What is the future of the crypto industry? Does it have a chance to survive as it was designed...with decentralization at the core?

This is something that everyone is going to have to decide. Unfortunately, the track record is not looking favorable. We still are mired in an industry that is mostly concerned with green candles. Market players outnumber builders by a wide margin.

So far, the battle pitted the likes of Wall Street against crypto. On that end, based upon the early progress, the mega firms are winning. Bitcoin was completely hijacked by these entities, with Blackrock becoming one of the largest holders of BTC.

They are also investing heavily in crypto mining companies. This two -pronged approached is given them stake in the networks along with the coins themselves.

Unfortunately, when it comes to opponents, the banks are small fish. Moby Dick is lurking and it raises the question of what will crypto do?

Will Crypto Surive A Takeover By Big Tech?

Blackrock. JPMorgan. Fidelity. State Street.

These are household names on Wall Street. These firms command a great deal of power due to the amount of money they have access to. With trillions in assets under management, they can literally move markets. They also create them.

When it comes to size, however, they are rather small. If we want to look at large entities, Big Tech is king. Here is where we find the most valuable companies in the world. Banks can have market caps into the hundreds of billions of dollars. Big Tech, on the other hand, are valued in trillions.

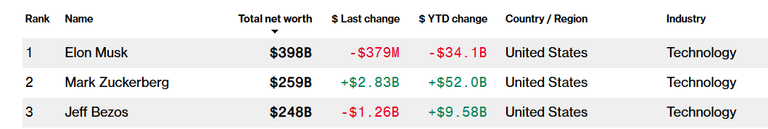

If we look at the 3 richest men, we see that Musk, Zuckerberg, and Bezos has a combined net worth of $907 billion. Each of these made their money in technology.

Source

As a comparison, the most valuable bank, JPMorgan, has a market cap of $774 billion. Many talk about the race to becoming "the trillion dollar man". Actually, another question is will JPMorgan get there before one of these individuals?

What does any of this have to do with crypto?

According to Charles Hoskinson, the founder of Cardano, a lot. He asked the question what happens when Big Tech is able to get involved in blockchain?

At present, within the United States, regulatory uncertainty still reigns supreme. This is likely to change with a chance that a stablecoin bill will emerge in the next 3 months. Here is where some certainty would be provided to these corporations, allowing them to enter crypto.

This is what Hoskinson focused upon:

He warns that tech giants like Meta, Google, Apple, Microsoft, and Amazon could potentially dominate the blockchain space once regulatory frameworks become clearer.

Given their vast resources and technological capabilities, these corporations could establish their own blockchain infrastructure, posing a significant challenge to existing decentralized networks.

He is right.

When dealing with these entities, their users can often jump into the billions. What is preventing them, at that point, from setting up their own blockchain networks? Some will state this goes counter to decentralization, which it does. But honestly, how many in crypto really care? Aren't most "crypto people" spending their days on Web 2.0 applications like X, Facebook, or Discord, feeding Big Tech?

Hoskinson posted this on X:

“And the inconvenient truth that a lot of people in this space don’t want to admit is. Our competitors are not Ethereum, Solana, or even Bitcoin. It’s Microsoft and Apple, Google and Amazon.”

“What’s going to happen is when the regulations get passed, we’re going to wake up and they’re going to be like, hey, by the way, let you know, like Android now has like a default crypto wallet.”

How will the industry combat that?

Another point is what will stop Apple and Google from having their own stablecoin? Again, with clear regulations, these firms would be free to enter this realm.

Layer 1 Hijacking

Many Big Tech firms have their own platforms. When we look at the names of X, Meta, Google, and Amazon, they own applications that continually feed them data. At the same time, there is the potential for even greater commercial activity.

Incorporating a blockchain would provide a simply monetization layer. Depending upon the regulation, this could streamline the rollout, allowing these firms to be involved in a short period of time.

In other words, they would hijack the layer 1 activity. Suddenly, blockchains like Solana, Cardano, and even Ethereum would not be as attractive. That does not mean they would not exist. The problem is the eyeballs are all on Web 2.0.

Of course, we have to be clear: what Big Tech builds will be highly centralized. Each company would control its own network. There would be no decentralization or user control. It would simply be another permissioned layer.

This means that your digital (and monetary) life is in their hands.

Unfortunately, if the most recent history is any indication, the masses do not care. As stated, even those in crypto are running towards centralized platforms.

So how can this be countered?

AI Agents

To me, if we are dealing with an agentic future, therein is the solution.

We can presume that Big Tech's platforms will be filled with AI agents. There is nothing preventing these companies from rolling out millions of them. Here again, we see another advantage.

That said, this is also an opportunity. The decentralized world also can roll out its own agents. Technology is advancing whereby anyone will be able to develop agents. The time frame on this is probably 24 months or so.

What happens when billions of AI agents are operating on decentralized networks? This is something that we have to seriously consider. Simply because Big Tech has all the people does not mean it will win the agent game. Over the past few months, we covered how humans are becoming a smaller portion of the Internet.

Online competition in the future will be waged by agents. That is where the battles will reside. This is how most of the stock market operates. Computers are the ones running the show due to the fact the overwhelming percentage of trades are initiated autonomously.

This means people have to be conscious of what they are doing. Simply running to X or Meta out of habit is not going to cut it. This is only feeding the beast even more.

It becomes even more imperative when it comes to developers. Those build applications and agents need to decide where they will stake their claim. The easy path is to focus upon the centralized systems. That, however, might not be the most prudent option.

Hoskinson is right. The real challenge to crypto will come when Big Tech enters the game.

Here is closing through from him:

“How the f**k are you going to compete with guys who have 3 billion users and they own the operating system that’s on your phone? That’s a lot harder. So that’s the next wave of competitors that are coming. And I can see a world where those guys actually launch a layer one.”

Posted Using INLEO