The Leofinance team put out a post earlier detailing the long-term objective of Polycub. It seems that many do not see the potential in what is being created.

For this reason, I wanted to do a post that comes as a result of a table @onealfa did pertaining to the project. It is vital for each to understand this.

Many have question as to the deflationary nature of POLYCUB and why would anyone want it. In this article we will cover how the price of POLYCUB is going to head higher at some point. Like always, to illustrate the point, we will use the absurd.

Before getting into the details, please remember that Polycub is the antithesis of what we have come to know as DeFi so far. Instead of just a quick hit, this is meant to be a long-term hold. The tokenomics are such that we are going to see how things will explode higher at some point.

Now let's get into the nuts and bolts of things.

How Deflationary Is Deflationary?

We are all familiar with Bitcoin and its halving cycle every 4 years. Polycub is designed on the same premise, just on an accelerated time line.

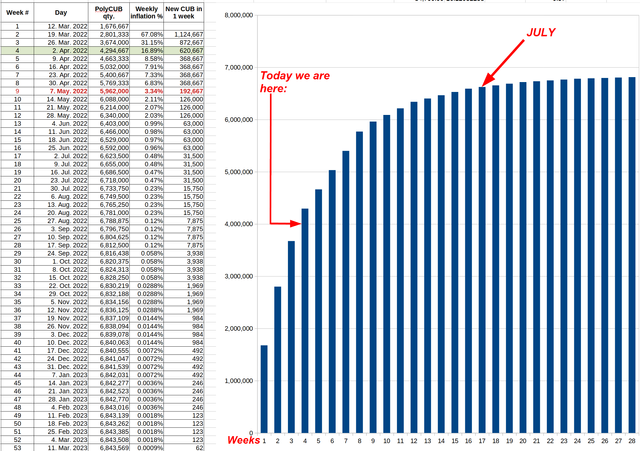

Here is a breakdown of the actually emission rate. It is best to open image in a new tab to see it.

When we say long-term, we are really talking about 6 months here. As we head into April, just look at where things will be come the beginning of October.

By that time, we will be looking at slightly less than 4,000 POLYCUB created per week. That is roughly $2,000 at today's price of POLYCUB.

Here is another quick tidbit: Look at where things will be in just over 11 months: 62 POLYCUB per week.

All of this compares to the 620K that will be issued this week. That is how quickly things drop and the accelerated deflation that is constantly discussed.

This is only one piece of the puzzle.

Buy-Side Demand

The second component is to establish buy-side demand. To be effective, this needs to be on a permanent basis.

We hear a lot about this "protocol" thing. What does that mean? Basically, another way of looking at it is as the platform Treasury. Much of what is being designed is to help feed into this.

So far, the fees from the Kingdoms are what is feeding into it. Here we see 10% of the proceeds being fed into the protocol. Obviously, to be sustainable long-term means a lot of money has to enter the system. This might, or might not, happen.

Therefore, a couple other pieces are being added.

- BONDING

This is what will give the protocol the assets it needs in the liquidity pool to ensure ongoing operates. One of the problems with LPs is when people pull out of them. If enough do this, it ends up drying up.

To prevent that, bonding is going to give the protocol ownership over the assets in the LP, based upon those who bond. If someone bonds his or her holdings in, effectively they are "selling" the stake to the protocol in exchange for a premium (if positive).

Let us take an example. Suppose someone has $10,000 in POLYCUB-USDC LP. That means there is $5,000 of each.

If we look a Tweet that was posted from the Leofinance article, we see the return is 3.9%.

Here the individual could bond the LP to the protocol, turn that over and collect $10,390 worth of POLYCUB There is no bonding period listed but it is usually 5 days. Not bad for 5 days worth of work.

Of course, the individual could opt to take the POLYCUB, turn half into USDC, and get right back into the pool. If the rate is still favorable, the person could repeat the process and bond again.

Here is where one is incentivized to bond.

The key is the protocol now owns the $10K that is in the LP. At the present total, that is 3.5% of a LP paying 543%. We can expect the APR to decline but the point should be clear. Whatever the yield comes out of the LP, that heads towards the protocol. Here is where the money for buying pressure can come from.

Harking back to the $2,000 per week, now we can see how bonding fill the protocol with assets that provide yield. This is used to gobble up POLYCUB and send it, at least in part, to the xPOLYCUB contract.

- Collateralization

Lending uses the same concept from the protocol perspective. It is a mechanism designed to keep feeding the protocol based upon the loans that are outstanding.

Holding xPOLYCUB generates a yield. Each day the ratio keeps increasing, generating a return. A portion of this is going to be used to pay the daily interest on the loan that is outstanding. Here is where the protocol generates a return while one can access part of what is held in xPOLYCUB.

We will leave the details out of this article since some were mentioned in the one by Leofinance.

To illustrate, let us use a xPOLYCUB holding of $10,000. For these purposes, we will presume a 50% loan, hence the person takes out $5,000.

Let us start by deciding what to do with the money. Maybe we get into the POLYCUB-USDC LP and earn the return there. Leaving aside the 500%, let us say that is earning 30% APR. Thus we will earn $1,500 from having the money in that pool.

Of course, we still have all our xPOLYCUB. It was collateralized not sold. Here is how we can access the value (a portion of it) and put it to work. This would be in addition to the projects 30%-50% APR on xPOLYCUB once things settle down.

This is why the goal is to never sell your xPOLYCUB. There is no need to when we can collateralize it and use the money to keep growing our returns. Making money to make money, it is what the international banking conglomerate did for decades.

The great part about this is the protocol is being paid each day with a portion of your xPOLYCUB proceeds. Since this keeps going up, at least in POLYCUB terms, there is a revenue stream to help offset any potential losses. Of course, there still could be a collateral call if the price plummets and one might have to unwind the position. The reverse, however, gets even more interesting. If the price of POLYCUB keeps going up, so does the value of one's xPOLYCUB holding. This means more can be collateralized over time.

In other words, rinse and repeat.

All the while, feeding more into the protocol which, as you can guess by now, can eat up more POLYCUB to feed back to the xPOLYCUB holders.

HBD and HIVE LP

This is something I am not going to delve into since there will be a separate post. However, I want to point out that HBD and HIVE liquidity pools can be monumental. Many ask why would people use the LPs? It is true, some of this exists elsewhere. That said, HBD and HIVE are tough to get. Anyone who tried to purchase knows the challenges.

Once this goes into place, there is a built in market. Hive has tens of thousands of users monthly. There are moves about to enhance the entire HBD platform, and providing a LP is one of them. This can really have a huge impact upon the utility as well as the liquidity of the token.

The point we will make at this point is that it could be one of the largest, as well as most active, LPs on POLYCUB. This could also end up feeding a lot into the protocol.

Anyone want to guess the chances there will be HIVE and HBD LP bonding options. I would put that at 100% at some point.

In conclusion, I just want to state that Polycub is built to make you money. It is really that simple. When they talk about a new system, this is it. The protocol feeding back into the xPOLYCUB holdings which then can be turned around and fed back into the ecosystem is really novel. It creates a positive feed back loop that just keeps growing the TVL on the platform.

If the protocol gets $1 million in it, at a 20% APR, that is $200K annually. These are minimal numbers but that is almost $4K per week. Remember the $2K example? This is double it meaning that buy pressure is going to be twice what new emissions yield.

What happens if the protocol is generating $25K or $50K per month?

As we can see, the price of POLYCUB will simply go up.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta