The best strategy for any trader, especially a retail trader like all of us, is to trade with the trend. If you try to trade against the trend, you may get lucky at times, but it's like swimming against a strong ocean current, more than likely you will get swallowed by the whales.

In today's case, it is all bear action for the dude today. Looking at the 2 hour time frame, it is pretty certain that the trend of the day is downward. Bitcoin has been trying to hold the 19-20k support levels for some time, but with the current market conditions and of course with an astronomical CPI report at 9.1%, it's not looking good for the Bitcoin price. So that's why we go short!

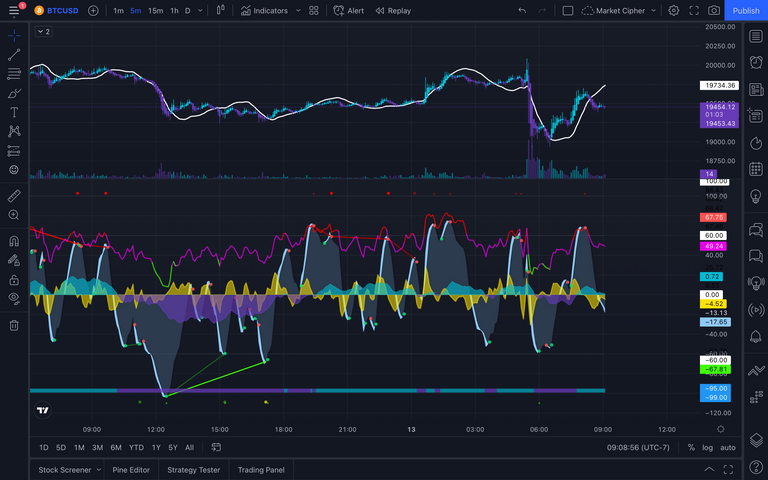

Now that we know that we are looking mostly for short opportunities today, we roll on down to the 5 minute chart where the action happens. This may be different for you, but it's been my strategy for a bit and seems to be my sweet spot time frame.

At this point we are looking for short entries. This chart is my volume and volume profile chart. The moving averages are the 50 and 200 period moving averages. The rule is that wen the green 50 EMA is below the red 200 EMA, I can only play shorts, and when the 50 is above the 200, I am only looking long. So today, you see, we are still short. The goal is to try and squeeze out at least 3 trades a day with a win rate of 66%, with a take profit at .5% and a stop loss at .3%. The stop loss is more important because I will choose to take profits or not at certain times, or let it ride if the trend is continuing. This is of course if I am watching it and not away from the computer. I set the SL as a market order and the TP as a limit order to save the fees.

Moving to my market cipher chart, which I run using a different browser and a separate Trading View account, I am looking at the indicators to find the next best entry. Looks like we are waiting for a bit as things are kind of in the middle of a move or just in a consolidation mode at the moment. I like to catch the moves at the peaks and valleys of the momentum waves and letting RSI either overbought or oversold. This way you can have it on good authority that you will get the maximum amount out of the move. If you go in too late, you won't make as much profit on the move, and if you go in too early, you could get your stop loss hunted and taken out causing you to miss the rest of the move. That can really put your day in the crapper sometimes.

My biggest lesson as of late is PATIENCE!!! Let the trade come to you. I know I have stated that in previous posts, but being that this is kind of my trade journal of sorts, I have to keep repeating it to myself, haha.

Anyway, happy trading everyone and until next time...

Be Cool, Be Real, and always Abide!

Nothing said is financial advise.

This is for educational and recreational purposes only!

Stay safe in these volatile markets and don’t get rekt!

Stake with our Cosmos ecosystem validator, carbonZERO

https://coin-logic.com/staking

Trade with me on Apollo X on BSC

Follow us on HiveHustlers.io and LeoFinance.io, both on the Hive Blockchain:

https://hivehustlers.io/@coinlogic.online

https://leofinance.io/@coinlogic.online

As well as on Twitter at https://twitter.com/coinlogiconline

Now posting to Odysee https://odysee.com/@coinlogictv

Videos by @thelogicaldude are posted to 3Speak through his account and posted to the Coin Logic TV channel on Youtube.

Posted Using LeoFinance Beta