We discuss the idea of the network effect quite frequently. This is something that tends to be associated with digital networks. Facebook and Twitter enjoy huge advantages over other platforms simply because of the network effect they wield. The same is true for YouTube when it comes to video.

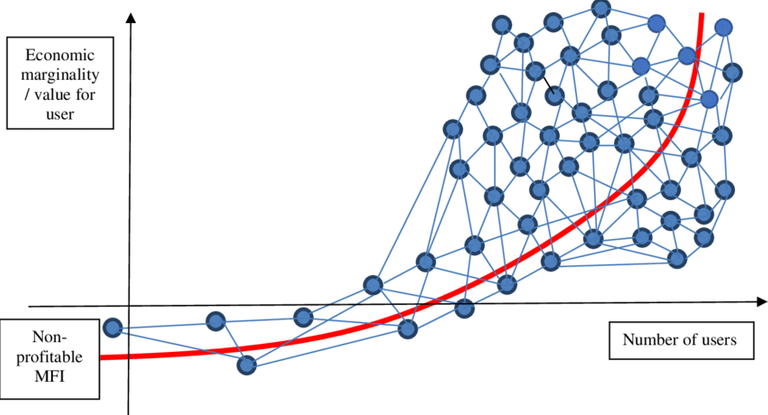

Metcalfe's Law is used to apply valuation. This was originally posed in the communications industry, stating that the value of the network grows in ration to each node joining. In other words, since each additional facsimile (what was originally studied) could interact with the others, the value was greater than just +1. It actually added value to every other machine.

This concept was applied to social media and digital networks. Research revealed it equally as applicable.

The basic essence is more is better.

It is something we have to keep in mind as we discuss blockchain and cryptocurrency.

Network Effects Tied To Blockchain

For us to envision the network effect applying to blockchain, it is not a difficult transition. After all, we know blockchain is technology.

Under this scenario, we will see an increase in value the more "nodes" tied to a blockchain.

Here we are not necessarily referring to computer nodes. A node is the equivalent of a user. This is where Facebook excels.

Of course, we have to keep in mind this can work in reverse. Each time someone shuts down their account and leaves a network, it has an impact greater than 1. This is what Reddit is facing.

Blockchain as a technology is fairly straightforward.

Network Effects And Currency

This situation changes completely when it comes to money. Or does it?

We presume this is something that is techy and not applicable to the world of finance. Actually, the opposite is true.

The U.S. dollar enjoys the greatest network effect of any currency in history. One of the reasons why calls for its demise are overblown is because of this. Network effects do not usually die overnight.

Most look at payments which is only one indicator of a currency. The network effect around the USD is much larger than that. When we look at all the USD denominated asset, including debt, we see how this is absolutely massive.

This is why, when it comes to a currency, liquidity, depth, sophistication and distribution are vital. While many believe there are too many dollars out there (due to the falsely held belief that central bank reserves are legal tender), the reverse is true. The world is suffering from a dollar shortage.

In other words, people do not have access to the network.

Reed's Law And Cryptocurrency

Cryptocurrency is digital. This means that, in addition to blockchain, it is also technology. Here we see a very interesting component inserted.

Without getting into the math, the difference with Reed's Law is that it factors other layers. This causes the numbers to operate on an even greater exponential basis.

Therefore, we have the network effect tied to the blockchain itself, then we have the currency, which is enhanced by the application and interoperability created with other networks.

The result is that currencies can have an exponential growth rate that far exceeds what we experienced historically. Each layer of integration has an outsized effect. A single application can enhance the value of a network significantly. This can actually generate more value for most other games on the network, showing a larger impact than is commonly seen.

It was one of the reasons why the Libra project by Facebook was so brilliant. This is also what scared the pants of most regulators and politicians. Once they saw the potential, even they figured out it was game over.

Without digital assets of this nature, the potential is to have more than 8 billion individual nodes. If we incorporate this concept into Reed's Law, we can get a glimpse of what we are dealing with.

This is why I repeatedly state that we are going to see quadrillions in this industry.

Decentralization Is Key

We often discuss decentralization as being key for our path forward. The reason tends to be security, freedom, and a host of other values. There is, however, another reason: network effect.

To truly realize the economic potential, cryptocurrency needs to be open. The challenge the banking system has is we see a closed system. This hinders the network effect. When dealing on a global scale, 8 billion people can set off Reed's Law to a much greater degree.

Few seem to realize the economic output being lost due to the present system. It is a number we cannot quantify since it is mind-blowing. We are likely talking hundreds of trillions of dollars.

Cryptocurrency (digital assets) can change this with decentralization. When you have the ability to take a blockchain like Hive, implement the building of applications, currencies, games, and then have more users, we can see how Reed's Law kicks off.

This is summarized by the collective articles written about Hive. Some focus upon the Hive Backed Dollar (HBD); other on communities. We have talk of games. Then we see the real world use cases.

All of these are valid. They are also layers in the mechanism. Utility can come in many forms. Even a glossary can provide value to the network.

The idea is all this can be accessed through one Hive account. That is a game changer. Consider what happens as different aspects of the ecosystem are built out.

Again, using these "laws" the impact is much greater than just one.

It is all exponential. And since monetary value is integrated throughout, we are looking at economic potential we never saw before.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Alpha