The situation with Russia and Ukraine is getting a lot of attention as it should. What takes place on the ground is horrific, especially for the population living there. War is hell and should be avoided at all costs. Alas, it sees we do not alter our behavior.

What is not being discussed too much is the impact upon global commodities. Many are not aware of how much both Russia and Ukraine produce. With sanctions being levied against the former, it is likely that there is a serious hit to the global supply of particular goods.

Of course, this is all taking place while the Fed is tapering and moving to a tightening stage. Perhaps price increases aren't tied to the printing of bank instruments after all.

Here is some of what we have to look forward to.

Source

Energy

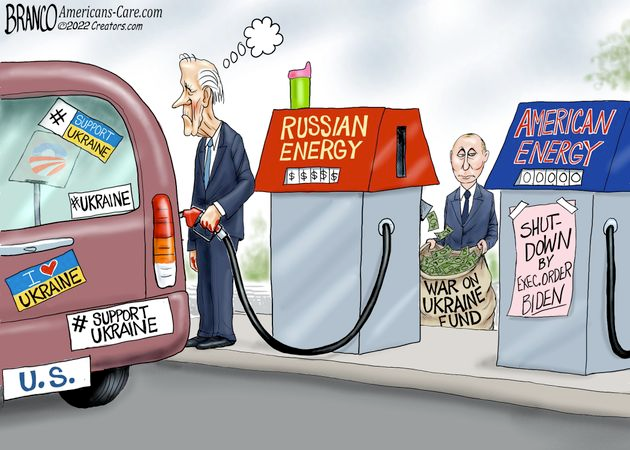

It is no secret that Russia is a powerful country when it comes to the production of energy. This is something that did get a bit of coverage since the EU is largely dependent upon the Russians for natural gas, which is used for heating.

In this area, they provide 40% of Europe's gas. It also produces 10% of the global oil supply.

No wonder oil prices are running.

Not to be left out, Ukraine also is a large producer of oil and gas. Zelensky is believed to want to step in and provide the gas to Europe, something that many feel is not likely to be feasible. The Russians simply provide too much. The US could step up to a point but they do not have enough to fill the gap that would be left.

Russia has stated that it will not interrupt the flow of gas to global markets but, as we know, this situation is changing. We might see where Russia is forced to take steps to get the Europeans to "blink".

Grains And Oils

When it comes to wheat, Russia accounts for almost 30% of the world's production. Here again, if there is a disruption, many are going to starve.

We also see Ukraine coming in with the exporting of corn.

Ukraine is also one of the world's top four corn (maize) exporters and had been shipping around 4.5 million tonnes a month with major customers including China and the European Union.

Here is something most might not have guessed:

The two countries also account for about 80% of global exports of sunflower oil.

Metals

This is too numerous to list. Here is an article that does a good job of detailing all that Russia and Ukraine contribute to the global stage.

Reading the list we see some common products that people use in everyday life. Commodities is a supply/demand business and if the supply chain gets hit, we could be in a world of hurt.

Higher Prices Crushing The Economy

The world has not recovered from the last shock due to the lockdowns. This sent supply chains into the toilet, a condition that still exists two years later. Unfortunately, when it comes to commodities, in the near-term, there is little that can be done. Alternates are not easy to come up with.

We are already dealing with CPIs that are at 40 years highs. The problems is PPIs are even higher in many instances. This means that not all the costs are being pushed out to consumers. At the same time, wages, while increasing, are not keeping pace.

All this leads to a situation where consumers simply cannot afford the higher prices. When the nominal wages is negative, this is a bad sign. The last reading in January, in the US, had it at -10%.

This conflict is only going to help send prices higher. We already saw most commodity markets running this week. It is a situation that could last a long time. Russia is the 11th largest economy yet supplies about 1/6th of all commodities. That is not a recipe for success from a global economic standpoint.

JPMorgan says $185 oil is in view with Russia's invasion Ukraine. While it is not likely to get there since there is no way the global economy can even come close to supporting that level. However, whatever the number, we can see easily see how this will lead to economic collapse.

As always, the economy is a highly complex, integrate system. So many want to simplify it down to a neat package. This is not possible.

Here is where we cannot predict where events like this will have an impact. What we know is the fallout is much greater these days than simply the areas affected.

This could get very messy on many different levels.

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta