Since the release almost 3 months ago, I supported Polycub completely. This continued even as the price of the POLYCUB token dropped. This also pulled down the value of xPOLYCUB, resulting is smaller numbers in USD terms.

Nevertheless, when you believe in a team, you keep at it. We are still not out of the woods yet but the crash does appear to be over.

As of this moment, the USD price for POLYCUB is just under 20 cents. It bottomed out around 13 cents, which is still a large move from its all time highs.

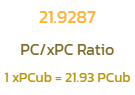

What is still growing is the POLYCUB/xPOLYCUB ratio. This was promised to always go up and it does.

Right now we sit just under 22 POLYCUB in each xPOLYCUB. Remember, this started as a 1:1 ratio.

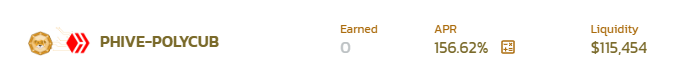

pHIVE Liquidity

A great deal of focus was placed upon the pHBD-USDC liquidity pool. Obviously, providing that for HBD is vital since we see a massive shortage of liquidity. This pool jumped initially yet has settled down. This is something we will have to keep an eye on going forward.

However, there was an addition that I thought would get a lot more activity and perhaps it is starting to come to life.

The pHIVE-POLYCUB liquidity pool filled a great need in my opinion due to the fact that HIVE is not readily available in terms of where people can buy it. This is similar to HBD. There is one difference between the two: a lot more HIVE exists than HBD.

For this reason, we could be seeing some growth in the liquidity pool over the next couple months.

As it stands now, there is over a 150% APR on this farm.

There is now over $100K in the pool. This is nothing spectacular but we have to keep in mind the price of both HIVE and POLYCUB was hammered. If we start to see a bit of upward movement, the value of the pool can jump.

This, of course, can help to attract more capital, pushing the value even higher.

Another Halving

We are about a week or so out from another halving. As we enter June, this was always a targeted area for many. The number of POLYCUB released per block is going to drop to .25. This is really starting to affect the amount of new tokens that do hit the market.

We have to keep in mind that we are still without Bonding or Lending. These two features will do a lot of add value to the platform. The former will allow the Treasury (Protocol) to take over parts of the farms by acquiring its own assets. This will increase the amount of POLYCUB that has to be bought on the open market.

At the same time, the lending will allow users to access locked up capital. This could be used to really enhance one's holdings. At the same time, it will also feed more capital into the TVL.

A final point that is vital is to remember that, with platforms such as this, all amounts are in USD. That is the common thread throughout. Hence, when the value of the assets on there increase, the totals start to jump. All numbers are affected which only expands the value.

With POLYCUB being in 4 farms, the price in USD has a big impact. Since the distribution is facing another halving, we are approaching the time when new POLYCUB is going to be scarce. That means the returns are going to have to be achieved through buy pressure on POLYCUB.

This was the entire point of the Protocol.

We might not be there yet but we appear to be closing in. There will come a time when we are going to see this entire platform flip and the supply/demand for POLYCUB will reverse.

Once that happens, the farms will see an increase in value which will only help the entire process.

We are still less than 90 days in. Where will this platform be when it is 6 months old?

If you found this article informative, please give an upvote and rehive.

gif by @doze

logo by @st8z

Posted Using LeoFinance Beta