It might not seem it right now but this is the future of Hive.

When we try to uncover all the layers of Hive, we see how much of this is going to feed into the value proposition. What is so powerful is how it all creates a reinforcing, circular feedback system that multiplies the value along the way.

The idea of looking at blockchain as real estate is nothing new. However, what was proposed in the past obviously didn't unfold as many described. Even with Hive, we do not see it at this moment.

That said, as we will explore in this article, we can easily contemplate how Hive fits into this model.

Scarce Digital Real Estate

On some levels, this can be thought of as absurd. The idea of scarcity and digital really do not go together. After all, one of the advantages of the digital world is the ability to keep expanding at a rapid pace. Often this only requires the addition of nodes to carry the traffic.

When it comes to blockchain, there are limitations. The size of the entire chain is crucial. As it gets larger, costs of housing increase. Also, we see how there would come a point whereby single servers could not handle the entire database. This is a problem since each node has to duplicate the information, at least that is the case for now.

As we often discuss, one of Hive's unique use cases is as a decentralized database. How much is that worth on the open market? Right now, since we still have so much room, it isn't carrying great weight. That could easily change with time.

Under this system, resource credits are required to engage in with the blockchain. While it is permissionless, one needs enough $HIVE staked to be able to operate. Here is where the scarcity can start to enter the picture.

With increased competition for the use of the database, we can see how this could cause demand pressure. If there is more need for resource credits, the cost, in terms of each activity, will increase. This means that each Hive Power will, effectively buy less on chain.

For simplicity sake, let us say that 10 HP is required for the posting of an article. That means one with this amount can post 1 article per day. However, what happens if it requires 20 HP to post an article? This individual is going to have to double the HP to utilize the blockchain in the same manner.

Scarcity Of $HIVE

Here is where things get very interesting.

People often discuss the inflation of a currency yet do so in a vacuum. Nothing monetarily operates in this manner. There are always interconnections which need consideration.

With $HIVE, the inflation rate is roughly 7%. As a standalone number, this really tells us nothing. Sadly, people use the rate to conclude whether it is too high or low.

Actually, there is another rate that has to factor into this. We need to consider what the growth rate is, especially as it pertains to the use of the scarce resources.

Therefore, if the rate of cost of resources is going up FASTER than the inflation rate, we will the demand side outpacing supply. This is what will cause scarcity.

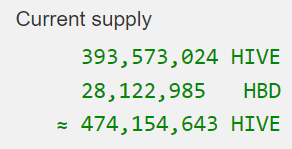

At present, when looking at Hiveblocks, this is what we see.

We have 393 million $HIVE available. The block explorer also tells us there are 164 million in Hive Power leaving roughly 230 million on the open market.

Once again, this sounds excessive and could be considered that as things stand now.

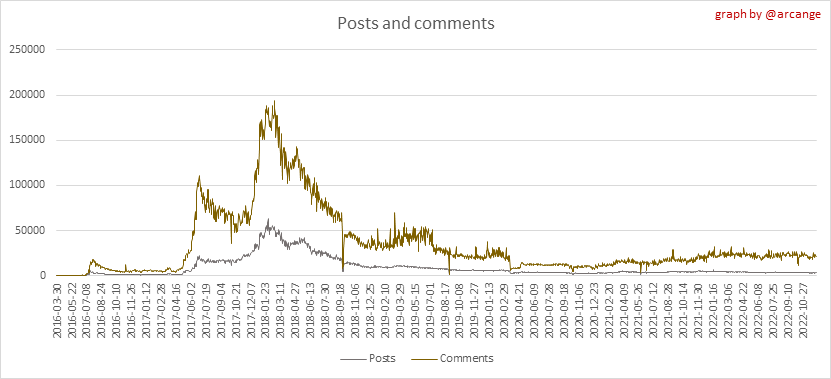

Here is a chart from the latest Hive statistics:

We can see the peak was just shy of 200K. What happens if the desire to post to the database gets to the point where there are 2 million? Or 20 million?

As a comparison, Twitter has roughly 500 million Tweets per day.

Of course, we know resource credits are used for things other than posting and commenting on articles. They are required for claiming accounts, Custom JSONs, and transacting in a financial manner. This means that gaming and finance have the ability to drive demand for the resources along with the social media applications.

The supply and demand equation is what simply determines the scarcity on Hive. As more people utilize the system, in more ways, this is going to drive the need for resource credits. Since there is the link to Hive Power, there is only one outcome.

Scarcity In Computing

Ultimately we are looking at a scarcity in computing. This is why Hive, as digital real estate, makes sense.

We are dealing with a censorship resistant, immutable database. While this might not be required for everything that is stored, there is a case whereby this is crucial. Some information simply needs to be held in this manner.

So far, there are not too many options. Hive offers this in a permissionless manner. To me, this is a vastly underappreciated feature at the moment. It will not always be the case.

This is not playing with NFTs and pretty pictures that people speculate upon. Certainly, they could hold a strong position in the digital asset world going forward. However, with Hive we are dealing with the base layer coin as an access token. It is through Hive Power that one is allowed to engage with this database.

It all boils down to the demand for the database. Here is where the exponential nature of the digital/computing world can kick in. Once revealed, things can happen quickly. A lot of work is going into scaling since many are anticipating a day when there will be a rush for space on chain. Even with the increases in efficiency, there will come a time where the limits are tested. We saw this with other blockchains and it will happen to Hive.

Harkening back to the idea of real estate, it will be a modern day gold rush. Those providing the infrastructure are creating a resource that has limitation. If demand skyrockets, we see how this can turn the equation completely in the opposite direction.

At that point, we will realize there is not enough $HIVE available.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta