Many question if the Hive blockchain paying a 20% interest rate on Hive Backed Dollars (HBD) placed into savings is sustainable. There are some who feel this is not possible.

In this article we will take a look at the mathematics of it and see how it compares to other currencies. Ultimately, sustainability comes from the building of economic productivity, ie the economy, surrounding the currencies.

With the "Get Rich Quick" mindset that is so common in cryptocurrency, we see how this is lacking. Nevertheless, through development, Hive is starting to have the foundation in place for sustained growth.

Here is where we can see HBD as being an important piece in this economic engine.

Before going into the discussion, there are a few key presumptions made that have to be detailed:

- All free HBD outside the DAO is in savings, earning 20%

- The only HBD creation is from interest, no conversion or post payouts

As we will see, these actually counter each other.

Source

HBD Starting Point

It is first important to see where we are. Thus, how much HBD is available for savings?

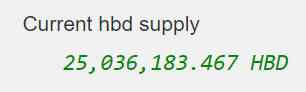

Look at Hiveblocks, the total currenct HBD supply looks like this:

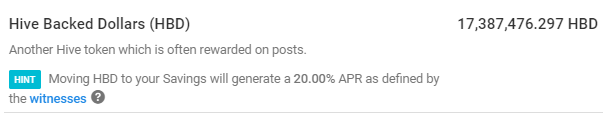

From that we deduct the HBD that is in the Decentralized Hive Fund (DHF).

Source

From here we can do some simply subtraction and we see the circulating supply of HBD is 7.648 million.

This is the number we will use.

HBD In 50 Years

Again, going back to our presumptions, what will the circulating supply of HBD look like in 50 years? That ought to be enough time for sustainability.

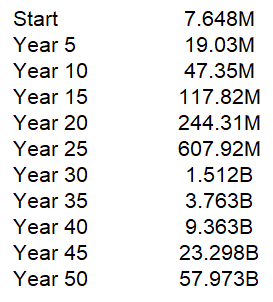

Here is where we simply compound out at 20% annually.

The totals look like this:

Thus, by 2072, going by this model, we will see the HBD supply grow to 57.9 billion.

That certainly is a big number. Or is it?

50 Billion In Comparison

How does this compare to other stablecoins we see on the market?

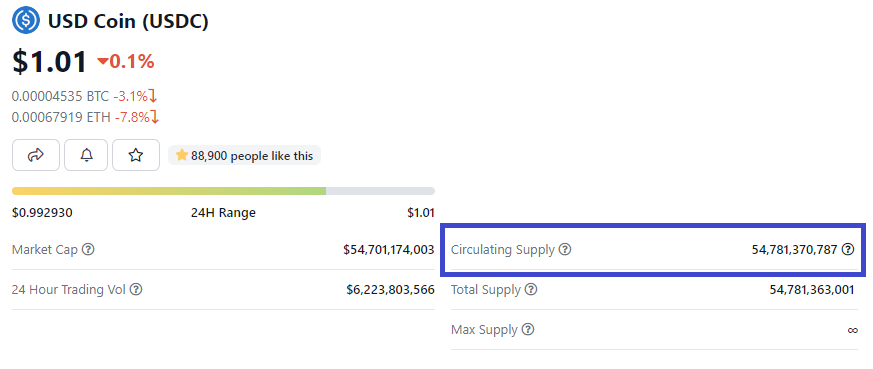

It is interesting to see this from Coingecko:

The present supply of USDC is 54 billion, near the number of HBD in 50 years.

For what it is worth, Tether's supply is listed at 65 billion.

As this shows, in the stablecoin world, 58 billion in half a century is going to be a drop in the bucket. Using the formula in this article, it will take 30 years for the supply to hit 1 billion.

By the way, as an aside, to bring things into real world currency, how would 58 billion HBD compare with some fiat currencies?

The two closest national currencies are:

That would put HBD in the same category as the Rufiyaa and Cordoba. Not exactly household currencies.

It's Economy Stupid

If an expanding money supply was enough to make a country wealthy, then we would see a lot of evidence of nation's printing their way to prosperity. Unfortunately for the citizens of these countries, we see this is not the case.

Currency is dependent upon utility. How is it factoring into economic production? What commercial and financial activities are built around the currency?

Obviously a lot can change over 50 years. In the realm of the Internet, a major paradigm shift can occur in less than a decade.

It is also difficult to compare companies and economies. However, if we think of Hive as a decentralized network-state, we can get an idea of the potential.

The two nations we looked at, Maldives and Nicaragua, have estimated GDPs of $5B and $15B, respectively. To contrast the power of the digital world, Facebook has annual revenues of over $100 billion.

Which brings up to the multi-billion dollar questions:

- How much is a decentralized database with immutable data worth?

- How valuable is a ledger built on distributed ledger technology and not controlled by banks?

- Is it imperative to have a digital asset that can serve as a medium of exchange that is outside the reach of both governments and central banks?

- Is an account management system that provides sovereignty to each individual as the precursor to Digital IDs important?

And most importantly, what applications and use cases are developed around these attributes to provide utility to not only the users, but HBD also?

From this will stem payment systems, investment opportunities, collateralization for lending, and derivative creation. All of this would provide greater depth and sophistication to HBD and the activity on Hive.

The Hive blockchain allows for transactions to occur in a permissionless manner. The only contingency is whether the user has enough Resource Credits or not. If that is attained, anyone can write to the blockchain.

This is something businesses can build on. There is no threat of their enterprise being shut down because the terms of service of some major technology company was used as an excuse to close an account.

All of this is leading into the value of Hive. Ultimately, with use cases and utility, the coins at the base layer will reflect that value.

For a thriving and expanding economy, there needs to be enough currency in circulation. As these numbers show, we have a lot of room for growth in HBD if the development continues.

What are your thoughts regarding the Hive economy and HBD?

Let us know in the comment section below.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta