This is the most valuable lesson that is to be offered by the entrance into DeFi 2.0.

Polycub is opening up a lot of doors for everyone who is involved. We are looking at an entirely new financial platform that incorporates some advanced ideas. For this reason, we have to understand exactly how this is operating.

Once we do, the action becomes evident. Never, ever, sell your xPOLYCUB. Put it in the vault and forget about it. This is something to set aside for decades down the road.

Understanding the tokenomics will show how valuable this is going to become.

Source

Deflationary Token

While most do not understand the inflation/deflation situation, here is an example of where the idea of deflationary money works.

POLYCUB is operating upon a scarcity model. This is intentional. It is not meant to fund an entire economy. In fact, the built in features of the platform necessitate scarcity.

This token is operating similar to Bitcoin. Because of this, we are not looking at a medium of exchange. This is designed to be speculated upon while also having value directed towards it. The idea is to keep pushing the deflationary pressure onto the token in terms of distribution while reaping percentages of the value that is being generated throughout the platform.

It is where xPOLYCUB becomes a HODLers paradise.

xPOLYCUB Grows In Value

When one stakes POLYCUB into xPOLYCUB, it grows in value over time. This is due to a couple of factors we will cover in a moment. Before that, let us look at how this works.

Anyone putting POLYCUB in will receive less xPOLYCUB in return. This is because it is not a 1:1 ratio. In fact, over time, it keeps decreasing in terms of the xPOLY received for each POLYCUB.

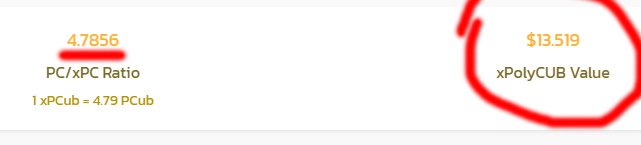

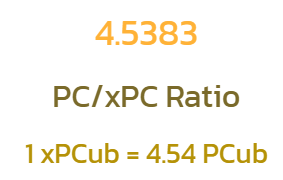

Here is the latest ratio:

This means that for every 4.53 POLYCUB that goes in, one will receive 1 xPOLYCUB.

The flipside is that when one exits the vault, he or she will receive 4.53 POLY for each xPOLY. Where this is important is the fact that this was 3.70 13 hours ago. Thus, the value of each xPOLY, in POLY terms, increased .83. Here is why you never sell your xPOLYCUB.

Over time, this will just keep increasing.

Polycub Tokenomics

Polycub has Kingdoms which allow people to stake different tokens and earn yield. This is straight forward yield farming. The returns are compounded through the use of different autocompounding harvests. Here is where we see the likes of SUSHI enter the picture.

These Kingdoms autocompound the returns. This is great for the user since there is nothing to do. For this service, POLYCUB splits the payouts with a 90/10 split. This means that 10% of this is directed to the xPOLYCUB contract. As the TVL of these Kingdoms grows, the amount autocompounded follows suit, resulting in greater amounts distributed to the vault.

Of course, there is an additional capital flow to consider. Those who are in these Kingdoms have the same lock up period as other harvesters. This means that they will always be confronted with the dilemma of whether to claim immediately and incur a 50% penalty or hold for the duration. Those who are active traders and players of market movements are not going to adhere to a lock up period of about 90 days. Thus, they will opt to cash out immediately.

Guess where the 50% penalty ends up?

If you said in the xPOLYCUB contract, you are correct.

Never Sell Your xPOLYCUB

It is easy to see why the idea of selling xPOLYCUB is a bad one. We have a situation where the value of this token, in POLYCUB terms, will only keep increasing. There will come a time when the POLY-to-xPOLY ratio will be 10:1. Then we will see 20:1. Eventually it will get to 50:1. And so on.

Remember, the amount of POLYCUB is decreasing on a weekly (then monthly basis). Anyone who wants to understand the tokenomics can read this post by @edicted.

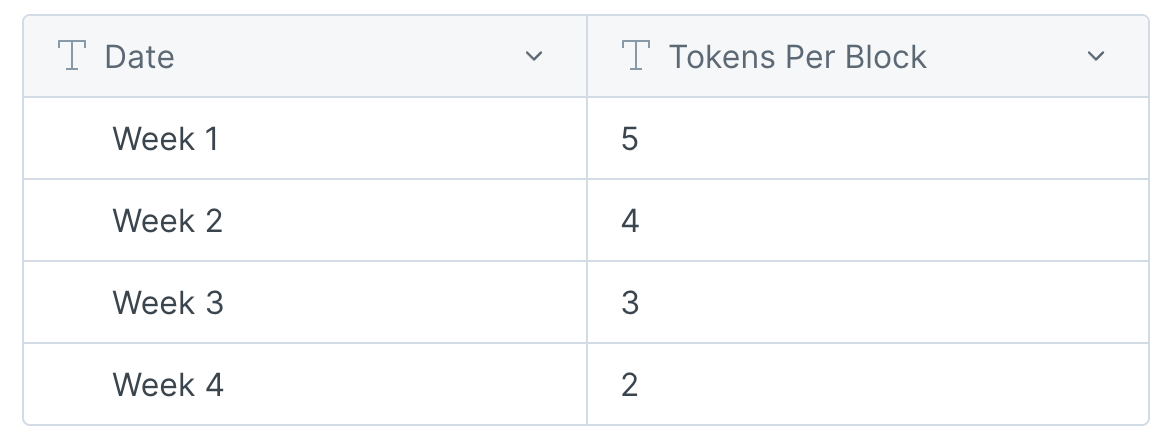

To grab a couple tables, we see this:

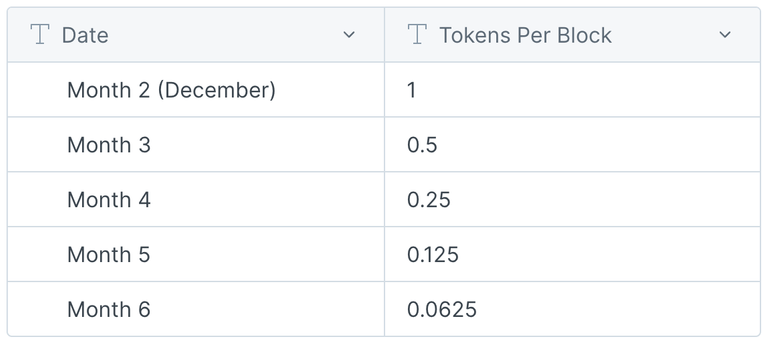

Then it looks something like this:

The deflation is accelerated as compared to what else is out there. This means the amount of POLYCUB is going to decrease, which should create a dilemma. What happens if the revenues from the Kingdoms is increasing while the amount of POLYCUB being produced is decreasing? There is a good chance that the price, in USD, goes up.

Which brings us to the next point about why never to sell xPOLYCUB.

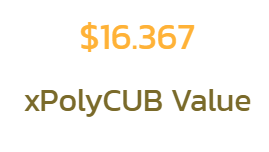

Here is what the value of each xPOLY looks like in USD.

The 50% penalty and 10% management fee will, at some point, add more buying pressure to POLYCUB. As more is locked into the vault, the price in USD will have to increase. This means that not only will the POLY-to-xPOLY ratio increase, it will also be more valuable in USD.

In fact, there is great likelihood that we see the point where the growth in USD is actually outpacing what is seen in POLY terms on a daily basis. Here is where the deflationary nature of POLYCUB forces higher price levels.

As long as people are in the Kingdoms, looking to farm yield, more value will be driven to xPOLYCUB. This is something that was designed in the tokenomics.

It is where DeFi 2.0 is vastly different from the first version.

By the way, we get to do this all over again in another 90-120 days when the next platform is released. Rinse and Repeat.

All of this can be found in the docs.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta