The Securities & Exchange Commission Chair is really going after the cryptocurrency industry. While there are some things we can disagree with him on, there are others that he gets right.

At question is whether assets within the cryptocurrency realm are securities. If so, then these entities are subject to regulation just like other financial institutions.

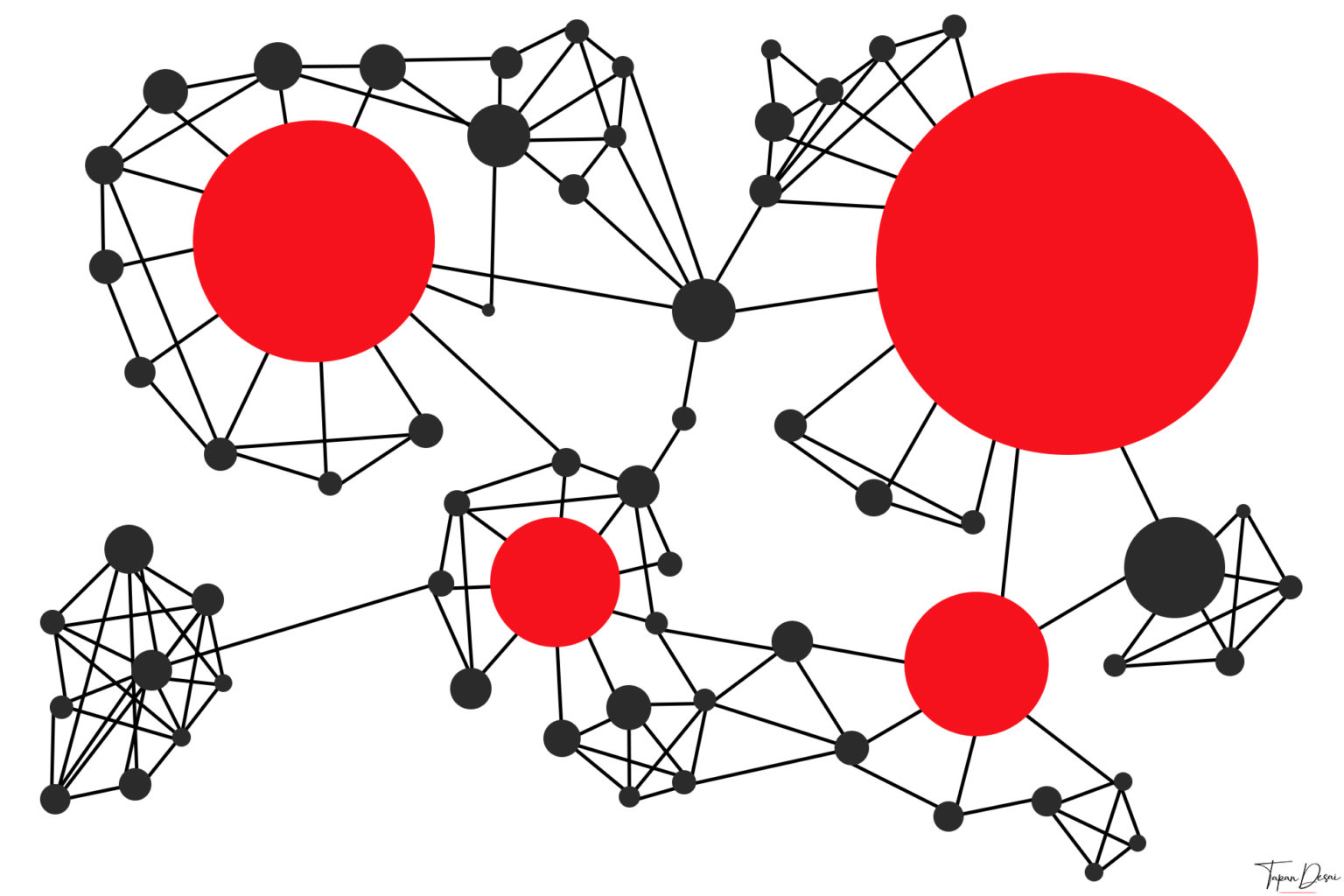

This is a very important point since most of the financial industry is highly centralized. It is a situation which incorporates enormous network effects, making entry from the outside near impossible. Could we be seeing this with cryptocurrency?

According to Gensler, the same thing is happening.

Here is an example of the current state of affairs:

As the chairman noted, merely four asset managers in the U.S. now control over 80% of total assets held in U.S.registered investment company index funds. Equity market makers responsible for handling retail market orders are also trending towards centralization, due to executions largely taking place off-exchange.

Of course, it does not take a genius to figure out the power being wielded by exchanges such as Binanace, Coinbase, and FTX. It is a move that is mirroring the intermediaries who controlled the established financial system.

As such, Gensler pointed out the cryptocurrency industry is not decentralized.

Decentralization Has To Step Up

This might seem like an obvious statement yet it is truly reflecting reality. Most are aware that Ethereum is about to become a chain that will be in full compliance. Transactions can be blocked by the producers. It was the post-Merge events that brought this to everyone's attention.

Thus, if Ethereum is centralized (and compliant) then how can anything built on it claim to be decentralized? The answer is obvious. When looking at points of vulnerability, there is a major one right there. Hence, the idea of decentralized finance (DeFi) encounters a bit of a challenge.

Hive is operating differently. This is a blockchain where there is no central, overriding authority. Nodes are spread throughout the world. We also see the coin distribution which far outpaces what exists on other chains. The absence of a foundation, lab, or anything else tied to a founder's stake is proving very valuable.

Gensler added this point:

“This field actually has significant concentration among intermediaries in the middle of the market,” he said. Thus, we must remain vigilant to areas where concentration and potential economic rents have built up or may do so in the future.”

Here we have the same rent seekers in different clothing. These exchanges are only growing in power especially in light of some of the collapse of centralized crypto firms. They are now able to buy the assets for pennies on the dollar.

At the same time, the network effect they are riding is powerful. Intermediaries of this nature benefit from the increase in depth and liquidity. They see their profits increase along with activity. Each step of the process includes transaction fees. This is something we discussed regarding both HBD and the Hive Financial Network.

Most People Do Not Think Decentralized

It is evident, even on Hive, how few people think in a decentralized manner. An example is the liquidity pools set up by Leofinance on both BSC and Polygon. They were able to create derivatives of both HBD and $HIVE.

This is something that received lackluster support overall. In fact, there are some on Hive who view this as a threat. The belief is that all should be resident in the base form.

Where this goes awry is in the fact that, by creating derivatives, we are decentralizing both coins. As more is spread out into liquidity pools, we see the ability to leverage the network effect in a powerful way. This also can take from exchanges.

One of the motives behind the article Adding To Hive's Fixed Income Platform: HIVE Into Savings is to incentivize people to remove their $HIVE from the exchanges. We are better off if more is in savings and the Internal Exchange is used for trading. Since this feeds the Decentralized Hive Fund through the HBD Stabilizer, we see how the advantage of the ecosystem comes into play.

At the same time, the goal is to set up massive liquidity pools using derivatives. Here is another concept that is widely misunderstood. Derivatives are a way to reduce risk. That is their design. By creating mirrored versions of HBD and $HIVE, we push the risk further out, away from the core. As liquidity grows at that level, the network effects can take off. A massive LP will keep gaining in value as more turn to it. Ultimately, there will be a handful of pools that take the majority of transactions.

This is much better than a few centralized exchanges.

Another concept is the idea of decentralized exchanges (DEX). We already have the Internal Exchange and one is being built on honeycomb. All of this will serve as a way to alter the landscape of these coins since there will be other options. Also, by enhancing the sophistication tied to HBD, such as with Hive Bonds, we move things to a completely new level.

If Not Hive, Then Who

The natural tendency is for people to stand around waiting for others to do things. Here is where we encounter a major problems in cryptocurrency. Few projects are being set up as decentralized. In fact, that is not the desired outcome.

We have billions in venture capital funding flowing in. This is not in alignment with decentralization.

Cardano, EOS, Ethereum, and Tron all have major centralization issues. None of them are being set up to provide a resilient base layer. To show how bad things are, Block.One already paid a fine to settle with the SEC. If you can do that, it is not decentralized.

Hive is one of the few out there with any hope. Fortunately, there are a number of people who believe in the concept of building decentralized systems using open source software. They are not really concerned with making themselves a boatload of money although, if their stake is high enough, they will do rather well.

Instead, they are driven by other motives. The ability to airdrop to Hive holders instantly removes the tendency to have a founder's stake. We saw this on a couple of occasions and other projects would be smart to follow suit.

Part of the excitement with some of what is taking place on the second layer is the fact that we see a decentralized node system emerging. If we tie that to the base layer of Hive, we have two layers where there is no overt control. Again, this is something we do not see out there.

So while many want to scoff and overlook Hive, those within the ecosystem should realize the onus that is upon us. This is not just some little blockchain that has no meaning. Actually, the opposite it true.

When it comes to decentralization, Hive is the leading candidate to make a difference. With the second layer infrastructure that is presently under construction, we will be able to leverage the network effects just like the centralized entities are doing.

We already do it with long-form blogging. Soon we will be adding microblogging and finance to the list.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta