We are embarking upon a lot of twists and turns. As we often covered, the relationship between HIVE and HBD is offering some very interesting possibilities.

In this article we will discuss the idea of Hive Power becoming deflationary and how that could change the governance of the ecosystem.

For those who are unaware, HIVE, when it is staked, becomes Hive Power (HP). This is where on-chain governance comes from. People votes are based upon the amount of HP that is in their account. This is also called "influence". Those with greater stake obviously have more impact.

The main governance actions are voting for witness and proposals. A non-governance activity is to use one's voting power to curate content, thus determining how the daily reward pool is distributed.

What happens if HIVE becomes extremely deflationary? This is something that we want to take a look at.

HBD Causing Deflation

HIVE is an inflationary token. There is a daily distribution that comes from new HIVE created. At this point, it is around 7% annually. It decreases every year, reducing the amount of new tokens created.

So how does something that is inflationary move towards deflationary? To get this answer it is best to follow the work of @dalz. For the year 2021, there was actually a negative in the creation of HIVE. Because of the amount of HBD created, there was less of the former on the 31st of December as compared to the first of the year.

Here is where we see the correlation between HIVE and HBD really having an impact. If memory serves me, the net was about a 3% drop in the amount of HIVE for the year.

Naturally, this brings up the question of what happens when large amounts of HBD are generated? How will that look?

Let is dive a bit into the numbers to see where things are.

Present Distribution

We are going to take all information from Hiveblocks.

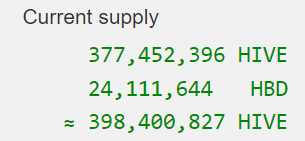

Here is the current supply of both tokens:

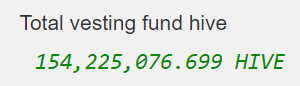

Then we have the amount vested:

Essentially there is roughly 223 million HIVE that is floating around in liquid form. This could be on the exchanges or in people's wallets.

Now we have an idea about the existing landscape when it comes to the token distribution.

Deflationary HP?

The idea that the amount of Hive Power being reduced is not something people will commonly think about. Here we have to make some presumptions to determine the likelihood of that happening.

Understanding that if HBD becomes popular, we are going to see a vast amount of HIVE converted. That will reduce the amount of the token available, causing a contraction of the supply. This is what we saw last year, a move that put us at roughly 25 million HBD. What happens if we set out to create a couple hundred million HBD?

Obviously the effective deflationary rate would be much greater. This could result in 50M-70M in HIVE being converted. Here we see a drastic decline in the supply.

Of course, a reduction in the amount of Hive does not mean that the HP will follow a similar path. It stands to reason that those who are powered up, for the most part, are the Diamond Paws. Thus, we can presume the conversion will take place, for the most part, using the liquid HIVE as compared to people powering down.

There is another variable that is about to enter the equation. We are about to see Resource Credit delegation taking place. This could be an incentive for people to power up more Hive. If one is able to profit from the delegating of Hive to help applications, this might be an incentive to move things in the opposite direction.

That said, if the amount of liquid HIVE becomes scarce, logic says the price will head higher, in USD terms, over time. Here is where things could change.

Let us be honest, we all have our price. At what level does it become attractive to sell at least some of your HIVE? Even if it is nothing more than playing market fluctuations, i.e. converting some to HBD expecting a market pullback, one could take a couple weeks of power down for that purpose.

Good Bet HIVE Becomes Deflationary

How the amount of HP that is out there is affected is rather uncertain. This is designed to be the most stable part of the ecosystem, providing security to the blockchain. Therefore, those who are staking their HIVE are making a rather strong commitment.

This is not going to wane with every tick of the market.

What we can conclude is that HIVE is likely to be deflationary over the next few years. With the attention HBD is getting, we are going to see some use cases emerging over that time. Once this happens, we are going to need to generate a great deal of it. While there are mechanisms in place such as getting half the rewards in HBD, it is still a slow process. The quickest way to massive amounts of HBD is converting HIVE.

Do not be surprised if the report for 2022 ends up showing a lower HIVE total at the end of the year as compared to where we started. This will eat up some of the liquid HIVE.

The question for the community is whether or not you think this will float into Hive Power? Will we see a reduction there over time as HIVE gets eaten up (if it takes place)?

Let us know in the comment section below.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta