The global payment market is enormous. It is estimated to be $2 quadrillion. This is roughly 20 times the amount of goods and services produced by the world economy.

It is why there are so many big players interested in the market. With that type of volume, even getting a small slice can result in some big numbers.

To achieve this end, a vast array of computer networks were set up, all designed to move data around at very high speeds. In this instance, the data reflects currency.

Cryptocurrency had its eyes set on this market from the start. The idea of making payments using a digital wallet is nothing new. In fact, that is the entire premise behind PayPal. However, crypto tied to a public blockchain adds in the element of decentralization. This removes counterparties from the equation.

In this instance, they can also be called rent seekers.

Stablecoins Are The First Major Use Case For Crypto

The early Bitcoin adopters believed this would serve as the replacement for the US Dollar and offer the world a decentralized medium of exchange.

There are a couple problems with this outlook.

First, stability is required if something is going to be a successful medium of exchange. Bitcoin does not quality. It is highly volatile, something that will always be present due to its fixed nature.

The other is the fact the network is inefficient. When looking at processing trillions of transactions, this is a problem.

Bitcoin provided the world with decentralized consensus, something it had not seen before in the digital realm, at least when it came to money. The problem is the inefficiency of the network.

This solution is to move the payment layer off the base, to a secondary network. It is the idea behind the Lightning Network. The challenge here is the lack of incentivization for the node operators. This ultimately will force other forms of monetization, adding the counterparty right back in.

Fortunately, we do see the potential of stablecoins. Diving into this could be a series of articles on its own. For nOW, the main point is these tokens use a peg, mostly to the USD, to achieve price stability.

Here is where we see cryptocurrency offering up a valid medium of exchange.

Ethereum Leading The Way

When we look at the stablecoin market, it all starts with Ethereum. This has the most coins on it, hence is still the leader.

That said, it is not the only game in town and, the numbers we will discuss are likely vastly underestimated at this point.

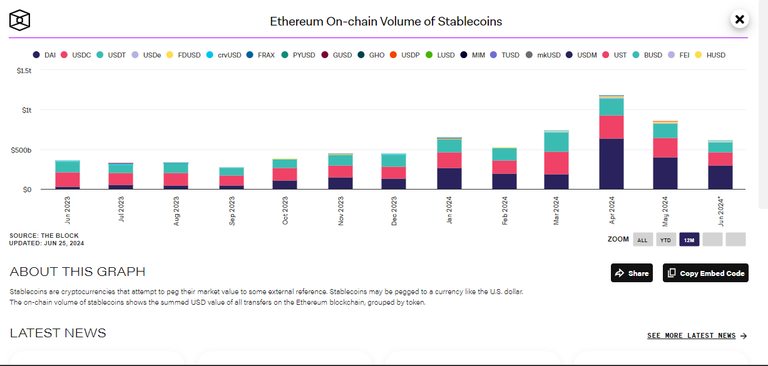

Nevertheless, here is a chart of the stablecoin volume on that blockchain. Keep in mind this is Ethereum only.

As we can see the trend if heading up. We saw a big jump in April, followed by a couple months of decline. That said, June will likely end up as the 3rd or 4th largest month ever, all achieved since March of this year.

If we look back to the end of Summer and Fall of 2023, we see a significant increase.

Why is this a positive outlook?

The main utility of stablecoins is payments. That is what they are most designed for. They are not speculative assets since they focus upon stability. In this case, volatility is the enemy.

Collective Growth

Ethereum is just one player in this emerging field. Most networks are finding they are able to incorporate stablecoins in some form.

This starts with the EVMs, which are forks of the Ethereum chain. Leading the way in payments here is TRON, which had $1.2 trillion in volume in the 4th quarter. That is an average of $400 billion per month. This significantly adds to the totals on Ethereum.

Wikipedia image

One of the keys going forward will be the power distribution curve, also know as the long tail theory.

The basic idea is that, in the digital realm, while there are a few dominant players, the totality of activity is enhanced by all the entire curve. Due to low costs, a handful of transactions, in this instance, are possible.

Basically, we are looking at the potential of hundreds of different stablecoins, all garnering market share. While most will have very low volume, it will have an impact.

This is an important feature since smaller networks could easily double their volume. When this happens in many instances, the total effect is felt. Of course, it is magnified is some do a 10x or 20x their present volume, say over the course of a year.

It is the type of growth the present system is not going to see.

Ultimately, this boils down to the network effects.

With crypto, there are a number of components. For the stablecoins, as each of these areas expands, the total impact is multiplied. Some of them are:

- the number of stablecoins

- number of wallets

- number of merchants/vendors/websites accepting them

- the number of goods or services that can be purchased

Each of these can grow in its own way. We can see the feedback loop derived from the fact that as more merchants accept the stablecoin, this incentivizes more users. At the same time, merchants are motivated to accept this as a means of payment if more of their customers are users of the network.

Of course, the growth of the entire crypto market, and people turning to it in general is also a wave that will aid stablecoin adoption.

This is not a trend that is going to be stopped.

Posted Using InLeo Alpha