The bear market has been fierce. Our sleeping beauty came out of hibernation in a powerful way.

Over the last 6 months, we saw a grinding down of the cryptocurrency markets. This is coupled, recently, with the reversal in the equities. Bonds are also getting hammered providing people with little safe haven.

All the talk is on inflation. Now, the Fed is going to do all it can to stamp that out. Since they didn't cause it, they will now go after the economy. If the stock market is wiped out, that is of little concern to them.

The same holds true for cryptocurrency.

For those involved, the major question is when will the bear market end? This is tough to predict but it looks like this will last through 2022. With the Fed's actions, we are going to see a bad situation made worse.

In this article we are going to analyze what is taking place and forecast what the Fed might do.

Liquidity Crisis

As mentioned in a number of other articles, the global banking system was suffering from a liquidity crisis. There are not enough US Dollars in the economy due to the fact commercial banks have not been lending. At the same time, since the Great Financial Crisis, collateral was in short supply, tightening the entire banking system.

Of course, the Fed's Quantitative Easing program only made the collateral situation worse by pulling Treasury securities off the market. By swapping them for Reserves, they were no longer available. Plus, from an international banking perspective, Reserves are useless since they cannot be collateralized.

Reserves do provide some liquidity to the Repo market. This helps keep the overnight lending between the banks going. Now the Fed is starting Quantitative Tightening which is going to pull some of the Reserve liquidity out of the market.

Or are they?

While they are now talking about this, it appears the Fed started a while back.

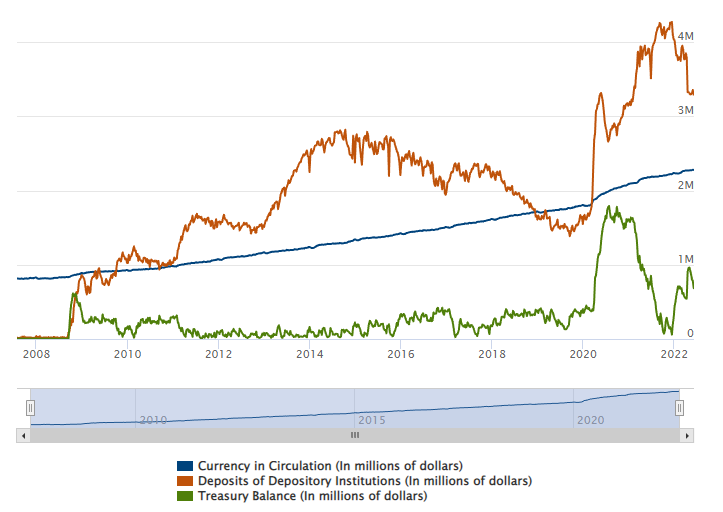

Notice the brown line, the bank deposits.

As we can see, there is a drop of almost $1 trillion since December. When we look at the Reserves, we see this accounts for a fair portion of it.

.png)

This saw a drop of $600 million in that time and Quantitative Tightening hasn't started yet.

Risk Off

Traders talk about Risk On/Risk Off. This is a risk off environment.

Over the last few months, we saw tech stocks like Tesla, Facebook, and Amazon get hit hard. These are high multiple growth stocks that do well when money is flowing. Naturally, if the opposite happens, they get killed.

When investors are moving to safety, assets like these get crushed. Contrary to the rhetoric, cryptocurrency is not a safe haven. It is a risk on/risk off asset category. That means when money gets tight, the markets will pullback.

Of late, we now have a lot more talk of a recession. This is only going to feed into the negative sentiment. The fear that people have is only going to grow as this is felt through the economy. Layoffs are likely to follow meaning households are going to be further affected.

None of this bodes well for cryptocurrency.

Inflation

All eyes are on inflation.

This is a problem because we are dealing with a situation that has multiple factors, few which have to do with the Fed. Nevertheless, the political pressure is now on the Fed to do something about this. As stated, they will hammer the economy in an effort to reduce demand.

Wars. Lockdowns. Supply chain shortages.

All of these are the reason for 40 year prints in the CPI. We also have a massive bull run in commodities which is not helping matters.

This is why we see persistence with prices. Since this is the Fed's focus, we are not going to see a change in policy until this is under control.

Unfortunately, that means removing whatever liquidity is out there. We are going to have to wait for another recession to take place so that we can see the stimulus start rolling out.

Gear Up For 2023

Cryptocurrency is going to take off and moon. This is for certain.

We are going to see the Fed reverse their policy. The multi-trillion dollar question is when?

It is safe to say they will hold this path until it is too late. There is little chance of a "soft" landing. We know a rate increase is coming in this Fed Meeting. It is likely we get one in the next. Looking out towards September, it could get questionable.

The Fed tends to foreshadow things. Thus, we have to build in 3-4 months before any change in policy actually takes effect.

For example, the Fed talked about raising rates back in December, yet did not move until March. We can expect the same thing on the reverse.

If the Fed stops raising sometime in the Fall, we could see them switch as we enter 2023. When the easing starts again, we will see the risk on trade go into overdrive.

This will set cryptocurrency on fire. At that time, we could see some of the six-figure price claims for Bitcoin coming true. In the meantime, we might be in for more pain.

The Fed's preference is to have the equity market grind down. That said, all of this could be accelerated if we see a major crash in a short period of time. It is easy to see how 3200 on the S&P is on tap. However, we could also see 2500 on the table at some point.

A market crash will get the Fed's attention. Consistently moving lower only reaffirms their actions (at least to them).

Therefore, it is vital to monitor the pace as well as the direction of things. Since all eyes are on the Fed, that gives them a lot of power.

It is time to dance very lightly.

Fixed Income Market

One final point that might help in terms of what to watch.

Typically, the fixed income market recovers before equities. The move to risk is first realized by entering there. So keep an eye on that.

Once that market starts to recover, then we can expect investors/traders to have a larger appetite for risk. That means equities and cryptocurrency will follow.

Remember, this is a game of expectations and the Fed is the major mouthpiece in this area. Following its playbook can offer insight into what is going to happen.

After all, they do not keep it a secret.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta