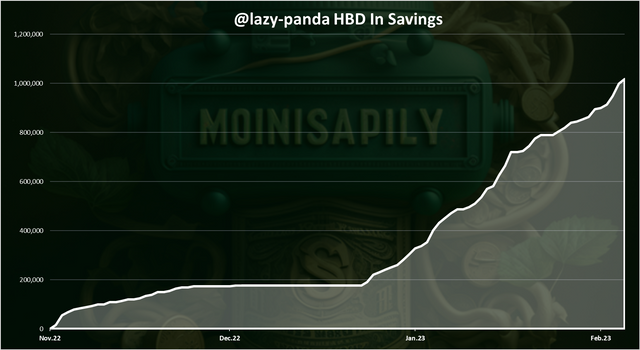

There is some excitement around one account loading up on HBD and placing it into savings. According to a recent post, it is now over 1 million HBD sitting in the savings of a single account.

Make no mistake, roughly $1 million is a lot of money. For Hive, it is a rather impressive amount. However, when we step back, we see this is a drop in the bucket.

In this article, we will analyze the potential with the fixed income market when dealing with assets of this type.

Source

1M In HBD Savings

This chart shows the progression of the deposits by this account. As we can see, this is a recent move, starting in November 2022. In the last 4 months, the additions have grown significantly. It really took off starting just before the 1st of the year.

Before starting, we have to analyze what this does for Hive and the statement it makes.

The Hive Backed Dollar (HBD) as a stablecoin is attractive because there is no company that stands as counterparty risk. That does not mean, however, we are totally clear. Every situation involves some risk and HBD is no exception.

There are a couple ways that HBD is vulnerable. They are:

- the blockchain ceases to run (extremely unlikely as 100+ nodes are running the software)

- the haircut level is exceeded meanings that 1 HBD is not backed by $1 worth of $HIVE (usually a temporary situation as the blockchain/market is designed to adjust)

In spite of the minimized risk, we can see this as a major vote of confidence for Hive and the HBD savings program. When 1 person is willing to put in a number of this magnitude it makes a statement, as evidenced by the fact we are writing and discussing it.

There are also rumors this account will keep adding until the level of 4 million is hit. That is even a bigger number, equating to a larger vote of confidence.

Yet, as we are going to see, this is nothing.

Trillions

How big is this market?

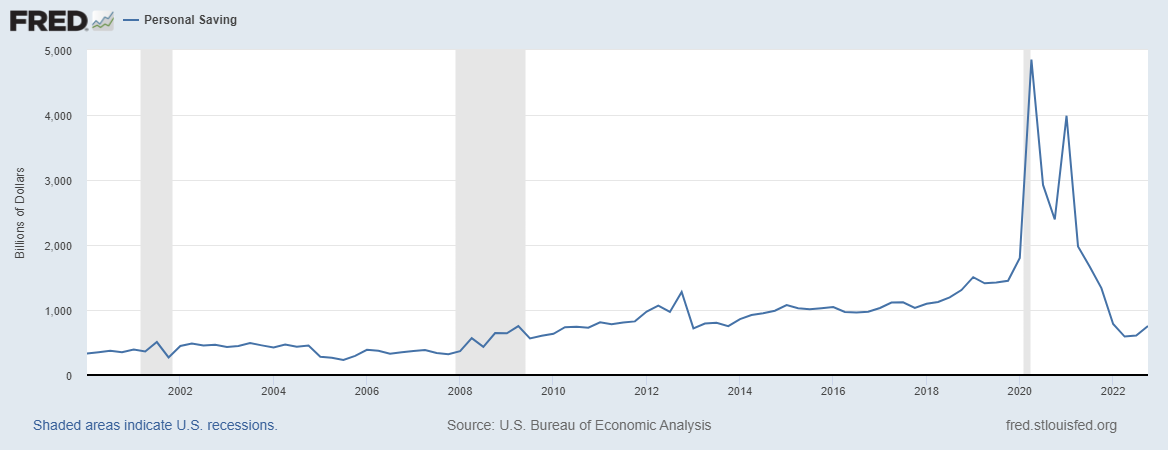

To get a glimpse, we use the most common currency, the US dollar. By looking at the savings rate, we get an idea of the magnitude we are dealing with.

Here are the deposit total for United States banks as of the end of Q4.

.png)

There is $755 billion in accounts in US banks. We are not incorporating the rest of the world.

To view it another way, while 1M HBD is impressive, FDIC covers up to $250K in deposits. It is obvious the numbers can get rather large.

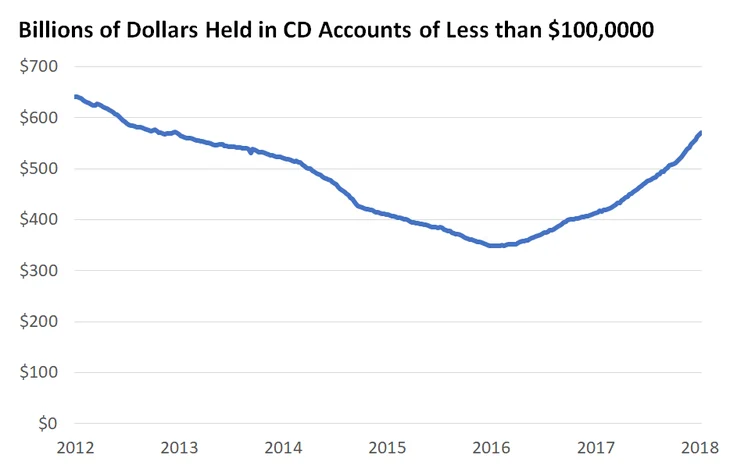

Then we have the certificate of deposits to take into account. The data is a bit dated but does give us an idea of what is out there.

For those who are not familiar with these instruments, CDs are akin to the idea of time vaults that we discussed in the past. It is a commitment of time in exchange for a better return. As interest rates increase, the appeal of CDs grows.

Here is what it looked like back in 2019.

If we extend this idea out globally, we can see how there are trillions of dollars that people place into accounts or assets of this nature.

Fixed income instruments are extremely popular.

The Future For Hive

It is hard to foresee exactly how things will unfold. However, based upon the last year, we can get an idea of where things are going.

The community has placed emphasis on HBD over the last 18-24 months. This is something that started with the introduction of the HBD stabilizer and keeps growing.

With this focus, the ecosystem is now starting to build out around this currency. It is vital that HBD become the default medium of exchange for commerce along with financial transactions. Since it is base layer, it feeds into the value of the entire system. This is what is captured by $HIVE.

In other words, this is the foundation for the Hive economy.

For this reason, as utility expands, a lot more HBD is required. Increasing investment in Hive savings obviously helps that except it comes with a couple issues.

- does the rate keep pace with the demand for HBD, i.e. the growth rate of the ecosystem?

- is the HBD generated as interest making it into the circulating supply or is more being locked in savings?

What this means is that, if the supply does not meet the demand, it is met by the conversion of $HIVE. Here is where a lot of HBD can be created if needed.

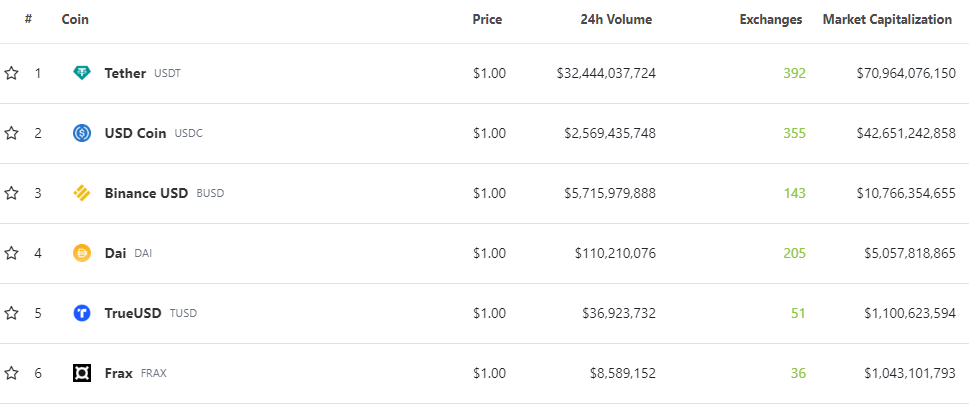

We now have a major barrier crossed. The discussion of HBD is now in the millions. It is a step forward. However, to fund a thriving Hive economy, we are going to have to focus upon billions. If we even look at the top stablecoins, we see how far behind HBD is.

These are the stablecoins with a market capitalization of $1 billion according to Coingecko.

To contrast, HBD has a total supply of 32 million, with 20 million in the Decentralized Hive Fund (DHF). This means the supply in circulating is 12 million. If the amount in savings is 5M, we are dealing with only 7 million on the open market.

This is not a lot to fuel an economy.

Again, as utility grows, we are going to require a lot more HBD.

By the way, going back to the list, can anyone tell us the commercial application that us FRAX or even TrueUSD? How many businesses are accepting them as payment for goods and services?

The advantage for Hive is we are building the utility surrounding HBD. Since it is base layer coin, and part of core ecosystem, everyone can focus upon it. We will reveal in an upcoming article how this can provide for exponential moves due to the many tentacles that it wields.

For now, we achieved a milestone. However, we have to realize, that against the backdrop of the present financial system, 1M in HBD savings is a drop in the bucket.

Down the road, this should become commonplace as it attracts high net worth individuals.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta