Let's start off with this weeks post prompt: The Earn, Spend, Give community has GIVE right in its name. However, I'd like to get idea on what the best way is to give. Is it to partner with someone and give them a hand up so they can get to a better place? Is it better to give a hand out with no thought of return for someone who has nothing? I'm certain it depends on the person and situation but I'm wondering about ways that the community here could help others.

So, feel free to talk about need in your area. How you think people should help. What aid would make the most difference. How much would that aid cost and how it is best to be done.

Please don't feel like you have to answer all parts of what I wrote just now. Make the post your own as long as it fits the idea of "best way to give to improve or develop your community".

As usual I'll be giving all good responses GLD tokens as a thank you after roughly a week.

Now in response to last weeks post prompt:

Last weeks topic was about credit cards in your country. There were a number of responses from :

@rare-gem

@jjmusa2004

@supernova004

@johnny023 and

@henrietta27

Who have all been sent 100 GLD tokens as a thank you.

When looking at the responses all of them came from Nigeria and all of them gave a resounding NOPE on using credit cards there. At first this came as quite a surprise. In Canada credit cards are well regarded and widely used to the point where I made it my mission to make sure both of my children get a credit card as soon as they are old enough AND make sure they know the benefits and dangers of credit as soon as they are old enough to start spending!

Never do I want them to see me use my card and think it is free money!

Why were they so scorned in Nigeria then?

Of course I had to do some looking and it quickly became apparent why Nigerians don't like credit cards.

First from the responses I got it seems that many are wary because the financial situation is a lot more fragile over there. People are worried about not being able to pay the bill. They are also worried that if the card is stolen they will be responsible for money they simply can't afford.

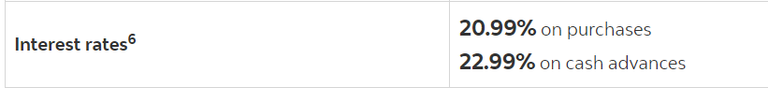

Second The interest rates are very high with none of the perks that you would find on a typical Canadian credit card.

I looked at this card online (I chose it because it had the best link of what you get with the card)

There are no perks. Just a credit card that lets you buy things on credit. That's terrible especially when the interest is 2.5% monthly which converts to about 34.5% annually.

That's awful!

To all my Nigerian friends who just say NO to being taken advantage of and getting into debt with credit cards I understand why now.

In defence of Canadian credit cards.

In Canada it is a very different situation.

I'll use this credit card as an example (it happens to be one that I like). Both card may look similar: Black colour, VISA logo but the difference is VAST.

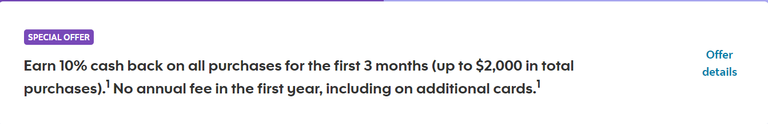

First 10% cashback for 3 months on every purchase. What's not to like with cashback?

Second 21% Interest Rate.

Okay, I hate 21% interest but its a lot better than 35%. I always pay within the grace period so I never pay a single penny in interest though.

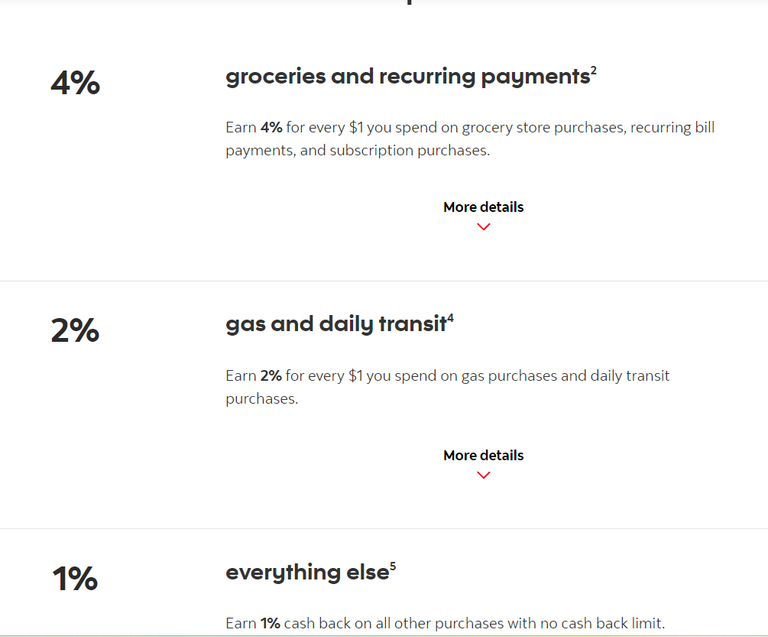

Third After the 3 month 10% cashback (honestly that's just a promotion) there is still cashback to be had. 4% cashback on food (my biggest expense) and 4% cashback on monthly bills (second biggest expense) why not just take the discount?

Fourth Sometimes there are big bills and 21% interest isn't much fun. But wait... How about 0% interest for a year? Yes. They do that..sort of. They actually charge a small amount (1.2% annually about 0.1% a month) as a processing fee. Compared to the 2.5% the Nigerian card charged its pretty minimal.

Now... the credit card company isn't being generous. If you miss the monthly payment then you pay the 21% on the entire balance. However, for those who are diligent in paying their bills the 0% is a nice way to make big purchases smaller 😄

Fifth Concierge services. Now these are typically things I do not use. However, if you ever want to look like a big shot or get access to things a little out of the everyday. Or maybe just impress your wife for an anniversary then calling up the concierge number can get you into some really nice luxury places of events....just expect it won't be cheap

Sixth Insurance!

The biggest reason that I use credit card and not debit card in Canada is the insurances:

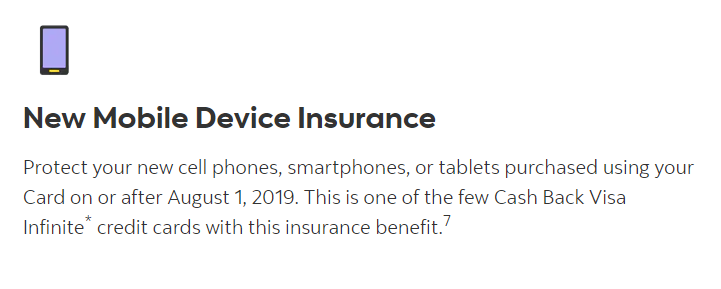

Having your cellphone die is traumatic! You lose a loved one and you have to spend money to replace it. Two bad things in one. Except with this credit card the credit company insures your phone will be replaced free of charge if it dies. Just make sure you read the terms and conditions!

When I travelled to Iceland two things happened. First: Wizz Air went out of business. Many passengers left stranded with no way home. With my credit card I called them up and they paid for me to get on a different airline home. A little inconvenient but no additional cost and I got to fly a nicer airline.

Went to a beach in Palawan, Philippines. My son got injured by stepping on something he shouldn't have. My son's foot was in a lot of pain so a quick trip to the hospital. The doctors quickly looked at him, took care of the injury and in less than 90 minutes we were out the door and my son was happy again. Total cost: Nothing the credit card paid for it.

Remember my flight back from Iceland? When I was coming home there was a connecting flight in New York. The problem was that a hurricane cancelled all flights and caused a fair amount of travel chaos. However, again the credit card company stepped in. I got free taxi, free hotel, free food, and free flight on next available plane. Again, inconvenient but then again got 3 nights free vacation in New York paid for by the credit card company!

Now, I don't usually check in my baggage when I fly so I haven't had an opportunity to use this insurance yet. However, having heard about the theft situation in Nigeria I can see it to be useful. If I take a bus from one city to another and someone steals my luggage? Horray! I win! I never carry anything very valuable in my luggage and the credit card will give me $500 to replace what got stolen. And I never carry anything worth nearly that much with me :)

Hope I never have to use this benefit. However, if I die on an airplane my wife would get $500,000 dollars. Then again I remember hearing about the "odd man out" scam in Nigeria where you get on transit but its actually a gang trying to extort money from you. Weird to think but if that happened to me my wife would actually get a huge amount of money. I'd be dead which isn't great...but good for my family I suppose. again, hope I never have this one kick in

When I went to Disneyworld I was able to find a really cheap rental car ($19/day) but the insurance on it was terrible ($50/day). Luckily with this card I had to pay nothing for insurance. Again, read the fine print. When I went to visit my mother I booked a basic car (covered by insurance) but they gave me an upgrade to a luxury SUV. Most people would be happy but the vehicle was expensive (over $80,000 value) which meant my credit card DIDN'T cover the insurance so I went from free insurance to having to pay...just because the rental car agency gave me an upgrade (and didn't have any cheaper vehicles in stock).

sometimes you play the game and lose

Double the warranty. Yes please. Bought a gaming computer. It died after 18 months with 12month warranty. Credit card company stepped up to give me a full refund which I used to buy an even better computer, horray!

Purchase protection? I bought a laptop for my nephew. He fell asleep watching a movie one night and the screen cracked. Expensive repair...except the purchase protection (90 days) meant he didn't have to pay for the repair! Awesome. Also worked really well when my son's new bike was stolen. Stolen bike...credit card gave me a full refund. Police found the bike 1 month later. I kept the refund and got the bike back.

Free Bike how nice is that?

The most useful part of credit cards in Canada

In Canada if someone steals my debit card then they are taking money right out of my bank account! How awful is that?

If someone steals my VISA card AND I report the card stolen then they are stealing money directly from VISA. I am responsible for NOTHING.

It doesn't seem like that is the case in Nigeria. Without that assurance of not being liable for fraud then all the benefit of a credit card is of no value.

How does the credit card company pay for all the perks?

Two reasons:

First: Most people have no discipline and they charge up more than they can pay. Then then pay huge interest month after month after month. Of course the credit card companies love this because it means they make huge profits!

the benefits are teasers to try and get you to spend more! Like the 10% benefit on this card. Spend a bunch in the beginning when you get cash back...awesome deal. BUT don't pay it on time and the credit company starts grinning. They gave you 10% and then collected far more back from you later.

Second: The credit card companies charge the merchant up to 4% (more typically 2%) every time you use the card. The pharmacy that I work at pays about 1.8% for every credit card transaction. Your medication costs $100? The pharmacy gets $98.20 and the credit card company gets $1.80. It may not seem like much but it certainly adds up!

But finally

... and this annoys me the most

It's not that expensive because most people don't bother claiming the insurance. People rarely even both reading that they have the insurance let alone take the initiative to file a claim when they are entitled. As a result its a nice benefit that LOOKS good on paper and gets people to sign up. Then happily costs nothing as the person doesn't bother.

Please don't be one of those people!

Pay the card on time,

Claim every benefit they offer,

Then the cardholder wins. Be a winner ... not someone stuck in a debt trap.