This is something we hear a lot about. By now, we saw the memes on Twitter and Facebook of the "printers go brrr". Of course, by now, anyone following my articles knows that is not how things operate.

The Fed does not create US Dollars. That is not in its ability. Neither does the United States Congress. That body does not create money, only spends it (and lots of it).

By now, most should realize that USD is under the domain of the commercial banking system. This is what creates USD. In a credit based system, lending is what expands the money supply.

For that reason, the only thing that matters in terms of monetary expansion is what are the banks doing. Congress passing spending bills does not create USD, only debt. The government doesn't pay with cash, it buys on credit.

The Fed creates bank instruments. What it "prints" can only be held by depository institutions. There is not a single American who personally owned what the Fed creates. Since individuals do not have an account at the Fed, there is little they can do directly to affect the economy.

When we understand the Fed truly only can manage the expectations that everyone has, we begin to see how impotent they really are. Much of what they do is for show and to make everyone believe they have a handle on what is taking place. They do not.

Credit Expansion

Since the domestic banking system is where US Dollars come from, it is best to delve into those numbers to determine what took place the last couple years. After all, do we not hear the Fed is going to destroy everything with all their "money printing"?

So how many dollar were generated over the past 20 months. To figure this out, we go to the data.

Is it in the trillions like many proclaim? Let us drill down into the different forms of credit to see what we come up with.

We will use April 1, 2020 as our starting point since the pandemic started to hit the US in March of that year. We will go through the end of 2021 with the exception of the last category since that only goes through Novembet.

Here is how it looks:

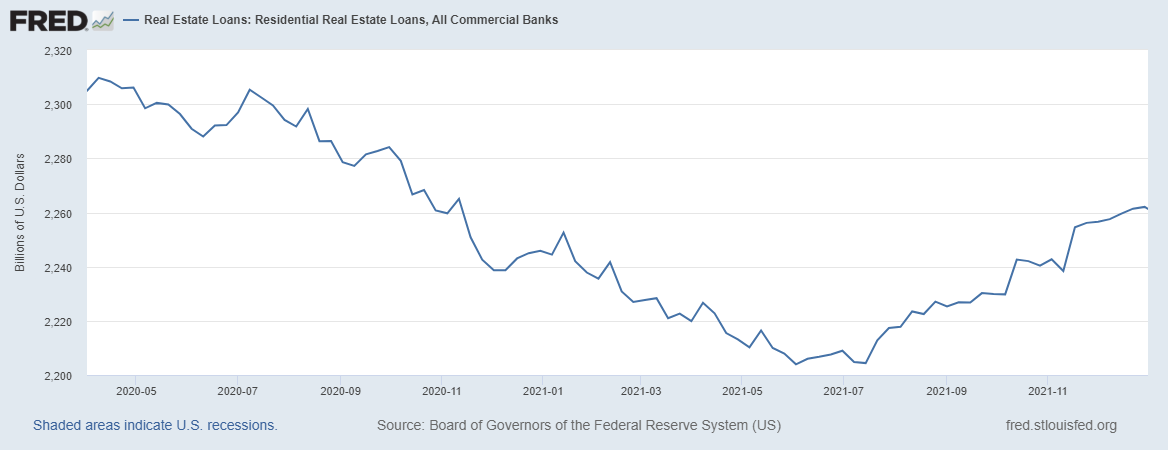

Residential Real Estate

April 2020 $2,304.951 Billion

Dec 2021 $2,262.065 Billion

Net difference -$42.886 Billion

Residential mortgage totals actually went down.

Commercial Real Estate

April 2020 $2,367.054 Billion

Dec 2021 $2,537.344 Billion

Net Difference $170.29 Billion

.png)

A fairly significant increase. Not sure who is lending on commercial properties but I guess it is better to re-fi as opposed to letting them go into default.

Commercial Loans and Leases

April 2020 $10,688.957 Billion

Dec 2021 $10,764.126 Billion

Net Difference $75.169 Billion

.png)

An interesting curve to say the least.

Total Consumer Credit

This is where we find car and student loans along with other personal credit.

April 2020 $4,139.76 Billion

Nov 2020 $4,414.74 Billion

Net Difference $274.98 Billion

.png)

So what do we get?

When to total it up, we see there was $477.55 Billion of new USD issued over the 21 months of 2020 and 2021. Since the numbers started at $19,498 Billion, this means there was an additional 2.5% added to the money supply during this time.

This is why we say there is a USD liquidity crisis. What the Fed creates does not get into the economy. Instead, they are bank instruments that lock USD into the banking system.

All the spending Congress did was paid for through the sale of Treasury bonds, which are paid for via existing dollars. Again, that entity does not create money, it just pulls out the charge card and runs up a balance. Unfortunately, since a portions of the Treasuries are sold off shore, this pulls more USD into the domestic banking system.

The global economy would be well served by more dollars being created. Herein lies the dilemma: banks are not going to lend when things are going south. They simply operate in their own best interest.

We see the Fed trying to manipulate things, by pleading and prodding. Yet, at the end of the day, they cannot force banks to lend.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta