We discussed the Hive Backed Dollar (HBD) quite frequently and for good reason. There is a lot to this, a new currency that is very powerful.

Whether it was through great foresight or simple luck, we have one of the more powerful currencies there is within cryptocurrency. This stablecoin has a great deal of potential due to the structure. It also is a blending of the present form with something more advanced.

HBD is a liquid, tradeable asset. That means it can act as money providing the ability to operate as a medium of exchange. This is nothing new, a point we covered on a number of occasions.

The question is, what is HBD really? Most simply point to the idea that it is debt, which is true. If there was a Hive balance sheet, HBD would show up as a liability for the ecosystem. Of course, that is offset by the assets listed in each wallet. Thus, from an accounting perspective, it is a wash.

This does not, however, explain what HBD is and how it is structured.

For that reason, we will look at it in greater detail.

Debt As Money

We moved far beyond the world of money and currency from a century ago. Many feel, for example, that fiat currency is bits of paper that we move back and forth. This is not the case. As most are aware, the percentage of any fiat currency that is in banknotes is minimal compared to the whole. Most currencies are in digital form.

The banking system created an assortment of financial instruments that it uses as money. This goes back decades. The ability to establish these assets in electronic (now digital) form and trade them means it served the role. Banks used this for all kinds of different purposes. To list some:

- lending

- collateralization

- remittance

- cross border payments

- settlements

- swaps

It can use anything from US Treasury bonds to interest rate swaps to LIBOR future contracts. Ledgers allow this to happen.

Blockchain is distributed ledger technology. In other words, it is a ledger that is not controlled by any related group of individuals. This is far different from the present system.

Hive offers the ledger capability on both HBD and $HIVE. This provides a decentralized monetary system that offers out the ability to transact without any counterparty risk. It is a permissionless, trusted system.

Thus, the blockchain is taking over many different roles. What is created as per the coding provides a different result as compared to monetary policy (fiscal also) undertaken by our present institutions.

This includes a different reworking of debt as money.

What The Hive Backed Dollar Really Is

When we look at HBD, many just say it is debt that is could pose a threat to the blockchain. On the surface, this looks to be the case. Some would simply call it "money printing", something that is so overused it totally lost its meaning, especially since it is usually misapplied.

Hive Backed Dollars are not created out of thin air. They are fully accounted for with the balance sheet, based upon rules that are designed to strengthen the ecosystem while reducing the risk associated with monetary elasticity.

So what is HBD?

To frame it properly, we have to understand that it is actually a collateralized loan. When the blockchain creates more HBD, it is backed. Hence, it can be viewed as collateralized. The currency appears on the Hive's balance sheet, the same way as any debt does.

This does go one step further. Since there is the haircut rule in place, we can say that HBD is a collateralized loan with a 30% loan-to-value. Since HBD creation ceases once the market cap of HBD reaches 30% of $HIVE, we are effectively dealing with a LtV ratio.

HBD Backed By $HIVE

By now, the majority of us are aware that HBD can be converted to $1 worth of $HIVE. This is not a reserve pool, hence we are dealing with an algorithmic stablecoin. It is, however, taking the value of the Hive ecosystem, as captured by market pricing of the value capture coin, and using part of it as the backing agent for HBD.

Therefore, HBD is not floating out there in a vacuum. Each new one created is accounted for not only in the ledger, but also real time within the value of the system.

To take the analysis a step deeper, we want to look at what $HIVE is. This is something that is often overlooked since most of cryptocurrency focuses upon speculation. There is a fundamental utility that this coin does provide.

When staked, it provides the ability to engage with the blockchain. In fact, there is no way to interact with the ledger unless there is some Hive Power, the staked version of the base layer coin. This equates into the backend credit system, called Resource Credits, which are utilized during each transaction. Since it is rechargeable, it is not a transaction fee, hence cannot be considered an expense. Thus, one is actually making an investment when looking for the ability to interact with the database.

This basic utility is vital to HBD. If we look at it as the backing agent, this plays a major role in demand, affecting the value proposition in this role.

Hence, HBD is a collateralized loan with a 30% loan-to-value backed by an access coin.

The collateral the blockchain is putting up against the loan is the access token for the ecosystem. This is a rather unique twist. Essentially, all of this boils down to demand for the decentralized database.

Settlement Of The System

What is described so far is in place even before we start to build value on HBD itself. This is where the true demand for a currency enters. We covered a number of way this can happen. To quickly recap, the basics are:

- collateral

- payments

- funding and investing

- derivatives

That said, the threat posed by HBD to the system only enters if we look for full settlement. If the above is undertaken, this will never take place since people have many different reasons to operate in HBD. Nevertheless, from an accounting perspective, we have to be able to account for all of this.

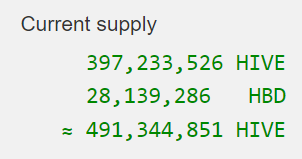

Fortunately, it is already done. This is what is known as the virtual supply. This is the amount of $HIVE required to fully settle the system.

Here is what we get from Hiveblocks:

This is the settlement amount, in $HIVE, based upon the most currency market prices (probably from the Internal Exchange). It is a number that takes the HBD and multiplies it against the price of $HIVE. Obviously, the higher the price of that coin, the less to total virtual supply.

Therefore, as utility grows, the threat to the system is actually lessened.

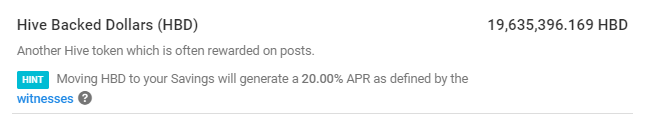

The virtual supply is a little misleading since it using the entire float in the calculations. We know that the vast majority of HBD is locked up in the Decentralized Hive Fund (DHF). When looking at that wallet, here is what we see:

We really are dealing with under 10 million HBD in circulation. It is a figure that adds around 30 million to the virtual supply, putting the total closer to 420 million.

The structure of HBD is really fascinating. Understanding it helps us to see how powerful this truly can be. Since it is designed to work in a circular fashion, the value comes, in part, from access to the ecosystem.

In future articles, we will delve into the circular nature of this and how we are looking at a feedback loop that could become exponential.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta