This is the final article in our three part series. The first two can be found:

Throughout this series we covered the idea of building an economy around the Hive Backed Dollar (HBD) and what that would entail. This dove into a few major points:

- an economy is fueled by the money that is available

- increasing the money supply will increase economic productivity as long as the country has the resources available to do so

- currencies other than USD and EUR are basically national currencies, with these making up the majority of reserves and transactions

- The Hive Backed Dollar(HBD) is global in nature

- Tether has a supply of 80 billion and is basically a parking spot for money when risk is removed

- what the economic building blocks are relating to a currency

- HBD requires staked $HIVE for transactions

- CBDC are targeting cash users while HBD provides access to a USD denominated asset in digital form that can operate as a medium of exchange

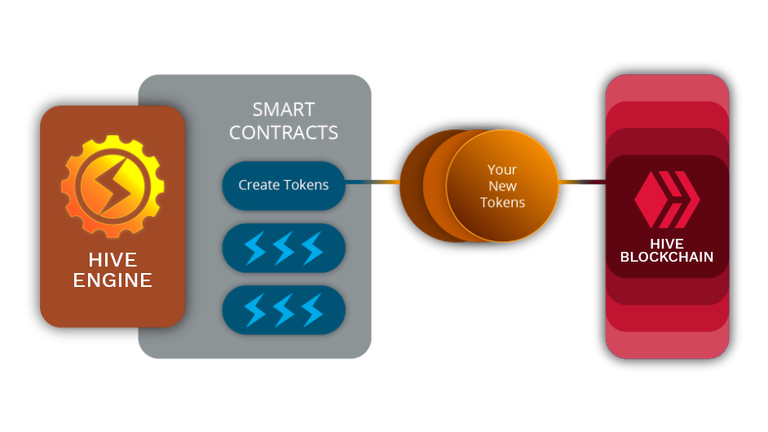

All of this serves as a foundation for building the Hive economy around HBD. There is one thing missing: smart contracts.

Smart Contract Platform

Hive is limited by the fact that it does not have smart contract capabilities available for all projects to access. Developers are forced to create work around or integrate multi-chain approaches, utilizing what is available on the EVMs (mostly).

For the last couple years, we discussed the idea of changing this. There were a number of projects that mentioned the willingness to take this on. It is likely that we see a couple smart contract platforms roll out over the next year. Blocktrades mentioned they are designing one.

Now, we have an announcement of one that is starting to emerge.

Here is what was said about it:

VSC is a highly advanced scalable L2 smart contract system utilizing HIVE as the base layer for settlement. It will provide developers with a sophisticated interface for their DApp while providing users with a zero fee experience. All operating via a shared smart contract layer across DApps.

This contains a host of nuggets. While smart contracts could be used for just about anything, we will focus upon on area: decentralized finance (DeFi). This appears to be bringing advanced DeFi capabilities to Hive.

Settlement On Hive

The first thing that stands out is that Hive is the base layer for settlement. Since there are zero transaction fees, this can be done without charge. Compare that with what takes place on Ethereum, especially during times of high usage.

What do you think the appeal will be to developers to have smart contract capability while offering zero transaction fees to their users. Outside of DeFi, who are accustomed to fees, this does allow for the contract to be integrated into gaming. For the DeFi applications, it stands out against the EVMs.

The second thing that strikes me about this announcement is the settlement itself. What do you think will be used to do that? It is happening on the base layer of Hive. Any guess?

How about the Hive Backed Dollar? The network has its own stablecoin that is pegs to $1 worth of $HIVE. Suddenly, we have Hive being framed as a settlement system.

One Block Irreversibility

Remember this feature being implemented in the last hard fork?

We covered this is great detail. At the time we mentioned how it made Hive the fastest settlement system in blockchain (perhaps in the world). The average settlement time is 1.6 seconds.

That means a transaction is not only completed in under 3 seconds but it is totally settled. There is no reversing the transaction nor waiting days for it to go through. We see this with payments using HBD on the base layer. When one pays a merchant using HBD, the money is sent from one wallet to the other. By the time the merchant looks to see if it completed, the blocks are completely locked. Unlike Visa where the money can be taken away, along with being charged fees, with HBD it is done.

VSC is going to bring this to the world of smart contracts.

Let us use a lending application as an example. One could build this utilizing the smart contract layer from VSC. This could be a system where one puts form of collateral into the contract and receives a loan. The terms will be coded in perhaps mirroring that of a traditional loan.

Payment is made in some type of stablecoin, potentially a derivative of HBD. This money can be used to buy a home, car, or other digital assets. We effectively bring lending to Hive.

The settlement in this instance might only be a custom JSON posted to the chain since the transaction takes place on the other layer. However, if this could be designed to pay out in HBD.

Either way, anything constructed that is tied into Hive will settle pretty much in one block. This opens up enormous possibilities.

Transaction Layer

Here is where things can get very interesting. What does it look like if Hive is the transaction layer for other cryptocurrencies.

Consider what is happening with Bitcoin. The blockchain itself is becoming a settlement system due to the lack of scaling and the cost. Lightning Network is being developed as the solution for transfer. This is removing it from the base layer.

A smart contract could house the Bitcoin. This would then utilize Hive as the transfer of value, eliminating the need to interact with the main chain until settlement.

This could effectively be done with any coin that is out there. It creates some very intriguing possibilities regarding the integration of Hive into many different aspects of cryptocurrency.

Economy Building Tools

When it comes to a currency, we covered the major components:

- payment

- collateral

- funding and investing

- derivatives

Much of this was covered in an idea we explored in the past, the Hive Financial Network. This was designed with the idea of a smart contract platform showing up on Hive.

From the list, payments can already be handled at the base layer. The other three, whoever, are better solved using smart contracts. This opens up the potential for HBD in savings being complimented by Hive Bonds, thus creating a class of collateral that is transparent, can expand greatly, and is immutable.

Hopefully this is starting to bring some of the potential forward.

How Much HBD Is Required?

Getting back to the onset of this series, how sustainable is the expansion of HBD? We already mapped out how long it will take, using the interest mechanism only, to reach Tether. As we can see, there are things in the works that take HBD to another level.

A currency is incorporated into commerce and finance. Both are required. That said, payments tend to be much smaller in number as compared to finance. As an example, the GDP of the US is roughly $23 trillion. In comparison, there are $12 trillion in foreign exchange derivatives outstanding. This is an asset that is nothing more than a hedge against currency fluctuation and there are $12 trillion of them.

As we went through these articles, the idea is to convey the many different areas where HBD is seeing some incorporation. There are many directions being pursued simultaneously, the nature of a decentralized system.

If we see even a portion of this built out, we are going to require a couple hundred billion HBD to satisfy the demand. Consider the fact that a DEX could be built on VSC with HBD as the pair for all other tokens created.

The situation is that, as more is developed, we can see the need for HBD growing. It is central part of the Hive economy. Residing at the base layer means that layer 2 tokens on VSC are effectively built upon this.

So, as we stated in the past: we are going to require a lot more HBD.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta