For the last year, Hive's own stablecoin received a great deal of attention. This started with the HBD Stabilizer which has tightened the range the token traded in while also adding over 1 million HIVE to the Decentralized Hive Fund (DHF).

At the same time, interest was added to any HBD that was placed in savings. This is paying a strong 12% per year, a level set by the witnesses. We also have the increase in the haircut limit taking place in the next hard fork.

All of this is helping to move HBD, an algorithmic stablecoin, forward.

Over the past few months, we covered ideas such as the Hive Saving Bonds as well as developing an entire bond tree.

Today we will look at the secondary innovations that could come from having projects such as these in place.

Innovation happens at many layers. The great thing about an ecosystem like this is that once something is in place, other are free to build on top of it. Here is where we can see things explode.

The main focus of this article will be base layer. However, it is easy to conceptualize how many idea on the second level can come forth.

Source

Transaction Fees

One of the benefits of having increased activity, from a token standpoint, is due to the fact that, if people want to transact, Resource Credits are required. Here is how people can promote the idea that Hive is feeless. There are no transaction fees at the moment on Hive.

This is accomplished by having Hive powered up in one's account. IT is what provides the Resource Credits to operate. If an account has even 100 HP, that individual can engage with the blockchain almost endlessly.

Here is where we can change things up. Let us start by implementing transaction fees. Please note that this does not mean we do away with the Resource Credit system. As long as one has HP in the account, everything operates the same.

The question arises pertaining to those who do not have Hive Power. More importantly, what about those people who are not aware of it? Resource Credits are a complex system and difficult to explain. If we are going to attract outside people, especially using a feature such as the Hive Savings Bond, simplicity is key.

Implementing transactions fees at this level could be the solution. How would this look?

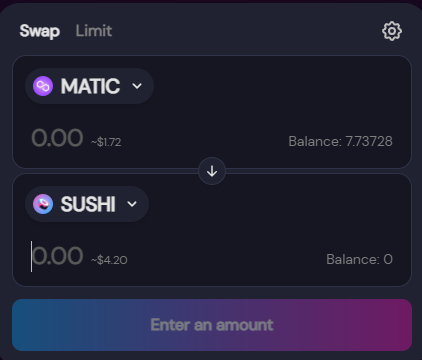

Someone comes to Hive looking to get involved in the fixed income market we are creating. The person is either going to have to swap/convert Hive to HBD or, if in HBD, transact to get it into savings. This requires Resource Credits.

Here is where the transaction fee enters. If the individual is lacking them, he or she can pay a 1 HBD ($1.00) fee. We could use some of the Hive in the DHF to provide the Resource Credits. This would all be driven on the back end. People who deal in financial matters are accustomed to paying fees. Naturally, if the person has the RCs, this step is not required.

It is basically to cater to people who are not really familiar with Hive and are not going to spend the time learning. They simply want to deposit their money to earn the return.

The HBD fee is sent to the DHF as a way to keep funding that.

Conversion Fees

Another idea is to implement a small fee when converting Hive-to-HBD or vice versa. Here we are addressing a few issues at the same time.

To start, we could enhance the security of network governance. Also, we are making it a bit more rewarding for people to hold Hive Power.

What does this look like? Each time someone uses the conversion mechanism, there is a fee of perhaps .25%-.5%. This is deducted from what is paid out on the conversion. Whatever comes through from this mechanism can be distributed to the holders of Hive Power, much in the same way as with the inflation. The accounts might now know it is happening.

This ends up as a way of securing the governance of the network. The idea is to get a steady flow of Hive being powered up. It happens automatically and will only increase if the conversion mechanism becomes more popular.

Here we can see how Diamond Paws are rewarded. More importantly, we have a flow of Hive going into accounts that are likely HODLers. This adds more stability to the network since HP translates to governance rights.

Just think about how much HP that is if we have to create 10 billion HBD over the next half decade. That is a lot of converting taking place.

Of course, for this to be desirable, the conversion mechanism will require some fine tuning. At present, there is the 3.5 day convert time on a portion of the transaction as a security feature. Hopefully, as we add security via different mechanisms, we see this drift away. Ultimately, the goal would be to have the conversion mechanism operate akin to a swapping feature. People will be able to seamlessly be able to go back and forth.

And each time this happens we will see a portion pushed into HP, furthering governance security. It is important to mention that the slippage in liquidity pools can often be 1%-3%.

Increasing The Appeal Of HBD

All of this is predicated upon increasing the appeal of HBD, not only to people on Hive but those outside it. Concentrating upon the fixed income market is a fantastic way to do this. With Hive, we can implement a great deal at the base layer, which provides enhanced security as compared to much of what is out there.

It all ties to the value of Hive in total. The conversion mechanism simply moves the value around to where it is needed. If HIVE is more attractive at the moment, that is where the focus will be. However, if market forces change, with HBD becoming the preferred, the system can adjust for that.

Through this, we can take secondary steps that enhance the entire ecosystem. Here we have a couple ideas which can keep driving value to the core levels. A steady flow of revenue to both the DHF and HP HODLers enables further expansion while providing a bit more incentive to power up.

As always, the numbers and percentages are just suggestions to give examples. However, it is important to convey some of these ideas and starting the conversation.

What are your thoughts? Do you see this as an effective way to drive value to the Hive ecosystem especially if HBD becomes an appealing token for people to hold or utilize?

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta