Just the mention of it elicits mixed reactions from those involved in cryptocurrency. Web 3.0 promises to be an upgrade over the old system. What, however, does this mean?

To get to the bottom of this, we have to look at what Web 2.0 really is. In retail terms, it could be considered nothing more than a bait-and-switch.

Are you unfamiliar with this phrase?

Basically, this is a tactic long used by retail operations. The idea is to get you into the store under one premise while switching things up to get you to leave with another. In this instance, premise equals product.

A company will advertise a particular item. This will get you to visit the location. Once there, a couple of methods can be employed. One course of action could be they are sold out. The marketing took place with scarcity. Of course, since you made the trip, and need the item, they do have a selection of other options, for more money. The wonderful deal that was promoted suddenly turns into a more expensive proposition.

Another approach is to use a salesperson to steer one away from the item. The marketing brings in a qualified buyer. Here is someone with the need and means, two criteria when sizing up a prospect, to get the item.

Under this scenario, the salesperson will offer all kinds of reasons why the advertised item should not be purchased. Instead, the more costly option will be pushed, arriving at the same conclusion.

Web 2.0: The Epitome of the Bait and Switch

The situation described above describes Web 2.0, especially social media platforms.

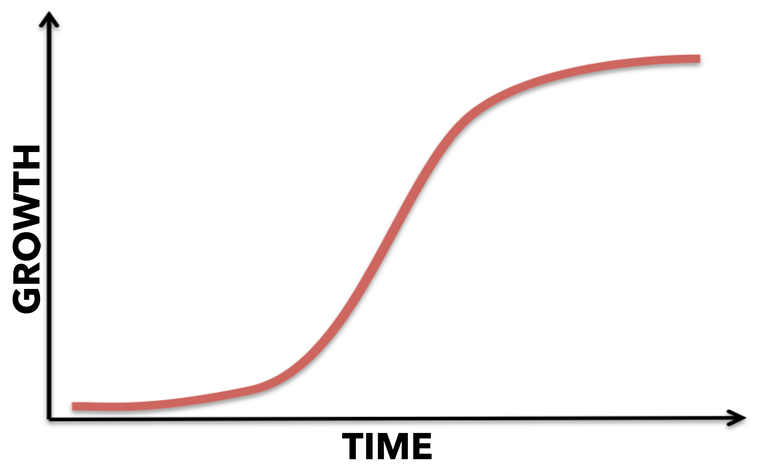

When the application is in the early stages of the S Curve, as depicted by the image above, it is welcoming and accommodating. The pretense put forth is our platform is free to use and we are here to offer a quality user experience.

Of course, during this period, the userbase is growing. Individuals find the application offers ease of use along with an enjoyable experience. Over time, more features are added, enhancing the impact upon the user.

Inevitably, growth slows. Here is where problems arise. The premise that was originally utilized to draw in users no longer applies.

Suddenly, the interests in the stakeholders diverges.

The founders along with venture capital people are still looking for growth. Monetization becomes paramount since the money players want to get paid. On the other side, the users simply want to continue their experience, with more being added to the platform.

Since growth is slowing, the networks turn to extraction as their model. Historically, this was done with advertising and data mining.

Neither of these is inherently negative. The challenge is that it does not mix with the initial premise. Also, the users do not benefit from this, at least not overly.

Stakeholders interests are no longer aligned. Web 2.0 platforms always reach this point. It is inherent in their business model.

Web 3.0: Tokenization Solves This

The power of Web 3.0 is the alignment of the stakeholders.

Tokenization instantly puts everyone on the same page. By having financial stake, all holders have the same interest. At no point is there a divergence.

What is that interest?

Simply, it all boils down to the growth of the network. All participants who are holding the token have this goal. Naturally, this can take on many different forms, from simply more users to greater profitability.

Whatever the focus, continued network growth is baseline from which all operate. With Web 2.0, there comes a point where it is only the money players who care about that.

Take Facebook.

At this time, there are a couple billion users on that platform. Do any of the users care if another 5,000 people sign up? That will not impact them in the slightest. Nor do they care if the platforms generate another 5% in ad revenue. These people are not sharing in it.

They might, although not likely, care about the company extracting their data and selling it to anyone with a few bucks.

Ultimately, the Web 2.0 business model necessitates figuring out ways to extract more value from the network. Again, this is not a bad thing until we look at who is benefitting. When it is a Facebook, Google, or X, the owners are the ones profiting. This means the shareholders for each company.

Notice how it does not say users.

With Web 2.0, for the most part, they are two distinct groups. Web 3.0 solves this by potentially making them one. The users have financial stake in the system, hence have the incentive to ensure its long term growth. A lot of the tactics employed, especially by social media, are tolerable if the users are also the ones benefitting.

With Web 3.0, they can.

The S Curve is employed to show how things unfold. When the point is reached where things flatten out, the stakeholders can innovation and come up with ways to keep the network growing. After all, unlike Web 2.0, they do have a vested interest.

Posted Using InLeo Alpha