Have you seen what is happening with the Waves blockchain and its stablecoin? This is starting to garner some attention as the peg broke and a lot of money is at risk.

It is a rather interesting story beginning many to question the validity of algorithmic driven stablecoins.

In this article we will detail what took place and how Hive is in a different situation.

UDSN Massive Printing

For those who are unaware there was a massive amount of printing of USDN which many are claiming is de-stabilizing the entire Waves ecosystem. It pushed the price down to 81 cents, motivating the article above to be written (it since bounced back to 92 cents).

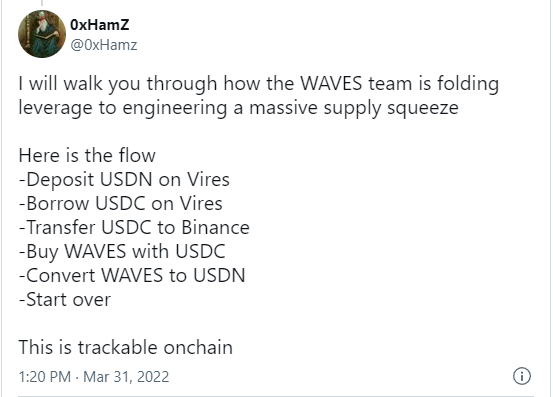

So what was really happening? An anonymous individual online did some research and this appears to be what was taking place.

Source

The question is what protections are in place with Hive and what are some of the differences? Let us take a look at the situation and how Hive is structured in a different manner.

Tokens

Waves uses three tokens. WAVES is for their gas fees while USDN is the stablecoin. There is a third token that is used for governance. Here we see the first issue. There is no reason to hold WAVE other than for an assortment of gas fees and speculation.

HIVE has utility. To start, it is the governance token so staking it (powering up) is a way to gain influence. Like WAVES, it is also the what allows people to engage in the blockchain. Finally, it allows for directing of the rewards pool since one can curate content based upon their HIVE that is staked.

There is a reason to hold HIVE, keeping it off the open market. It is why 40% of HIVE is locked up. We also have a 13 week power down period which also acts to secure the blockchain.

Founder's Stake

In this situation, there are accusations this is coming from the founder, or at least someone close. The fact there is a corporation behind WAVES only adds to the problem. When there is a large stake held by a small group of individuals, it can be used against the chain. This is something Hive already experienced.

We were seeing a lot of WAVES being converted. When the process started, someone started to convert WAVES. Where did it come from? It is opined the founder's were pumping the price to be able to cash in. Hard to know exactly what is happening but this cannot occur on Hive.

The founder's stake was locked up in the Decentralized Hive Fund and cannot be used against the blockchain. In fact, as we will see, it is actually helping to defend it.

Smart Contracts

Waves is a smart contract platform. There is a lot taking place at the base layer. With Hive, it is the exact opposite. What is occurring at that level is very targeted. There are not many features available. Everything has to build on the second layer. Once again, this provides enhanced security.

With HBD, there are only a few areas that apply to it. We see the distribution when 50/50 payout is selected. Then we have the interest paid on HBD in savings, And finally, there is the haircut rate where applicable.

When looking at Waves, they have a lot more going on. In fact, they created so many layers tied to the stablecoin it is head spinning. Part of the stablizatioin comes from a variety of synthetics that are tied to fiat currencies. That means their stablecoin is, at least in part, meant to be stabilized by synthetic assets.

Haircut Rule

At present, if the market cap of HBD reaches 10% of that of HIVE, the blockchain stops printing HBD. It is a mechanism that is designed to slow the production of HBD if things get too far out of line.

This is being raised in the next hard fork to 30% but it is not being eliminated. We can see a larger buffer allows for more HBD to be created. However, since it is there, unlimited conversion cannot take place.

It is not something that appears to be in place with Waves.

HBD Stabilizer

Here is where the original founder's stake is helping to defend the blockchain.

HBD Stabilizer is allocated payouts each day from the DHF to buy up HBD or HIVE on the market, depending upon where the price is in relation to the peg. If it gets below the $1.00, it buys up HBD which is then deposited in the DAO. This effectively locks up the HBD, removing it from the free market. There is an emission rate hard coded that distributes the holding of the funds.

Does this mean that the potential for this to happen does not exist? No, there is the possibility that someone tries it. However, to do that, it would have to come in from the outside. An individual, or group, could some in with $40-$50 million and buy up HIVE to convert. Of course, at some point, the haircut limit would be reached, eliminating this part of the scheme.

However, there is another area where this fall short compared to Waves.

With that ecosystem, there is a money market type application called Vires Finance. This is also part of the core, meaning it could provide vulnerability to the system. When the price of Waves goes up, the interest paid out automatically increases. Hence, doing a pump of WAVES means the stablecoin staked is earning more.

This does not exist on Hive. If it was available, it would have to be a second layer application. This means it could blow up that application but have a lot less impact upon the ecosystem as a whole.

Hive Savings Bond As A Defense Mechanism

At present, there is a savings program on Hive which pays interest. Like with Waves, this is base layer. The rate, however, has nothing to do with the price of HIVE. That could moon like nothing we ever saw and the HBD interest payout would be the same.

It is the Witnesses who set the rate on the interest. This is a medium of the Witnesses' rate. The rate only changes when they decide to move it.

There is another aspect to this we discussed over the last few months. The Hive Savings Bond is the idea of using the time locked capability of Hive. Under this scenario, one takes the HBD and agrees to lock it up for a certain period of time in return for a higher interest rate. For this discussion, we will use 1 year and 25% interest.

What if we did encounter the situation where there was just too much HBD out there. In spite of what was mentioned here, what if there was still a massive amount of liquidity that was deemed a threat.

Hive Savings Bond would provide the Witnesses with one more tool. Want to dry up liquidity? Provide a large enough incentive to lock it up. Thus, the Witnesses could form a defense by moving the interest on a 1 year time lock to, say, 40%. Here we see the incentive to pull HBD off the open market and lock it away. This would dry up the liquidity while providing the time to allow things to settle down.

As the liquidity dries up, the rate could be lowered. It would also provide the blockchain time to grow even more to absorb the extra liquidity.

In Closing

Hive is fortunate we are still operating under the radar. We are able to watch other projects operate in a similar fashion and experience the attacks. This ecosystem went through it a couple years ago, only to come out stronger. As others pave the way, we can learn from what they go through.

It seems the key is to keep building layers of defense. The best is a strong community that is willing to step in and project what they view as home. This is what many refer to as "Layer 0". Hive certainly has this.

Nevertheless, we can keep adding in more options to be utilized should the need arise. When there are more choices, it can make attack that much more difficult. At the same time, it can help to reduce the profitability of such a move, further reducing the incentive for one to undertake it.

Having a portion of the base layer tokens locked up for periods of time provides a great deal of security. Those tokens cannot be used against the chain. With HIVE powered up or HBD put in a time locked account, this effectively removes it from the free float. It is as if they tokens do not exist, at least until released.

A major component to all this is time. Anything that can slow down attackers is helpful. Often, their success comes from doing things before anyone can respond. With Hive we are building in those defenses that will lessen the appeal of attack. Can it happen? Sure. But if it is so much of a pain in the hind end, the incentive is further reduced.

It appears Waves did not have safeguards in place. Of course, if the founders are behind this, then we can see why.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta