Is it possible for HBD to become one of the top stablecoins?

This is something that might seen unlikely to most people. However, when we consider all that is taking place, we can easily conclude the potential of the Hive Backed Dollar ranks up there with any stablecoin on the market.

For something that was overlooked for so long, HBD is one of Hive's greatest assets. As things keeps evolving, the range of what can be built utilizing this coin starts to reach epic proportions. This is coupled with the fact that HBD is tied to a truly decentralized blockchain. From this perspective, it instantly puts it in a completely different category.

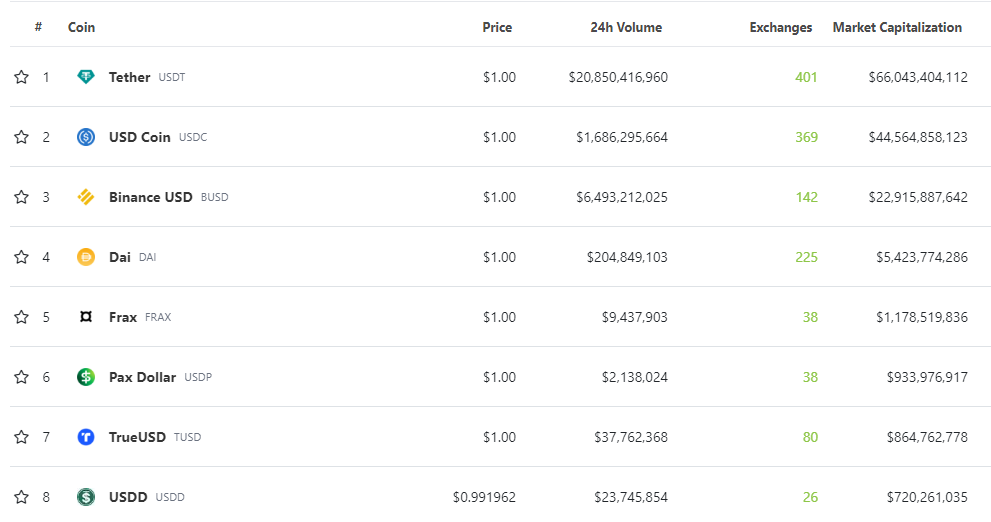

How can HBD conceivably compete with the likes of Tether or USDC? These are listed on so many exchanges whereas HBD is next to impossible to find. Here again we see can easily conclude how this is just another aspect to Hive that doesn't amount to much.

The reverse of this is, like most things tied to Hive, this is an undiscovered gem. HBD has the potential to eclipse any stablecoin that is in operation. Throughout the rest of this article we will delve into the reasons why this is so.

Transparency

Algorithmic stablecoins got a black eye due to the UST/LUNA fiasco. This has ratcheted up the talk of regulations even further. It is likely that we see all coins of this nature banned by any US based exchange (and likely EU).

A big part of the question is what is backing the stablecoins. Even with the top coins, we see debate about how much they have in reserve. Once again, the mainstream establishment believes that reserves mean something in monetary and financial matters. It is a con the central banks keep trying to run in spite of the commercial banks rejecting them.

Unlike Tether and USDC, there is no audit required. We know exactly what is backing HBD and if the ratio is getting out of proportion. At any time, we can look up the HBD-HIVE ratio. If it does get out of kilter, there are precautions in place to allow it to realign.

Who Controls It?

One of the problems with the fiat currency system is that most people hate the fact that the government or central bank controls the money supply. Leaving aside the fact that this isn't true under fraction reserve banking, it does show how people want sovereign money.

There is a challenge in the stablecoin market: this does not exist. USDC is backed by Circle, who already applied for a banking license. Tether has a foundation backing it. BUSD has Binance. USDD is on Tron which means what Sun says is all that matters.

Do you want another coin that is controlled and susceptible to be taken over? With HBD, none of this exists. The production of HBD is driven solely by the community. Anyone can utilize the conversion mechanism to create or destroy HBD. It is a money supply that is at the discretion of the market.

One of the reasons why governments will hate HBD is because it cannot be controlled. Wallets cannot be blocked. If one has HBD in the wallet, it can be sent to someone else. There is no way to prevent this since nobody is in control of the blockchain.

Building

The biggest advantage to Hive is we are not leaving the future of our ecosystem to someone else. In other words, we are building what is needed.

This obviously extends to HBD.

Here is a simple example. What does it take for USDC to be the main trading pair on a DEX? The answer is that the project team behind the development of the DEX has to decide to use that. Naturally, they could opt for Tether or any other coin they wanted to use. The point is the USDC team has no say in that.

With HBD it is different. This coin becomes the trading pair on a DEX simply because we build it. Consider what the SpkNetwork is constructing. Do you think they are going to opt for USDC or Tether as the stablecoin on the platform or will it more likely be a derivative (wrapped version) of HBD?

The answer seems pretty obvious to me.

Where this really takes on a greater meaning is when we consider the building of more advanced financial features. If we consider lending, bonds, synthetic assets, and derivatives, what is going to be used to conduct those transactions?

Since we are building these systems, we are the ones making the decisions. USDC and Tether do not have this advantage.

Hive develops at a slow pace. We know that without venture capital funding, things tend to take time. The difference is that people on Hive are trying to code actual solutions as opposed to just engaging in hype.

That said, we are able to put Hive's assets in the middle of all we build. Since Circle and the other foundations are focused solely on their stablecoin, HBD offers the advantage of building out an entire ecosystem.

The only one who appears to follow this model is Binance and BUSD.

Solves The Need For USD

We are now in a financial system that is starved for U.S. dollars. People do not believe this. A lot of this extends from the fact that most do not understand the difference between de-dollarizing versus de-dollared.

When China sells US Treasury's it is not because they are de-dollarizing. That country is tied to the USD more than any other outside the U.S. itself. It carries a $50B-$70B monthly trade surplus. This is the net of the activity between the two countries. When they sell anything to the U.S., they get paid in USD. The reverse is also true. All Chinese purchases of U.S. products use the same currency.

Hence, the Chinese need a lot of USD. So they are not de-dollarizing as much as being de-dollared. The selling of Treasuries is the remaining avenue to get their hands on USD. This is what they are doing.

Of course, this is not only the Chinese. Throughout the world, there is a shortage of USD. It is both in the general economy and the Eurodollar system. Hence, we need more exposure to USD and USD denominated securities.

USDC does not provide this. While it is back by USD and cash equivalents, it is not creating any more. Tether is in the same boat if their stablecoin is actually 1:1 backed.

Here again, we can see how HBD solves the issue. While the currency is backed by a USD denomination, it has no tied to actual USD. Each HBD can be converted to $1 worth of HIVE. This means that each HBD generated provides access to the USD since there is the peg yet has nothing to do with it.

Those who are in nations such as Nigeria and Venezuela understand this situation very well. HBD is an excellent option for those countries to protect themselves against the fluctuations of their native currencies.

This is not where the story ends. HBD also has the ability to address the collateral problems. We discussed Hive Bonds on a number of occasions. One of the reasons for this is the fact that US Treasuries are the only form of high quality collateral to the international and banking system. All the rest was proven to be less than desirable.

By creating bonds tied to the staking of HBD, we can provide collateral that has known cash flow, timestamped on the blockchain for full transparency, and very little counterparty risk.

Do you see this being discussed regarding USDC, Tether, or even BUSD?

Building A Legitimate Currency

It takes time to build out a new currency that is legitimate. This is something lost on much of cryptocurrency. There are a number of factors that have to be addressed when looking at creating something akin to the world's reserve currency.

For this to even be remotely possible we need:

- liquidity

- depth

- sophistication

- infrastructure

Without these components, any currency is destined to be niche at most. With HBD, we are working on this. That is the difference. Since we are putting attention in this area, the potential is to actually get things in place. What other currency do we see this being done with?

The bottom line is that HBD will become one of the top stablecoins if we achieve progress in each of these areas. There is simply nobody addressing all of them at the same time.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta