I'm sure Preferred Shares aren't on the radar of almost anyone in the crypto sphere.

I doubt it even comes up in LeoFinance.

However, I believe its an important part of a well balanced HIVE plan.

I'm certain that you have heard of the stock market

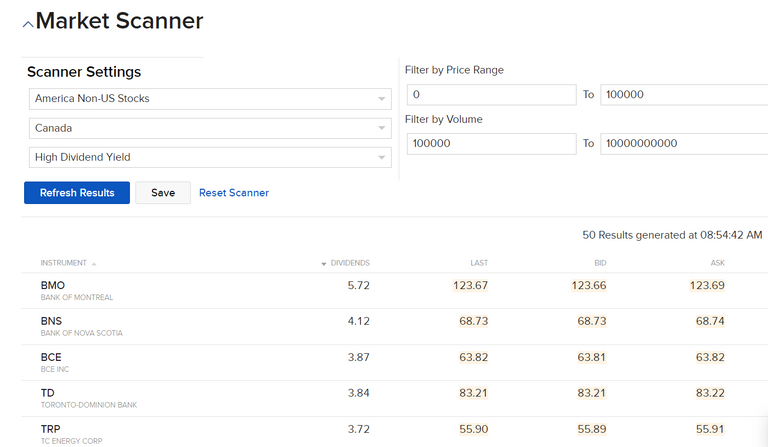

Leo Finance people tend to be pretty on the pulse of investments. Stocks are sure to have come up in conversation. My favorite stocks are Dividend stocks because they pay out their profits on a regular basis. Here is a quick look at some of the top yielding Canadian Dividend stocks.

Now the highest yielding stock on this list gives almost 6% but almost everything else is under 5%. Compared to the 20% that HBD is paying out why would anyone bother with dividend stocks?

Well, at 5% I'd wonder too. I can get that on a high interest savings account here in Canada!

But what if I could get a quality stock that pays a much higher dividend?

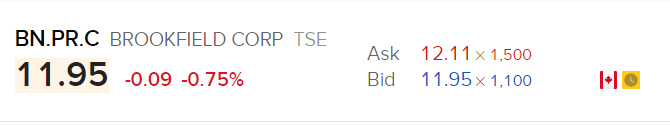

How about just under 10%?

More interesting?

Well, I like Brookfield and if you are curious about the company you can check them out here: https://www.brookfield.com/

What is more important is that they do real world work to make real world profits.

I might do a much longer write up on Preferred Shares at another time as they are a whole topic unto themselves.

However, I mentioned using them in conjunction with HBD and Hive and that balance is my main interest for now.

Ask any person who likes crypto how stable it is. If they are honest they will admit that it can skyrocket or tank in a very short period of time! How to mitigate the risk? Don't hold everything in one asset! Or in one place.

For myself that means spreading the money three ways.

I'm working on balancing a ratio of 1:1:1 in value of :

Preferred Shares : HBD : HIVE.

The preferred shares give me regular FIAT income that I can invest into HBD

I believe that is important because it puts real world money into the Hive ecosystem! A note to remember is that if no FIAT goes into the Hive system then the Hive value drops. Low value of Hive then fewer rewards, fewer newcomers and less overall value to the community.

Supporting the Hive ecosystem with real world currencies is important in my books.

Ideally I'd want that money to come from Advertising revenue, Marketing, or even transaction fees from people using Hive as currency. However, until that becomes a reality I'm going to keep supporting it with my income from dividends.

But why do I buy HBD and not HIVE directly?

Because HBD has a better yield than HIVE does and it is more stable. Also I don't have to work to get my yield. Just let it sit staked in savings account and collect my monthly cash.

So why don't I just keep only investing in HBD?

Because Hive (and Hive Power) is where all the action is! I can actually use Hive Power to make money through posts and curation. I can benefit from growth in the community through increased value in the Hive token. The Hive token allows for more growth than a Preferred Share or HBD ever could.

Then again the Hive token also has way more risk and requires way more work.

So, what do I do with my Hive creation and curation rewards?

Depends on the value of Hive. If Hive is soaring then take the profits and roll them into the Investment account. In that way I'm always guaranteed to take some profits when things are doing well and know that I "sold high". However, when Hive's value is down they get re-invested to take advantage of the lower price.

Now I'm sure that some savvy investors are going to say I'm crazy. Watch the technicals, look for inflections, inversions, candlesticks, bull signs, death cross, and whatever jargon they want to throw at me.

For those people I wish you the best in your quest to be rich and watch every fluctuation. However, for me simple is better.

Keep some real world income coming in from Preferred shares and invest in the Hive ecosystem. Keep it as safe as the ecosystem allows in HBD.

- Use the money in the ecosystem to grow itself and the platform.

- Be active and try to make it a better place for everyone while growing some cash in the meantime.

As the ecosystem grows: rebalance so that some money is taken out. Take advantage of the bull markets to grow real world value. When the bear inevitably returns use that real world money to re-invest into the community to help it grow again.

Simple:

At least for me.

Side note: I'm not a financial analyst and I'm not giving financial advice. Just letting you know what I think is a good plan for me. If you have any comments or questions--by all means drop a comment. I'd love to hear from you.