive increase will be required if we are going to make a dent in this market.

Of course, we have to keep in mind that each transaction requires a small amount of resource credits. That means each wallet is going requires a bit of Hive Power (HP). This is another coin that could end up in short supply.

Here is a $1.725 trillion opportunity that exists today and have roughly 2 billion people who could be served by the expansion of the Hive Backed Dollar (HBD).

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta