This article is the result of a conversation with @blocktrades. It is being posted to get feedback from the community.

Source

Over the past few months we discussed different ideas regarding expanding Hive into the fixed income market. This is a crucial aspect of the investing world and one that is going to be vital in the evolution of Decentralized Finance (DeFi).

We already see the first layer established with the introduction of interest payments by utilizing the Hive savings account. At present, this has a 12% APR utilizing the Hive Backed Dollar (HBD). This is the premise we are going to build from.

Here we are going to delve into the issues with the stablecoin market as well as what we are proposing to develop on Hive.

The Problem

For now, the stablecoin market is paying a return of 12%-20%. This is the range that most projects fall into. This is, naturally, an outstanding return compared to the traditional market. When it comes to the hunt for yield, DeFi is excelling in this area.

That advantage to this, in addition to satisfying the need for a return, is that we see a great deal of liquidity. Money is available, for the most part, in a very short period of time.

Where the problem comes in is the design. Here is what we see tied to these projects.

Counter-risk because one is often dependent upon an application. We watched recent events exposing how this is the case with wallets and other applications.

The return is often in a token other than the stablecoin staked. This adds another level of risk which could affect the return.

The Solution - Hive Savings Bond

This is another layer added to the Hive savings program. Whereas that is a liquid account providing a return, the Hive Savings Bond is a time-locked account that offers incentive to lock up one's HBD.

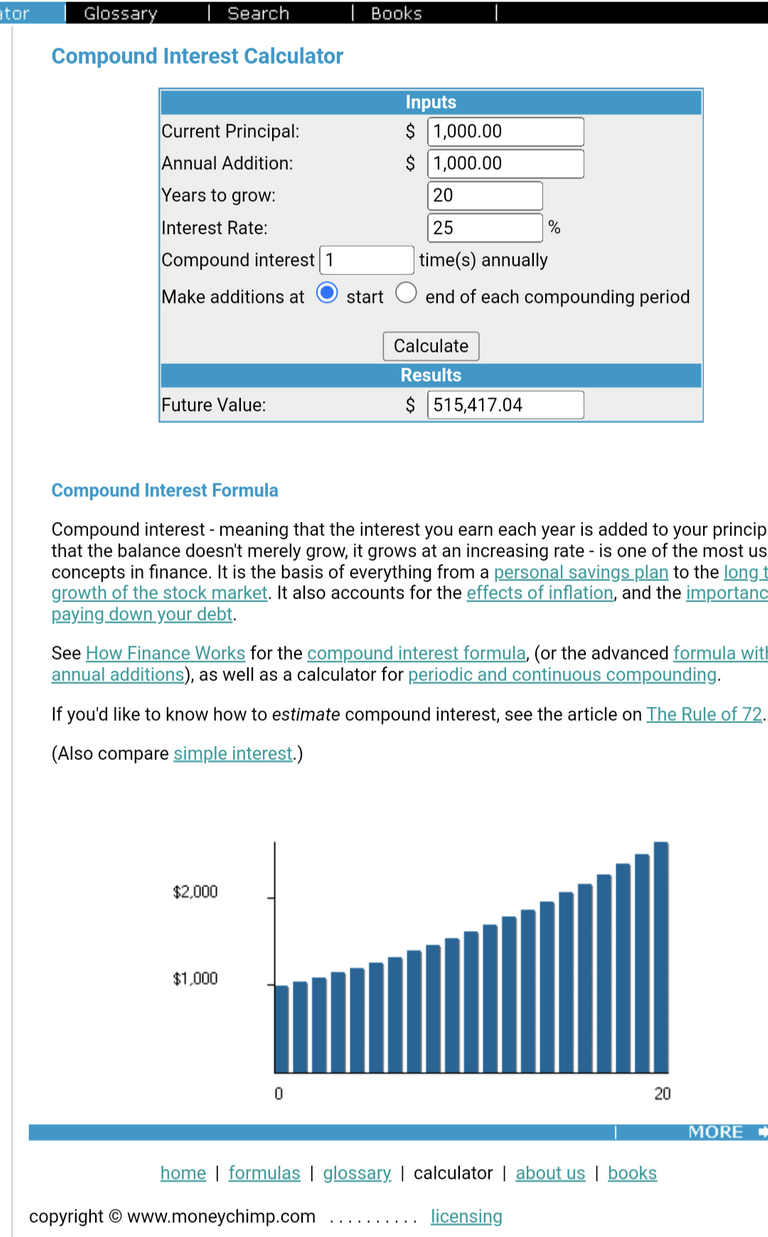

We are looking at the first configuration at being a 1-year lock up, yielding a return of, say, 25%.

This is about double what the savings account pays, a price paid to sacrifice liquidity. Layer 2 solutions could be built in the future that allows for the trading/collateralization of these assets. For the moment though, we are dealing with a non-liquid asset.

It will work exactly the same as the savings account. Individuals would put HBD in and receive a return. That is set by the consensus of the witnesses. Whatever rate one deposits at, that is in place for the 365 day term. It is no different than buying a savings bond from the government.

Each month a claim could be made. Of course, we don't want the payouts automatically locked up so they would have to be directed either to liquid HBD or the savings account.

As we can see, another layer of fixed income options would be operating on Hive. People will have a choice of where to deposit their HBD. If one wants liquidity, then savings is the place. However, if the quest for yield is the main parameter, one can get a higher return if willing to forgo liquidity and lock the HBD up for a year. There is a trade-off yet both options are available.

Benefits

This could have an enormous impact upon the Hive ecosystem if successful. We can see a number of benefits that can be spawned from this one move.

- Hive Legitimate In The Fixed Income Market

We are dealing with a base-layer, algorithmic driven stablecoin with no counterparty risk. It is also tied to a decentralized blockchain with no foundation, company, or venture capital firm behind. With all the talk about regulation, this is removing that entirely.

This adheres to the "your keys, your crypto" that is one of the main tenets of this industry. Also, unlike what took place in Canada, the money is not at risk of seizure or banning. Nobody can take one's Hive account away.

- Payout In HBD

Put in HBD, get paid in HBD.

Sounds simple but it is so rare within the cryptocurrency world. This is eliminating the risk with another token involved in the transaction, thus removing a pitfall present in most stablecoin opportunities.

It also serves as a method to create a great deal more HBD. At present there are roughly 10M-12M outside the DHF. In the stablecoin world, this is not even a flea on a dog.

Look at some of the others:

Tether 80 billion

USDC 50 billion

BUSD 18 billion

UST 14 billion

In other words, Hive needs a lot more HBD if we are going to be a legitimate player in the stablecoin world. A lack of liquidity is also causing volatility in the token price, something that is counter to what is desired with a stablecoin.

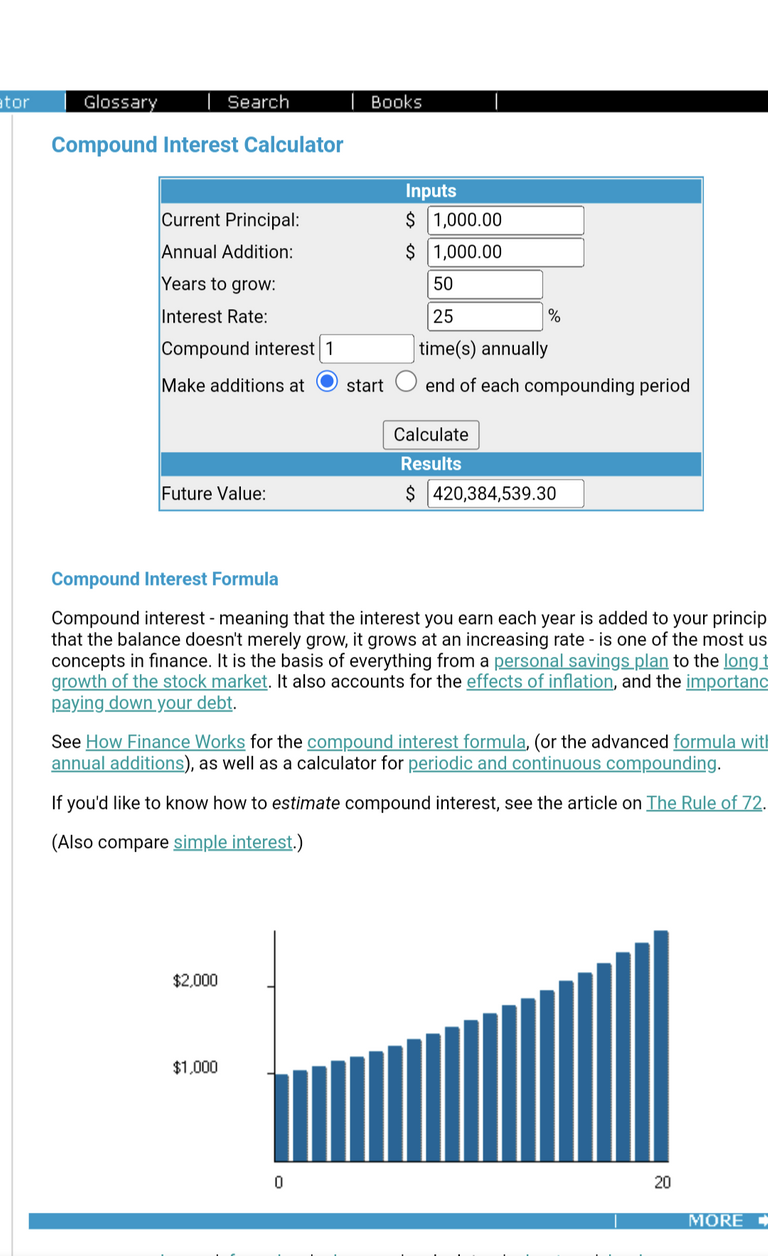

If we take the present HBD (outside the DHF) and extrapolate it out over 20 years at 25%, we get 1.04 billion.

Network Stability

The HIVE-HBD relationship brings up some interesting characteristics. One is that we have a supply that is truly driven by the community. Anyone can create either HIVE or HBD via the conversion mechanism. This means the market dictates whether one or the other is generated.

There is a risk to this. Since HBD is backed by $1.00 worth of HIVE, there is a potential threat by nefarious players to the system if they use market swings to create a lot of HBD and then convert it reverses. It is counterbalanced by the haircut rule which is bring moved to 30% in the next hard fork.

We see increased network stability through the use of the Hive Savings Bond. Since the HBD will be time locked, it is not a threat to the network since it cannot be converted to HIVE until released. With all the information is on chain, it is easy to tell what is being released over the next 30 days.

Hence, we have the opportunity to expand the supply of HBD while not putting the network at much greater risk.

Funding Mechanism

Most are going to look at the APR as a way to enhance our personal returns. However, this is equally applicable to the projects built on Hive.

For example, imagine you develop a game. In this case, one could take $10K and put it in the Hive Savings Bond. This would generate a little over 200 HBD per month. Here we see where the contests or leaderboard rewards could come from.

The same applies to a project in general. Let us suppose it raised $200K. Half of that could be put into the account and earn $25K per year. This would help to fund development, marketing, or whatever other tasks were needed.

We can see this really enhanced by the release of the Hive Application Framework (HAF) which will make development on Hive much simpler.

Pull In Money From The Outside

Having an APR of 25% in the crypto world might not sound like much. However, for those who understand compounding, it is huge. To contrast, Warren Buffett is known as the greatest investor in the world due to the fact he generated a 20% return over half a century.

Going into the 1980s, when interest rates were higher, the fixed income market was a legitimate avenue to pursue. People would buy bonds yielding 12%-14%. It was a way to develop a strong cashflow over time.

For those who are in their 30s or 40s, this could be a very powerful opportunity. If one looks at investing regularly into something like this, the 25% return would compound into a big number by the time one reaches his or her mid-60s. In the US, one can put in about $7K into an IRA. Doing something similar to that over 20 year, at 25%, will turn into millions.

Here we see not only the opportunity to appeal to those investing in stablecoins but also to pull money out of people's traditional accounts that are underperforming. It is easy to see how millions could end up pouring in as people learn about this opportunity.

Create A Demand For HIVE

If this project is mildly successful, it will not likely have much impact in this area. However, if it does take off, this could really alter things.

We see projects that are pooling billions. This is a fairly regular occurrence in the DeFi world. With this, we will not set our sites so high.

However, what happens if we start to move into the tens of millions? Where is all that HBD going to come from? The answer is through the conversion mechanism. Here is where we could see the demand for HIVE increase since people will need that to convert so as to enter the Hive Savings Bond.

This could actually further reduce the amount of HIVE outstanding.

Hive Accounts

Anyone who wants to partake will need a Hive account. This will help to expose more people to the ecosystem.

At the same time, there will be Resource Credits required. Here we could also see some increase in the demand for HIVE as people need to get some to power up in an effort to operate.

With increased transactions comes more need for those ever important Resources Credits. Someone has to create them by powering up.

Risks

There are risks to everything and we would be remiss if we did not cover them.

With this opportunity, we are looking at a very low risk ratio. In fact, it is as safe as one can get.

- No Longer Backed By $1 Worth Of HIVE

The Hive Backed Dollar is backed by $1 worth of HIVE. When the ratio of HBD to the USD value of HIVE goes to an extreme, this could be broken. It is the reason for the haircut rule which adds a layer of risk. Of course, that rule is in place to allow the system to self correct if it gets close to the limit. With the next hard fork, this is going to be raised, furthering reducing this risk.

- Hive Shuts Down

If the blockchain completely stops, there is nothing to access. While this is unlikely since it only requires one person, somewhere in the world, running the software, it is a risk. If Hive disappears, all that is one it goes away. The same is true for any other blockchain.

- HIVE Goes To Zero

The old saying of anything multiplied by zero is still zero.

If HIVE becomes worthless, than what it is backing, by definition, is also worthless. It is only possible to claim $1 worth of HIVE for each HBD if HIVE has some value.

Again, the likelihood of this happening is almost nil but it is out there in the realm of potentiality.

In Conclusion

Cryptocurrency is filled with people who are looking to get rich overnight. Everyone is looking for the "moon" token, one that will lead to Lambos and islands.

We saw another phase development where stablecoins emerged as a means of parking some of those profits. As risk-off took hold, many moved to stablecoins to preserve the gains. At the same time, some of the yield farming projects arose, providing some return.

However, few are fully focused upon the Decentralized Fixed Income Market. This is a place where Hive can easily set up camp. We have the basic infrastructure in place with the Hive Savings Program. Now it is just a matter of expanding it, adding another layer that includes the time-locked feature.

Essentially we are looking at a base-layer project with very low risk while offering a very strong return. It appeals to a different type of investor as compared to the one who is out there setting his or her hair on fire and throwing caution to the wind. While not as exciting, it does provide a solution for a larger portion of the investing public.

What are your thoughts on the matter? Give us feedback in the comment section.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta