Over the past few weeks we discussed the Hive Backed Dollar (HBD). This was instigated by the article proposing the idea of Hive Bonds. Here we have a concept whereby we can develop, at the base layer, a fixed income system that starts with a basic bond tree.

Since this is tied to blockchain, the transparency could set this up to be pristine collateral. Reducing the risk associated with collateralization always elevates that asset for this purpose. The world is in desperate need of high quality collateral. It is a problem that cryptocurrency can fill.

Another benefit of the Hive Bond idea is to strengthen the HBD. As a stablecoin, the token is still lacking. That is understandable since it was overlooked for so long. Now we are seeing focus placed upon it and Hive Bonds can help in a big way.

The benefits are:

- Locking up HBD for long periods of time

- Creating an astronomical amount of HBD

Many scoff at this notion believing that there is a major risk.

Let us look at what is taking place in the cryptocurrency world.

UST Reaches $10 Billion

UST is the stablecoin that is built on LUNA. This is a very interesting project since it uses a similar concept to what Hive does. The relationship between HIVE-HBD is something that should be focused upon. We now see this concept in action.

What is important to note is that UST is an algorithmic stablecoin that is not backed by USD. Like HBD, the tied to USD is only as a unit of measure. There are no Dollars involved in the process. Instead, it is tied to the base token.

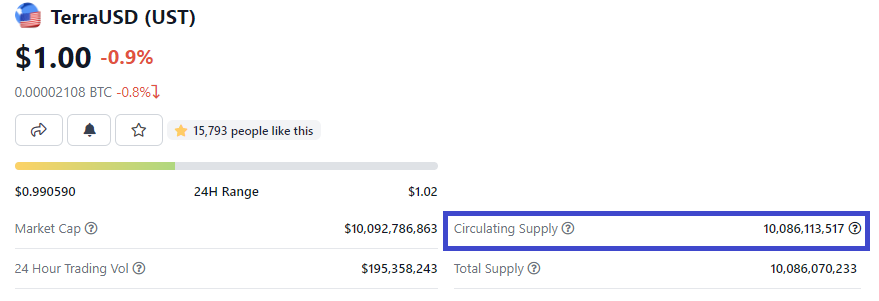

Here is what the situation with UST looks like right now according to Coingecko:

Notice how it just reached 10 billion UST in circulation. Read that again: 10 billion. Where have we heard that before?

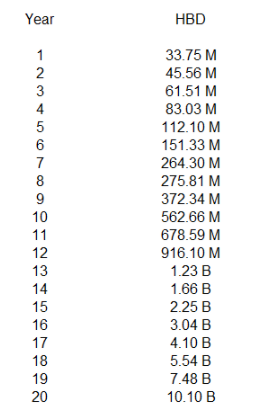

In the article How Much HBD Will Be Produced, we charted the path to 10 billion HBD. As the chart shows, it will take up to 20 years using the Hive Bond idea presuming all present tokens are put into the 30 year category.

To be a serious stablecoin, there needs to be billions of tokens available. This is something that many seem to overlook. One of the worst fates is a liquidity crisis. When there is not enough money to engage in the level of commercial activity an economy requires, it contracts harshly.

Here is a short video about how Terra works

In short, each UST is created by swapping LUNA. Sound familiar? As the need for UST grows, LUNA is swapped to create more of it. This is exactly how HBD can work.

While this sounds great for the value of the base token, with Hive there is an issue. We could well be creating a liquidity crisis in that token. As have to keep in mind that HIVE also applies to account creation and Resource Credits. Splinterlands already showed how much HIVE can get eaten up if there are a lot of accounts created. All of this is based upon HIVE, not the value in USD.

Thus, Hive Bonds is a way to solve this problem. We can generate a lot of HBD, which will help grow the Hive economy while protecting the circulation of HIVE. The latter can then be used for other purposes such as the two functions just mention, something that is likely to take place in 2022.

The First Pillar Going Into Place

Did everyone see the article about Ragnarok? It appears from the reactions many are very excited about this game.

There are a few major points that need to be considered. From the overview, it looks like this could rival Splinterlands in terms of the growth and popularity. There is a uniqueness to the game, especially in blockchain gaming. With some targeted marketing, it could end up bringing a large number of new users to Hive.

The other piece that is vital is this game will utilize HBD as the purchasing token. Here we see the first major use case potentially developing. Like the concept of Hive Bonds, the idea is to lock up the HBD for long-term income generation.

From the article we see this:

HBD Sink, all HBD for in-game items is put into a SIP v1 where interest is paid out to players perpetually

The different components of the game are going to require players to utilize HBD. This is going to be locked away in a SIP. Since we are unsure what that means at this time, we will presume that it is tied to the base layer savings project that is currently paying out at 12%.

Of course, if the game does become very popular with an expanding economy, where is all that HBD going to come from? Many will feel that HIVE conversion would be a good thing but that harkens the question of how are we going to create millions of accounts when necessary? Naturally, we also need to be mindful of Resource Credits since those are essentially created by HIVE moved into Hive Power.

A lot of this seems far-fetched at the moment. However, it is always best to plan for something before it is needed. This is akin to scaling. Many blockchains focused on areas other than scaling, an issue that is becoming serious as the traffic gets clogged up. On Hive, the core development team spend time scaling the blockchain, long before it was needed.

HBD is no different. We need to ensure there is enough available to allow for the pace of organic growth that occurs. At this moment, things seem slow yet Splinterlands did show how quickly things could change. Does Ragnarok doing something similar? If it does, we best be prepared.

The Chicken Or The Egg?

Here we see the dilemma we are facing. It is hard for most to envision a rapid expansion of HBD while things are slow. For this to be achieved, we obviously need use cases. That comes from having a sufficient amount of the token available so that projects will utilize it. Once again, for that to happen, there need to be use cases.

Unfortunately, while this block continues, advancement will be slow. As the Terra project shows, those who aggressively go after things can quickly position themselves. Stablecoins are coming under attack from regulators so algorithmic driven tokens are likely to become popular. HBD is an excellent opportunity for this.

To achieve this end, we need to address some of the shortcomings of the token. At the present moment, the failure to hold the peg is an issue. Part of this stems from the lack of liquidity since so few tokens are available. Also, the fact that it is not spread widely on exchanges creates an issue.

Once again, the chicken or the egg?

The bottom line is that we are going to need a great deal more HBD going forward. Failure to provide it will stifle the economic growth of projects.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta