The CEX versus DEX argument is getting much bigger. This is taking on even greater meaning with each passing day. As the CEX fall under the control of governments, it is vital that coins and tokens have alternatives.

If we are being honest, people like CZ have way too much power. The centralized exchanges are really no different than bankers. They are just another form of gatekeeping. Instead of having Banks of America or Barclays, we have Coinbase and Binance.

They control the on and off ramp.

While bridging to fiat currency might be difficult, there is no reason for these entities to dominate the crypto-to-crypt transactions. Since we can see more transactions occurring in this manner, the idea of liquidity pools and DEX should be expanding.

In short, this is where the action should be taking place.

Hive At The Mercy Of Two Exchanges

Where can you get HIVE? What about HBD?

For years we heard how it is vital to get HIVE on the exchanges. At present, we basically are looking at Upbit, which is only open to Koreans and Binance. When it comes to HBD, the options are even more limited. We would be remiss if we didn't mention Bittrex yet those wallets are shut down much of the time.

It is also worth noting that CZ appears to be on good terms with Justin Sun. There is obviously no love lost with Sun and Hive.

We also know it is rather common for exchanges to simply go through and axe a bunch of tokens. This makes sense from their business perspective. If there is almost no volume on them, it is more effort to support a coin or token than it is worth. Nevertheless, this does exemplify the power these exchanges hold.

For this reason, the future of Hive-based coins should be in the decentralized finance world. Why even try to fight with the system that we are trying to unseat? The discussion often centers around decentralization. This should include the way the coins are acquired.

What If Binance Dropped HIVE?

Have you considered how things would look if HIVE was suddenly dumped by Binance? That could happen without warning. We could get an announcement that it was being delisted. What would people do?

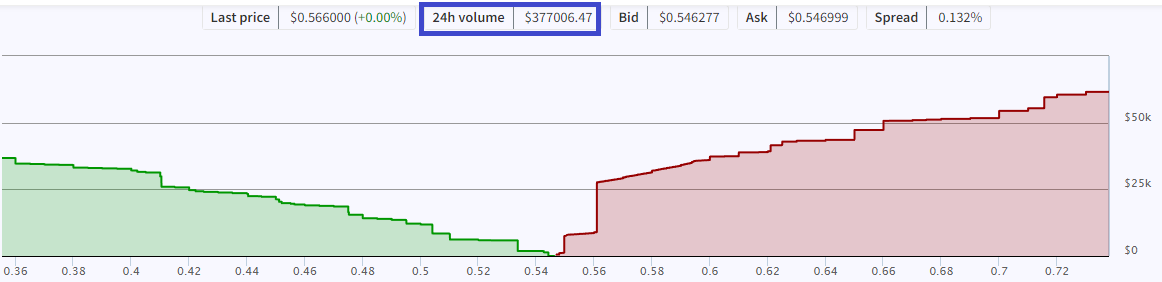

A major piece of the puzzle when it comes to exchanges, assets, and trades is liquidity. Without that, the appeal of what is being sought diminishes. When there is a premium paid to acquire something due to a lack of liquidity, that can be frustrating. The bid-asked starts to widen, causing people to pay more.

Hive does have a built-in option. the internal exchange. This is one of the more popular ways to swap HIVE-HBD. As we can see, there is a 24 hour volume of over $375,000. This is healthy volume, especially for an internal exchange that only caters to the captive audience.

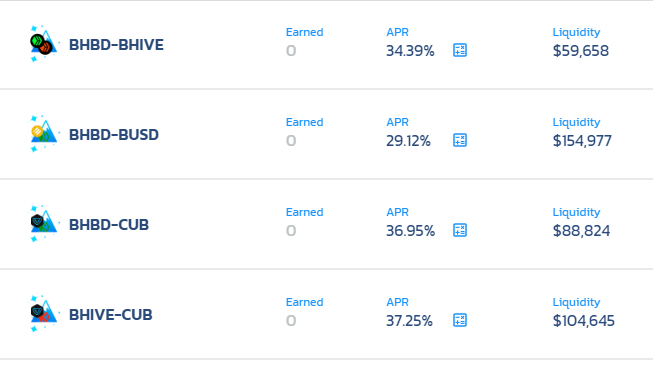

Then we have Cubfinance which has 4 liquidity pools on Binance Smart Chain. It has roughly $400K in liquidity. This is a drop in the bucket when it comes to the world of decentralized finance.

There is also another couple hundred thousands over on Polycub.

Finally, we can add in Blocktrades which supports both HIVE and HBD. There is some liquidity there too which is added to the pile.

Swapping For Popular Coins

A great deal of focus is upon building infrastructure. For the moment, what we are discussing has to be built out. Leofinance did a good job getting some pools set up. But more are required.

When we look at the major coins, how many can be swapped directly for either HIVE or HBD? Do we see a path to Bitcoin (the wrapped versions)? Ethereum? Litecoin? Tether?

Certainly, having a wrapped version of the Hive coins on Polygon and BSC give us access to different versions of these tokens. However, it is still going through a couple different steps, even if on the back end.

Ease of use is going to be a key factor going forward. The industry is going to have to really make it a lot easier for people to utilize the different applications. One of the advantages that centralized exchanges have is they are fairly logical to use. If one did any trading for stocks or bonds on exchanges, you can use a Binance or Coinbase. The same is true for the internal exchange which is very intuitive.

Once we get into Metamask, Pancakeswap, and contracts, it can get confusing for the average person. Alas, this is the point we are at.

Last week I brought up the idea of the Hive Central Fund. This article laid the foundation for a decentralized system built on top of Hive.

One of the ideas that follows this is to tied an expansive DEX system to it where different coins and tokens are paired with a derivative of HBD. Over time, this would allow for the deepening of these pools tied to this system. As long as we have one lode with deep and accessible coins, then we are insulated from the actions of the major CEX.

This would not only help to feed into Hive's popularity but also would grow along with Hive.

In other words, we simply build the infrastructure ourselves. Through the Hive Central Fund, it would feed back to the holders of Hive Power. We also start to integrate other tokens in there such as synthetic assets. As we can imagine, each layer only adds to the utility of HBD but also pushes value back to the Hive ecosystem.

There are many facets to Hive. We have a lot of directions to focus attention on. This makes the overall results appear slower since progress is incremental in each area. However, when we total it up, over time, there are more areas where things can explode.

While the social media aspect of Hive is vital, we cannot overlook the monetary and financial component. With the industry going how it is, we have to focus upon ensuring that our coins are available to those who want them.

This is going to require a great deal of effort in this area but it will bode well for all of us in the future.

Liquidity pools are a starting point. We also need to have the DEX activity increasing. It is the future in my opinion.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta