There are many ways where Hive can succeed. This is one of the most dynamic blockchain with capacity for growth coming from many different places. By combining social media with finance, along with a robust layer 2, smart contract platform, we could see an ecosystem that is one of the most valuable in this industry.

Sometimes, we can get lost with all the options that are before us. In this article, we are going to revert back to the most basic essence of blockchain to see where Hive stands. If we bore down to core, it quickly becomes evident what we are dealing with.

Years ago, in one of the James Bond films, Carly Simon had a song where called "Nobody Does It Better". When it comes to this facet of Hive, it is applicable.

So let us investigate what Hive has to offer from this perspective and the impact it could have on the value of the network.

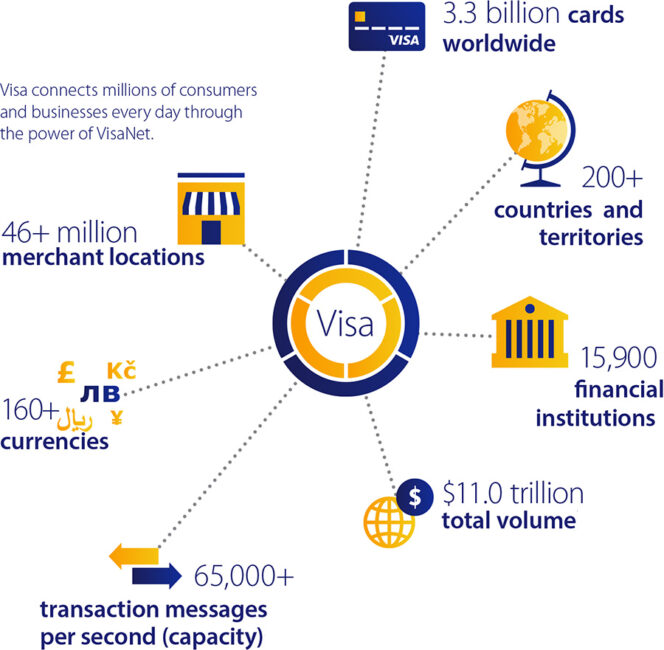

Source

Visa Payments

As we can see from the above graphic, the numbers are absolutely huge. When it comes to payments, at least on North America, Visa simply dominates.

The company does about 150 million transactions per day. According to the most recent numbers, as of March 2022, the company had done 255.4 billion transactions totaling more than $14 trillion. Source

Their operating income for the trailing 12 months, as of Sept 30 was $19 billion on $29 billion in revenue. The present market capitalization of the corporation is $490 billion.

Indeed, some rather large numbers.

That said, what is Visa? We think of them as a financial services company but that is not the case. They are primarily a computer networking firm. It establish a massive communications network that processes and transfers data not only in large volumes but at rapid speeds.

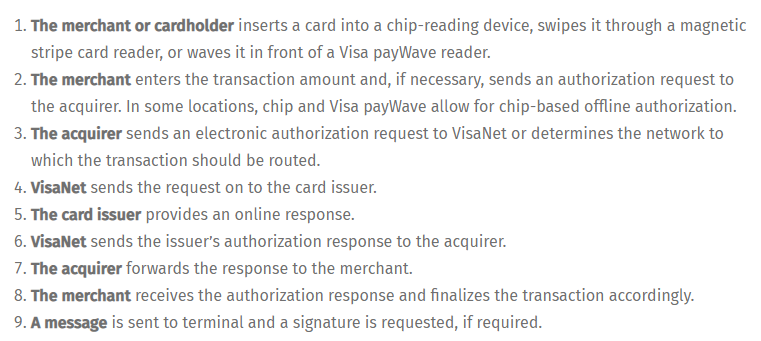

Of course when we look at the complexity of how things operate, we see why this is.

Here is the transaction authorization process:

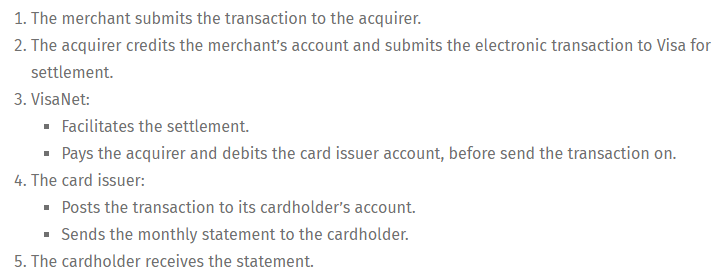

That is just to run the transaction through. Then we have to account for the settlement.

Fortunately all of this happens in the background because there are a lot of moving pieces. Visa has spend a fortune building out their network to ensure it is able to facilitate all these processes.

Ultimately, the company is doing nothing more than moving data around. There is no currency involved in this. It is nothing more than crediting and debiting ledgers. Under this scenario, it is all controlled by Visa. We are dealing with their network, servers, and account management. In short, it is their world.

And because of this, they are worth half a trillion dollars.

Blockchain

Blockchain solves this.

With the introduction of Bitcoin, we saw the establishment of distributed ledger technology that does the same thing companies like Visa do. At its core, a blockchain transmits data and updates the ledger. This is what block producers do. When it is tied to a cryptocurrency, we have a system that is transferring value.

Here is where we see the currency idea of cryptocurrency. The concept was to have the value, i.e. coins, in a wallet, and the network transfers what is desired to another wallet based upon the user's request. Through the different consensus mechanisms (PoW, PoS, DPoS), the double spend problem was eliminated.

Basically we are looking at a digital cash payment system. Obviously this differs from Visa in the fact there is no credit involved. For this reason, the process is akin to PayPal. Nevertheless, when looking at the money involved, we can see how Visa is the king.

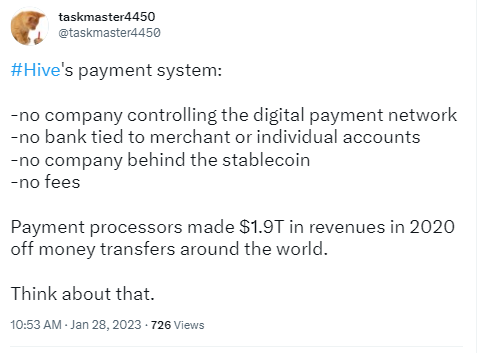

Here is where Hive and Carly Simon enter.

This is a Tweet I sent out the other day:

Hive is a digital network of nodes operating all over the world. This system is open 24/7/365 with blocks being produced every 3 seconds.

The fact there is no company means the trust comes from the blockchain itself. Each minute of the day, 20 more blocks are produced. This is filled with transactions of all kinds. However, whenever anyone sends $HIVE or HBD to another wallet, it is recorded.

Here is the kicker.

Hive offers, at most, 3 second, transaction time. The average is about 1.6 seconds. Even more importantly, due to one block irreversibility, the total transaction is settled in a few milliseconds more. That means the entire process is done in under 2 seconds.

When it comes to the blockchain world, nothing can touch that. Bitcoin can have transactions hung up for hours before they ultimately fail. Litecoin can do the same thing. With Hive, we know very quickly if there is an issue.

Since the days of Satoshi Nakamoto, this was the focus: an electronic cash transfer system without the use of banks or other financial institutions.

Well, based upon upgrades to the network, at this point, when it comes to transfer of value, nobody does it better than Hive. It is the premier digital payment system out there.

Impact On The Value Of Hive

Everyone is looking for the moonshots.

For the past few weeks I have discussed transactions and the value of them. Obviously, this is often from the social media and gaming point of view since that is something that Hive offers also.

However, when it comes to finance, it is vital to think in these terms. A system's value grows a great deal when the transactions increase. Naturally, this is compounded by the total amount transferred.

So what could be the value of Hive simply as a payment system?

We are dealing with a lot of guess work here but if we can pull in 1% of Visa, that would give us a range to play one. One thing we much mention is that, when it comes total amount, the banking system sends far more than Visa, at a much higher cost.

Nevertheless, using 1.5 million payments per day, with a 1% market capitalization of Visa, that puts Hive close to $5 billion. That would not even break into the Top 20 of cryptocurrency even with the bear market. During the bull, that might not enter the Top 75.

Of course, we have to highlight the fact that payments on Hive have zero direct transaction fees. The only thing needed is to stake the main coin.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta