Things are changing very quickly. It is difficult to keep up with how industry's can be completely altered. While a decade might seem like a long time on one hand, it is a spec in time when looking at the bigger picture.

Of late we discussed the idea of Web 3.0 and how one of the core pieces is the combination of social media and finance. The latter is what can possibly make these networks worth a great deal more.

In this article we will explore the present value of Hive along with where it will proceed.

Digital Wallets

The digital wallet was a major innovation. It is often overlooked yet the functions that it provides radically alter the financial system.

This single device can replace a bank for 90% of what most people use it for. The ability to send, receive, and store money was something monopolized by the banking industry. A wallet effectively eliminates that need.

At the same time, cryptocurrency was built on blockchain, providing the world with a completely new ledger system which can be utilized to transfer value. All transactions are made in that currency while they are recorded on distributed ledger technology.

The impact of this is yet to be realized. However, when this matures, we can presume the value associated will be enormous.

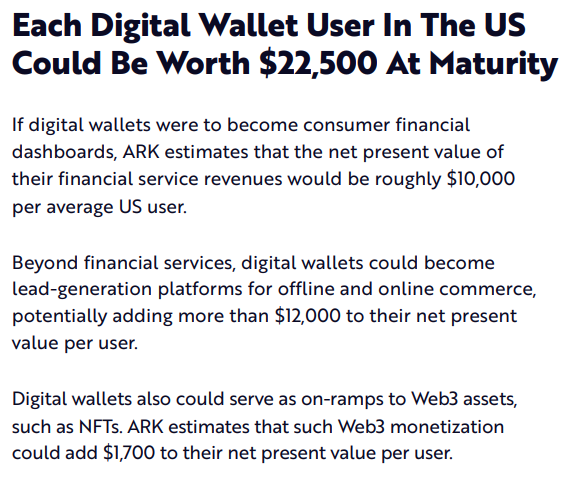

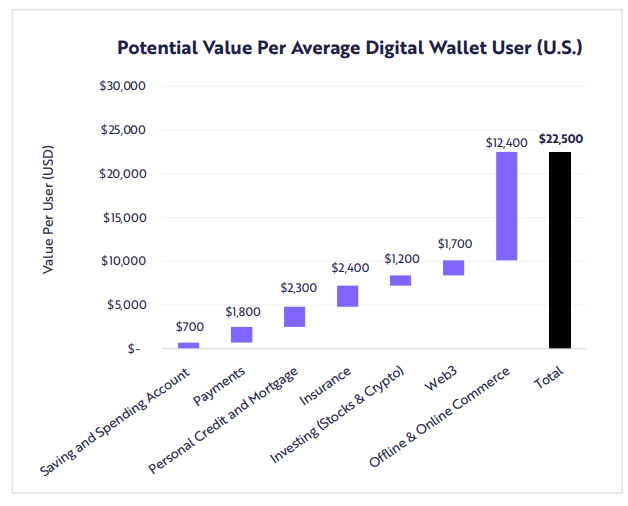

Ark Invest tried to quantify the potential in their Big Ideas paper.

We know services such as PayPal and Square are worth billions. The present market cap of PayPal is over $90 billion. Of course, we have to mention this is really nothing more than a payment system.

Building upon this, Ark forecast the value of a digital wallet into the future.

Here are their conclusions.

They also put it in chart form:

As we can see, due to the different services that can be tied to a digital wallet, the value of each will be worth significantly more in the future. While the number might not be exact, the mode of analysis makes sense. How much activity will be tied to these wallets in the future?

Hive Wallets

We all know that Hive is overlooked. For the time being, that is okay. We are in the process of building.

What started as a social media network is transitioning. Each social media user is worth a couple hundred dollars in value based upon market pricing. For example, the purchase of Twitter for $44 billion puts each user at roughly $175.

This is obviously a long way from $22,500. It also shows how finance is vital. Bank of America of over $300 billion. By treading into investment banking, we see JP Morgan topping $400 billion.

Here we see the difference between social media and finance. Combining the two should leverage the best of both industries.

As for Hive, where do we stand at the moment?

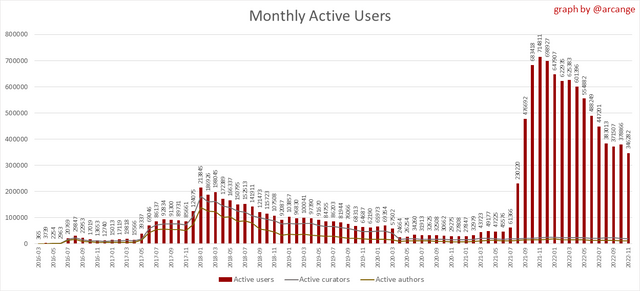

According to the stats compiled in this post, we have a chart outlining the number of users. Since each account is tied to a wallet, and most activities on Hive has some time of monetization tied to them, we can look at this is the number of wallets.

Here is the chart:

With over 35,000 users, this puts the future value, using Ark's numbers, at $787.5 million. This is much higher than the present market cap of $130 million.

Naturally, Hive does not have a robust financial network built out at this time. We are still in the early days yet this does show the potential of what exists out there.

Businesses As A Foundation

The Ark list has a lot of industries that blockchain is not yet involved in. For example, we do not have much in the way of insurance. The mortgage industry is also something that was not tapped into. These are sectors that we can expect innovators to start investigating throughout the rest of this decade.

With Hive, building businesses will lead into enormous network effects. Each success will enhance the entire ecosystem.

Look at the @podping project. Here is what was sent out on Twitter.

That is a significant number of an insignificant chain.

The fact that 15% of all podcast updates are received by the podcasting applications via Hive is very telling. Where will this number be in by the middle of next year?

Of course, this is not financial in the sense of what we are describing in this article. It does, however, save these companies a lot of money on running servers that scan for updates. Podping, i.e. Hive, handles it for them.

Here we have one example that provides value that is not directly tied to the ecosystem. We do see a valuable service forming that will be a basic part of these applications infrastructure going forward.

As for finance, this was the idea behind the Hive Financial Network written about a month or so ago. There will be another article coming out describing a lending application that can be build, something that moves Hive closer to Ark's vision regarding digital wallets. This will target the "Personal Credit and Mortgage" section of the chart.

What happens when Hive has 500K monthly users. If we apply Ark's numbers to that, what kind of valuation is there? Social media becomes the feeder system for the financial. Simply be partaking in social media activities on Hive, one is involved with decentralized finance (DeFi). As we build out more aspects to the financial network, other services are available to people through their Hive account.

This is the potential that we often discuss. It is also something that many are dismissing.

Even if we reduce Ark's projections to $10K, half a million wallets has a valuation of $5 billion.

Financial accounts are worth a lot more than social media. This is the area to leverage for enormous growth.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta