When we look at the highest per capita GDP countries in the world, we see Monaco at the top of the list. This small country registers over $173,000 per citizen. Obviously, with only 36,000 residents, it is a miniscule player on the world stage. Nevertheless, when it comes to wealth, the country is the envy of most of the world.

Looking at China provides a much different story. The world's second largest economy certainly is the major success story over the last 40 years. With a GDP of over $14 trillion, it is a global player. It does that, however, with around 1.3 billion people. The world's most populous country, on a gdp-per-capita basis, comes in at 79th according to the IMF. China's number is just over $14,000 per individual.

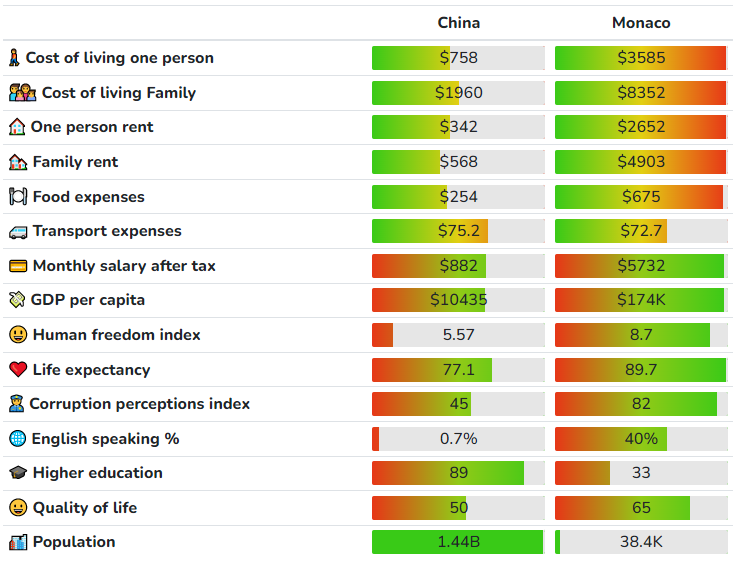

It is easy to picture the difference in living standards between the two countries. We have to keep in mid that Monaco is able to 12.25 times the GDP per individual as compared to China. Let us look at the cost of living:

As we can see, the cost of living is not 12 times that of China in Monaco. In fact, it is much less. This highlights the major differences between the two countries.

Of course, we could focus upon the monthly salary. This does not show such a stark contrast. However, when it comes to a nation like Monaco, salary is only a small piece of the puzzle. This is something that is crucial for cryptocurrency going forward.

Where Does Hive Fit In?

Small and wealthy? Large and relatively poor?

What does Hive's future hold?

This is hard to predict. Nevertheless, we can use this mental model to contrast how things could unfold. A lot of this exercise stems from the idea of what is taking place in terms of production. When we start with the idea of just money, we tend to lose the ability to expand in the ways we are framing here.

As mentioned in cryptocurrency funding real economy, one of the keys will be for this industry to bridge to the rest of the world. At present, we can view it as a bit of an island. Cryptocurrency is basically a self-referential system which keeps feeding itself due to the fact that the number one use case for coins or tokens is swapping them. Ultimately, we need to expand further into the real economy.

This is done by investing in projects that generate a real world return. Here is one of the ways that Hive can become like Monaco.

Nobody is going to deny that Hive is a small fish in the blockchain world. We all know that Bitcoin, Ethereum, EOS, and Cardano get a lot more publicity. This is not to mention the different EVM forks like BSC and Polygon. Hive is a bit player so far.

Of course, the same is true for Monaco. It is small yet wealthy. A lot is generated with relatively few people. A big piece is, naturally, bringing in money from the outside. Hence the concept of investing cryptocurrency into real world projects which ultimately feeds the profits back. Here is where we see a positive feedback loop which automatically generates buy pressure on the coin. If there are periodic payouts of gains from different projects in HIVE or HBD, we can see how this would present a different market mechanism on these coins.

Thus, for now, we have to frame Hive as more like Monaco as compared to China. Bitcoin and Ethereum have a lot more money, numbers that dwarf Hive. Of course, there are a lot more projects tied to them, especially Ethereum. Thus, if we look at the "populations", here, too, Hive is miniscule.

Will this change?

Network Effect

One of the crucial principles in the digital world is the idea of network effects. Here is where we see the notion of users enhancing the value of a network exponentially. The impact is not linear.

Another key factor here is not only users. While this is the end metric that has the effect, development in the form of applications and games is crucial. This is what attracts users.

Historically, we see this realm as a winner take all. With digital applications, there is usually a top dog and then a bunch of runts. We see this with YouTube, Facebook, and Twitter. There are alternatives to those yet they are miniscule in scale. The number of users is next to nothing, as is the value.

In this regard, becoming Monaco might be different. At least that was the case under Web 2.0. Does this, however, change with Web 3.0?

The monetization aspect of things is really interesting. For example, we could have a game that is not very popular in terms of numbers of users. In this regard, the network effect would be minimal. That said, what if this game was very exclusive with high stakes. It might only have a couple hundred players but they are elite in this area. Here we see how the situation could be changed. This game could be enormous value to the ecosystem even though it only has a few users. When we look at value of transactions (and perhaps asset), it is very Monaco-like.

After all, Beverly Hills does not have the most houses yet the real estate is very expensive.

Hive As China

Is there a way for Hive to enjoy the large-scale network effects to become something like China? It is possible naturally. However, the question is what will it take to get there?

So far, Hive is under the radar. Will this always be the case is the question.

For Hive to break out, it is going to require a hook that attracts millions of users. Fortunately, there is one area that is known to achieve this and that is social media. Here we are dealing with an industry that has billions of users.

The key for Hive is that its decentralized database can handle more than just ledger transactions. Data can be stored in the form of social media engagement. This makes it a bit unique.

Is that enough to cross it over to the major player side of the equation? On its own, no. There needs to be a lot of development tied to this. Here is where games and applications enter the picture. If the builders can put forth that which attracts users, then we are dealing with the realistic possibility of the user base radically expanding.

Does this mean a drop in the "gdp" of the ecosystem? Not necessarily. Unlike national economies, productivity can be enhanced by more users. Since the numbers tend to provide move value to what is utilized, we see a much greater economic impact under the monetization of Web 3.0.

Hence, it might not be possible to be China without being Monaco. Following this thought process, each person holding 500 HIVE might be sitting on $10,000 if it was to become a major player on the blockchain stage.

In the end, these analogies are likely to fall in comparison. We are embarking upon something completely different. The valuation models that exist will no longer apply. Nevertheless, since this is what our reference points are, it is good to frame the discussion in ways we all can relate to.

Over time, as the evolution of cryptocurrency and Web 3.0 takes place, we will see how the metrics change.

So what do you think? What is the likely future of Hive?

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta