Why do we want to hold HIVE?

This is something that is an obvious question. It is also something that we do not discuss very often. What is ironic is the staking of Ethereum brought out all kinds of articles covering the benefits there. However, this is something that Hive operated with since the beginning.

In this article, we will discuss why someone will want to hold HIVE.

1. The Ability To Trade For Profit

Speculation is one of the use cases of HIVE, like most assets. Throughout the cryptocurrency world, this is the primary use case. Most enter looking to buy a coin or token and watch the green candles take over. Everyone gets excited when the bull market is in full swing. Of course, the opposite seems to be true when the bear emerges.

An increase in asset value is an important component of wealth building. Many attack speculation as something negative or wrong. It is not. This is a driver of markets providing incentive for people to part with their money. They seek a return greater than what they can receive elsewhere.

2. Yield

What got people excited about staking ETH was the fact that not only could people speculate on the price, they could earn yield while doing so. I believe they have a 1 year lock up period which essentially presents a one year money market curve.

HIVE does the same thing. We can power it up to earn a yield. This is known as Hive Power (HP) and increases the value of our holdings (in HIVE terms).

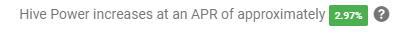

Here is what it looks like now.

We presently are paid just shy of 3% for holding HIVE as HP. This is a not much different from the 4%-5% that ETH staking pays. It might not sound like much, especially not that interest rates have shot up. However, keep in mind that over the last decade, fixed income products were usually paying around 1%.

3. Governance

Powering up Hive has a direct impact upon governance. This means that voting for block producers along with proposals is enhanced as one accumulates (and stakes) more HIVE.

One vital component is that individuals can earn HP through their rewards (more on that in a moment). This means that one has the potential to fill his or her wallet through activity. Most other chains require one to purchase the coin before being able to partake in any type of governance.

Ultimately, this serves as a distribution model that can place Hive in the hands of more people. Other chains are financial based in this regard. Hive incorporates social media activities as providing a path to increased input into governance.

4. Curation

The amount of HP one has directly impact the distribution of the reward pool. Each day, part of the inflation is allocated to content creators and those who support the content. The latter is known as curation.

When votes are placed, they carry a particular value based upon the amount of HP tied to it. The distribution of said amount is on a 50/50 basis between author and curator.

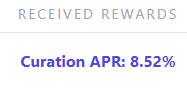

Curation means a great influence over the reward pool. It also enhances ones return.

As we can see, this yields 8.52% for this account used for the snapshot. If we add in the near 3% APR for just holding HP, we can see this comes in just shy of 11.5%.

5. The Ability To Interact With The Chain

Most blockchains operate under the premise of using transaction fees. Remember, they are designed based upon finance. Since Hive is based upon social media, direct transaction fees would not work. Instead, Hive engagement is possible by making an investment into the ecosystem.

What this means is acquiring HIVE and powering up. This provides a backend, non-tradeable token called Resource Credits (RC). As the amount of HP increases, there is a correlation to RC. This is how one is able ot engage with the chain.

Whereas holding ETH allows one to pay GAS fees on Ethereum, HP gives people the ability to write to the blockchain. The difference is the ETH, once the fee is paid, is gone. With Hive, the HP is still in the possession of the individual who had it.

6. The Ability To Create HBD

Hive has its own stablecoin. This is called the Hive Backed Dollar (HBD). One of the ways it is generated is through the conversion of HIVE. Here we see another important use case.

HBD is starting to spread its wings. The first use case is to place it in savings, earning a 20% APR. Here we can see how being able to convert HIVE is an advantage.

At the same time, we are watching payment systems starting to be centered around this coin. It is base layer meaning there is no counterparty risk (only the blockchain). The market cap of HIVE is what stands behind the stablecoin.

One important factor is how an increase in the utility of HBD has an impact upon the value of HIVE. Since this is the primary way to generate larges sums of HBD in a short period of time, if needed, we are going to have to see large conversion amounts. There were many times when the amount of HIVE actually decreased over a specific period of time in spite of the coin being inflationary.

Bonus: Future Use Case

One of the major use cases going forward will be digital assets used as collateral. This is no different for HIVE. It stands to reason that, at some point, a lending platform will be build whereby people can post their HIVE as collateral on a loan.

This ultimately could spread to a host of DeFi applications which require collateral.

In Conclusion

All of this can help to make HIVE attractive. It comes down to the ability to generate a passive return which is enhanced through activity as compared to earning nothing. At the same time, counterparty risk is minimized since all of this is taking place at the blockchain level. We saw the dangers of dealing with third parties such as FTX or Celsius.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Alpha