Things are changing on LEO.

The introduction of LeoDex is altering a lot of things, especially our approaches to the platform. What this means is we have to look at the token in a much different way as compared to before.

In this article we will go through what this entails. We will also cover how this could really start to move the token price higher.

Leo Pools Require 1.75 Million tokens

My estimate is we need roughly 10% of the total circulating supply in the two pools. This includes both the LEO/SWAP.HIVE diesel pool along with LEO/CACAO on Maya. It is the latter that got most of the attention but the former is also worthy of discussion.

There is always a fine line between scarcity and creating liquidity. This is especially true for a value capture token. Over the years, the idea was to lock up as much LEO as we could, making the number available on the market scarce. The idea is to put the price higher.

Unfortunately, as crypto has repeatedly proven, this is backwards. When it comes to tokens like this, a parallel is stocks. Do we not see stocks go up in price when companies announce a split? Why does that happen? The reason is because people have more shares in a growing enterprise.

Why do they not do the equivalent of a burn? This is called a reverse and, most times, when this happens, it is done by a company that is diving. It is nothing more than market maneuvering trying to pump the price.

From my perspective, we have seen this repeatedly in crypto.

With Leo, that could be changing. Here we have some a legitimate design that is changing the direction of things.

Vehicle currency

It was discussed how LeoDex is going to be a ramp either into or out of the Hive ecosystem. This includes the Hive-Engine tokens.

To achieve this, there are two pools which are essential to the operation. They were listed above. Here is where liquidity is required.

LEO is now a vehicle currency. It is the asset that carries value from Hive to Maya (and in reverse). Anyone who wants to span these two chains has to use LEO.

This is similar to how the US Dollar operates internationally. A Korean supplier will invoice a Mexican distribution in USD. Why? The Mexican company doesn't have won and the Koreans don't want pesos. Hence, the US dollar is the vehicle between the two entities (actually their banks).

LEO is doing the same thing.

Do you want BTC for your SPS? It requires LEO. Is there a desire to get HIVE using ETH? LEO is involved. Want some RUNE for your HBD? LEO again.

This is provides enormous utility.

LEO Diesel Pool

A lot of discussion took place regarding the liquidity pool on Maya.

Here is a snapshot of the current pool:

At the present pricing, with $50K in the pool (LEO portion) this means there are almost 472K tokens. This is a strong start. Remember, anything going from Maya to HIVE has to pass through this pool.

The challenge is we are likely to see as much, if not more, heading the other direction. This is why the diesel pool requires a lot of attention.

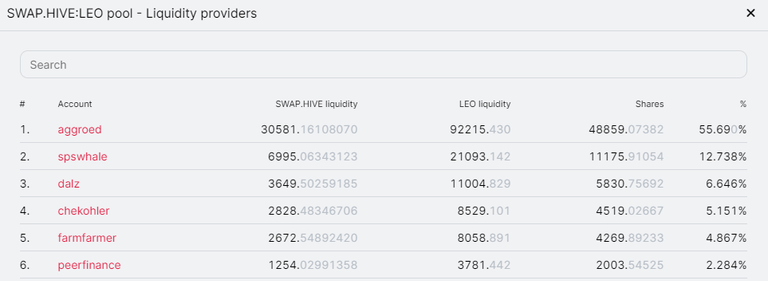

Here is a snapshot of this:

We see there is roughly 195K LEO in this pool. Combine the two and we are looking at around 630K. That means we need 1.1 million more LEO to be placed into these pools.

This is where the community needs to step up. Liquidity is crucial if we want the activity to increase. We cannot handle a $50K order going either in or out of Hive. The diesel pool is only at $37.5 right now. To handle larger amounts requires more liquidity.

We also have to factor slippage. When a pool is deeper, there is less slippage on each trade. When that is minimized, trading tends to increase since the percentage of the entire transaction lost declines.

Diesel Pool Breakdown

We have a couple problems that we must address.

The first is in the number of people are have provided liquidity. The number is barely over 100. We have to increase this significantly.

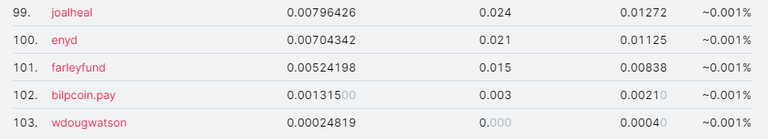

Here is a screenshot from Beeswap showing the bottom of the providers. As we can see, 103 in total.

Unfortunately, it gets worse.

Look at the percentage the top two providers are holding:

They account for 68.5% of the pool. This is a large number that could cause issues if that was pulled out. For this reason, we need more liquidity from a larger number of users.

Once again, this is the challenge put forth to the community. Each person holding LEO has a vested interest in the success here.

Personally, I have a fair bit of liquid LEO that is going to end up in the diesel pool. For now, I will swap a bit each day so as not to crash the price. Over time, I will keep increasing the liquidity I provide.

That said, others need to follow suit.

In the diesel pool, liquidity providers are paid based upon the fees. Hence, transactions can increase in volume (and amount) the more liquidity that is in there. This will mean more fees aka a greater return.

Of course, the pools operate in USD. That means that an increase in LEO price only enhances the value of the pools (the same is true for the pair). Having the price of LEO increasing will help both pools.

For this reason, LEO as a vehicle currency can add a great deal of value. This means adding more to the mix so that is can facilitate more transactions.

The onus is now on the community.

Posted Using InLeo Alpha