This is the 4th installation of our ongoing series.

You can read the other parts:

- HBD: Creating A Currency (Part 1)

- HBD: Creating A Currency (Part 2)

- HBD: Creating A Currency (Part 3)

There are many aspects that go into a currency. It is much broader and deeper than just being used for payments although that is certainly a part of it. In this series we tried to provide an outline of how the Hive Backed Dollar (HBD) can evolve, elevating it to a higher level.

In the stablecoin world, we do not see this approach being taken. USDC and Tether all focus upon payments, believing that is all there is. Here is where we find opportunity.

The next area we will discuss is worth hundreds of trillions of dollars. It is one of the major use cases for the USD and it is something to really focus upon.

This is where we could see the bridging from the digital to the real world, another important step in the evolution of things.

The World of Investments

Payments are dwarfed by finance. As big as the numbers are when discussing the payment world, they are orders of magnitude larger when we focus upon the financial realm.

Ultimately, this gets into the quadrillions. Here we see the opportunity when we discuss the specific aspects.

For example, think of how much money is involved with:

- stock markets

- bond markets

- private equity

- venture capital

- derivatives

- FOREX

This are just a few of the opportunities for a currency like HBD. Here is where the value of it can explode.

The debt and capital markets are responsible for the funding of global trade. As discussed, short-term lending accounts for 90% of this total. We know the Repo market has $4T-$5T daily. This is the tri-lateral agreements. It is estimated there is a similar number in bilateral lending taking place.

A powerful use case for a coin like HBD is funding and investing. People are always looking for capital. Ideas tend to require money to transform into working products or services. Here is where many of the above markets step in.

Naturally, and not surprisingly, the USD dominates this completely. This goes back to one of the earlier topics we discuss, depth and liquidity. It also ties into to distribution.

Having a currency that is available globally is imperative to these end.

Hive already has a small example of this with the Hive Borehole Project. Funding different projects around the world is a crucial baseline to establish.

Growth

The key factor that is usually overlooked in discussions about money, inflation, and lending is growth. Too many want to look at things in a vacuum, not realizing the true interconnectedness of things.

A crucial element to money is growth. Since it is nothing more than a tool, what is the result. For example, marketers tend to operate under the premise that $1 invested in advertising should result in $3 or profit. Depending upon the industry, that is a metric cited within the industry.

In other words, money has to generate a return.

It is the same thing at an economic level. If we are creating more money, is it resulting in growth. Under the fractional reserve banking system, this is easy to see. The money supply is expanded as loans are made. Economic productivity also increases as a result. Unfortunately, now all plans work out, especially if the business cycle is on a decline. Defaults eradicate the money supply, contracting the supply as businesses fail to pay off the loans.

From an overall economic standpoint, we see contraction. This is a bad yet unavoidable situation since the business cycle is reflective of human behavior. In good times, we tend towards excess forgetting the bad can quickly return.

Here is where the ability to have elasticity is crucial. Altering this cycle has not happened in hundreds of years. When the opportunity is there, a monetary system has to generate growth, especially if the population (community) is expanding.

HBD As A Tool For Funding

Consider the value of HBD if it was used to fund thousands of different projects. The peg is established by the conversion mechanism and is in place as long as the haircut ratio is in effect. This means that people can use the value contained within this to finance projects that could provide growth to the Hive economy.

It is also where we can transition from the digital world to the physical.

Consider the Hive Borehole Project again. The money that is used is paying people in the real world. There are people who require payment for their labor and services. The money is coming from a digital source yet produces a physical outcome (the Borehole).

This might be a simple example but it does exemplify the potential. If we expand this out into billions of dollars, what kind of value does the currency carry then? Are the masses really concerned about the backing agent in that situation? The answer is no. As long as someone (or a group such as witnesses) is keeping an eye on it, the rest of the userbase is able to piggyback off that.

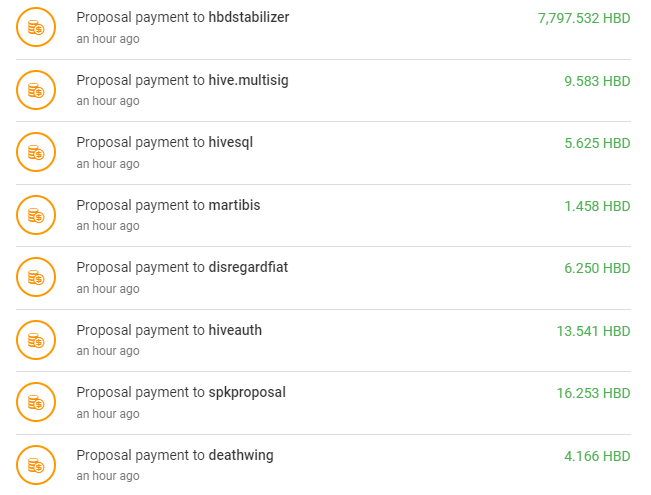

Of course, this is already in place. Let us look at payouts from the Decentralized Hive Fund (DHF).

We know this DAO ends up funding different projects based upon the community's voting. Here we see HBD as the currency used for payment.

The point is to expand this thinking. Extrapolate this out beyond the DHF and into the mainstream community. Under this scenario, anyone on Hive with HBD could get involved in the funding or investing in projects that he or she deems worthy. Tokenization makes the ownership units easy to quantify.

Using HBD as a vehicle for investing is an overlooked feature. Yet, when we focus upon the numbers, it can dwarf the payment world.

Going back to the USD, when there are hundreds of trillions in financing out there, we can see why it has a baseline that is much higher than anything else. Most projects need money. When a currency is used to fill that need, it carries great value.

This is another way that HBD can stand out. If we are continually funding and investing in projects that are providing economic growth, we get into a circular situation where the returns generated end up being filtered through to create even more growth.

Have you heard this mentioned by the teams behind USDC and Tether?

It simply is not part of the discussion. With Hive, since we are building this ourselves, we simply go out and create the infrastructure.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta